- The EUR/USD has gone back and forth during the trading session here on Monday.

- To kick off the week a little bit lackluster, it does look like it's supported, but at the same time it also doesn't look like it has anywhere to be.

- Maybe that's the actual lesson here, as the market does tend to be very sleepy at times, which is part of why the spread is so tight with most brokers.

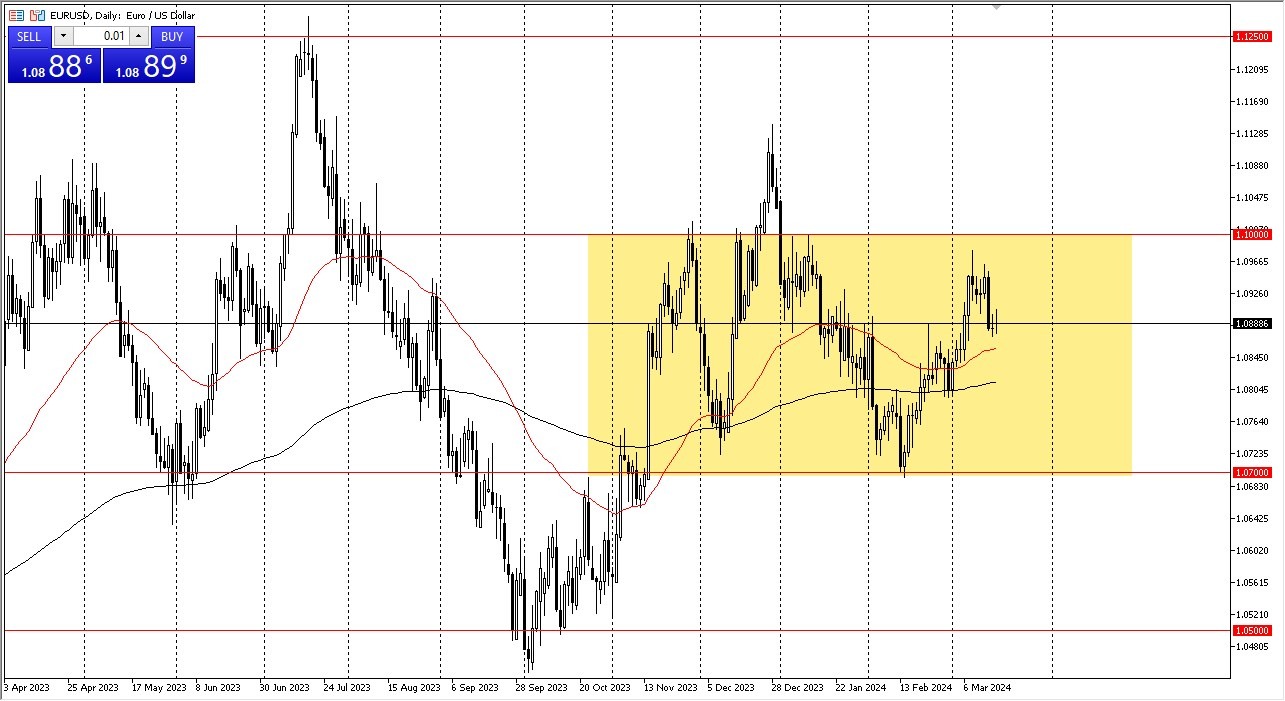

The 50 day EMA sits just below and that, of course, is a situation where people will be paying close attention and seeing whether or not it holds up. If it does not, then we likely go down to the 200 day EMA. Looking at the EUR/USD it appears that we have a larger consolidation area between the 1.07 level and the bottom and the 1.10 level at the top. This is an area that has been important many times in the past, so it does make a lot of sense that we would see it be important in the future as well.

Top Forex Brokers

If We Stay in Range

As long as we are in this range, I think you have to look at it more or less from a short term perspective. For myself, I use this pair as a proxy for the US dollar index as it's the largest part, and I can gauge what the dollar should be doing against other currencies around the world. That being said, if we were to break above the 1.10 level, then I think the euro has a real shot at going to the 1.1150 level and then eventually the 1.1250 level.

If we were to break down below the moving averages underneath, then the 1.07 level I think is going to be a very hard floor in this market. Both central banks are likely to cut rates later this year. So that's part of why you see such lackluster trading. Ultimately, if you're a short term scalper, this might be the place to be, but other than that, you're probably going to struggle to make big swings in a pair that, quite frankly, could put you to sleep this year.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.