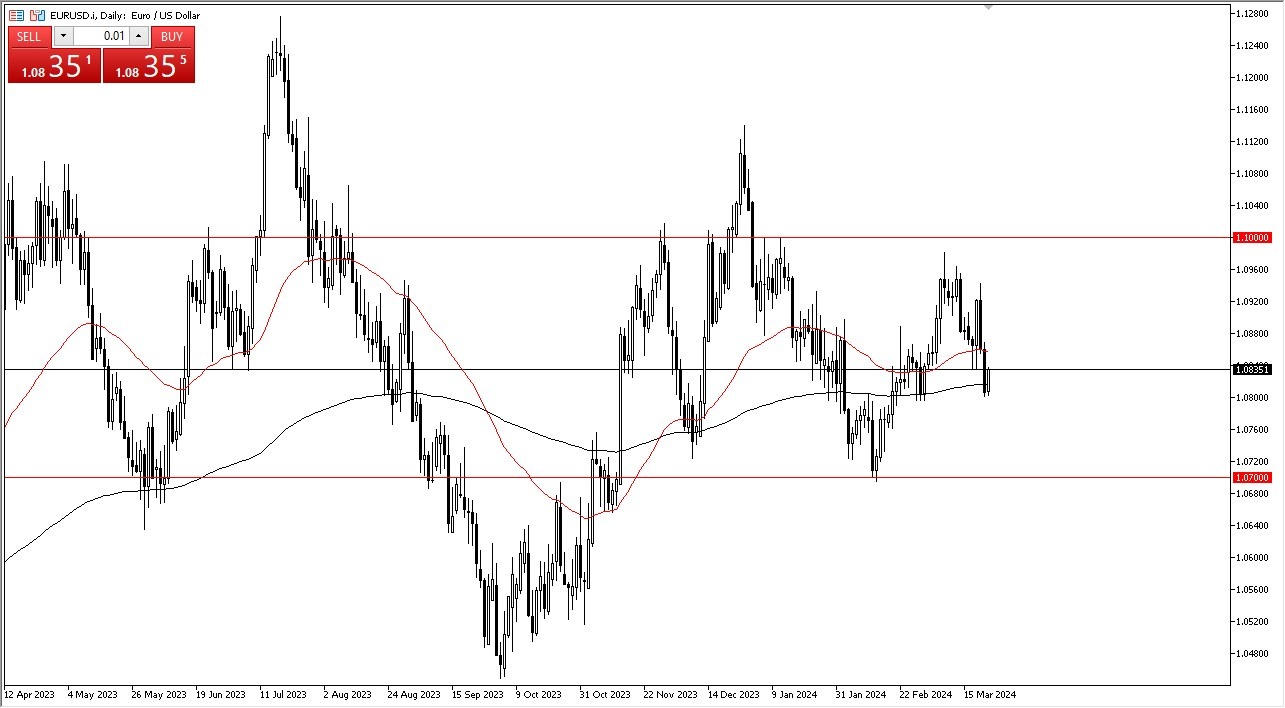

- The euro has rallied a bit during the early hours on Monday as the 200 day EMA is offering a significant amount of support.

- At this point in time, I think it's probably a situation where we are trying to turn things back around and just simply grind in the middle of the overall consolidation area that we have been in.

Ultimately, this is a market that given enough time. I do have a sneaking suspicion we will have to make a bigger move, but this year might be a little tough as both central banks are likely to be very loose with monetary policy or at least loosening later this year in other words both of these currencies probably suffer you basically have two currencies that are going to be losing value so this pair might be better used as an idea as to what the US dollar may be doing in other markets.

Top Forex Brokers

Same Range

In general, I think as long as we stay in the same range, we've been in between the 1.07 level underneath and the 1.10 level above, then you look at this more or less as a back and forth type of market. If we were to break out of this range, then we're talking about a 300 pip move, but right now I just don't see anything making that happen. I suspect in the short term we could go to the 1.09 level.

That's an area that has been a little bit resistant in the past. Just like underneath, we have the 1.08 level that's offered support. I expect very choppy conditions for the foreseeable future. The EUR/USD market will continue to pay the most attention to this scenario of two completing central banks looking to loosen the monetary policy later this year. I still think this is a situation where the market is more likely than not going to be the best gauge of the US Dollar strength or weakness in various other markets. While I don’t necessarily like the idea of putting a bunch of money into this market, but I will certainly be watching this chart regardless.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.