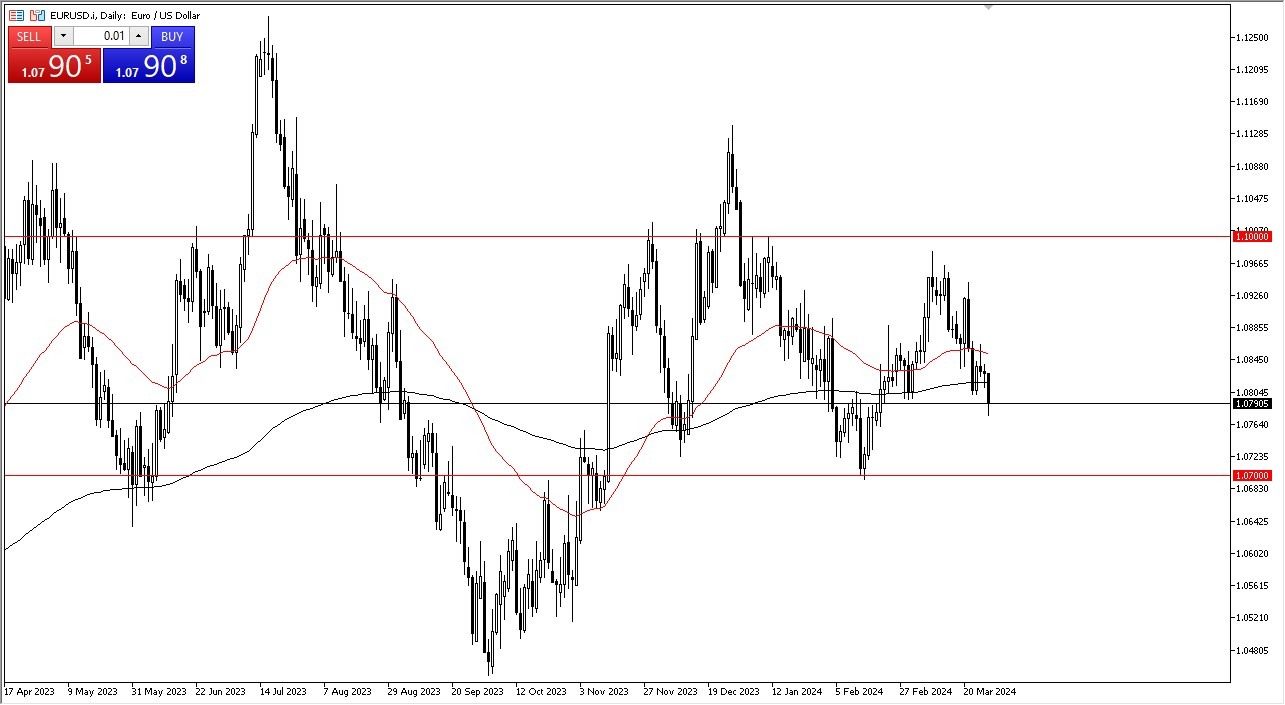

- The Euro dollar, as you can see, drifted a little bit lower during the trading session on Thursday as we dropped below the 1.08 level.

- That being said, I think we are somewhat limited in where we would go due to multiple factors.

- Not the least of which will be that Friday is going to be a very quiet session due to most banks and quite a few brokers being closed, but the forex markets will be open.

At this point in time the 1.07 level of course is an area that should offer plenty of support and we are getting close to it so I think the downside somewhat limited as far as the upside is concerned the ceiling is at 1.10 above and of course we have a lot of noise between here and there that could come into the picture offering quite a few headaches for traders who are trying to fight that.

Top Forex Brokers

Overall, We Are Just Bouncing in a Range

In general, I think this is a market that is just drifting towards the bottom of its range. It will turn around and it will go higher. However, over the next several days, if we do break down below the 1.07 level, then that would obviously be a very pro-US dollar stance and could send this pair much lower. I do use this chart quite a bit to determine the strength or weakness of the US dollar and apply that to other currency pairs. That might be the best way to do it here because this is a market that just doesn't look like it has anywhere to be at the moment.

Ultimately, this is a market that I think given enough time will have to break out of this 300 point range, but there's nothing to cause it to happen right now. After all, both central banks are expected to cut rates later this year, so that will continue to keep this market range bound.

Ready to trade our free trading signals? We’ve made a list of the best European brokers to trade with worth using.