- The euro did pretty much nothing in the Friday session, which is typical for this pair as we have a situation where two central banks are going to be doing the same thing by the end of the year.

- That, of course, is cutting rates.

- We did have a massive sell off on Thursday that had a lot of people concerned. However, the Friday candlestick is a different story that the market is telling us.

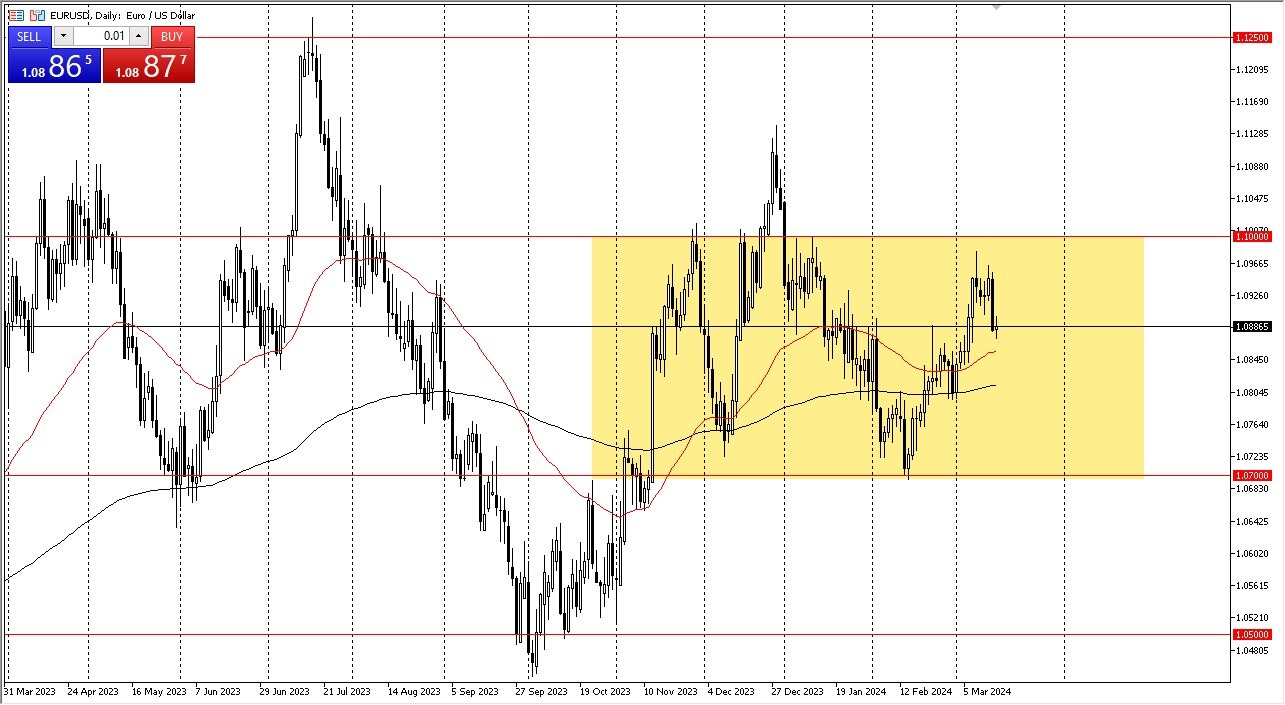

The fact that we just sat here on Friday might actually be positive. We are pretty close to the middle of the overall consolidation range, which I currently define as 1.07 underneath and 1.10 above. As we are in the middle, that might be part of what's going on. We are essentially near fair value. The 50 day EMA sits just underneath and then is something that you need to pay close attention to, as it is a pretty significant indicator that people pay close attention to for longer term trades.

Top Forex Brokers

Massive Selloff, Only to Sit Still

The size of the candlestick on Thursday, is somewhat scary, but really, when you look at the attitude of the euro over the last couple of years, you can see that it's not that unprecedented. So with that, I think this is a market that's going to continue to just grind sideways. Longer term, short term traders probably like more of a rangebound set up.

But right now, as we are in the middle of the more important range, I don't really have much of an opinion on this pair. Instead, I will use this as an indicator as to what the US dollar may be doing. The US dollar, of course, is crucial to understanding where everything goes. So, if the US dollar strengthens here, that's more of a risk off signal in other markets. At this point, this is the only real use I have for this pair, as it is essentially machines kicking orders back and forth at this point in time.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.