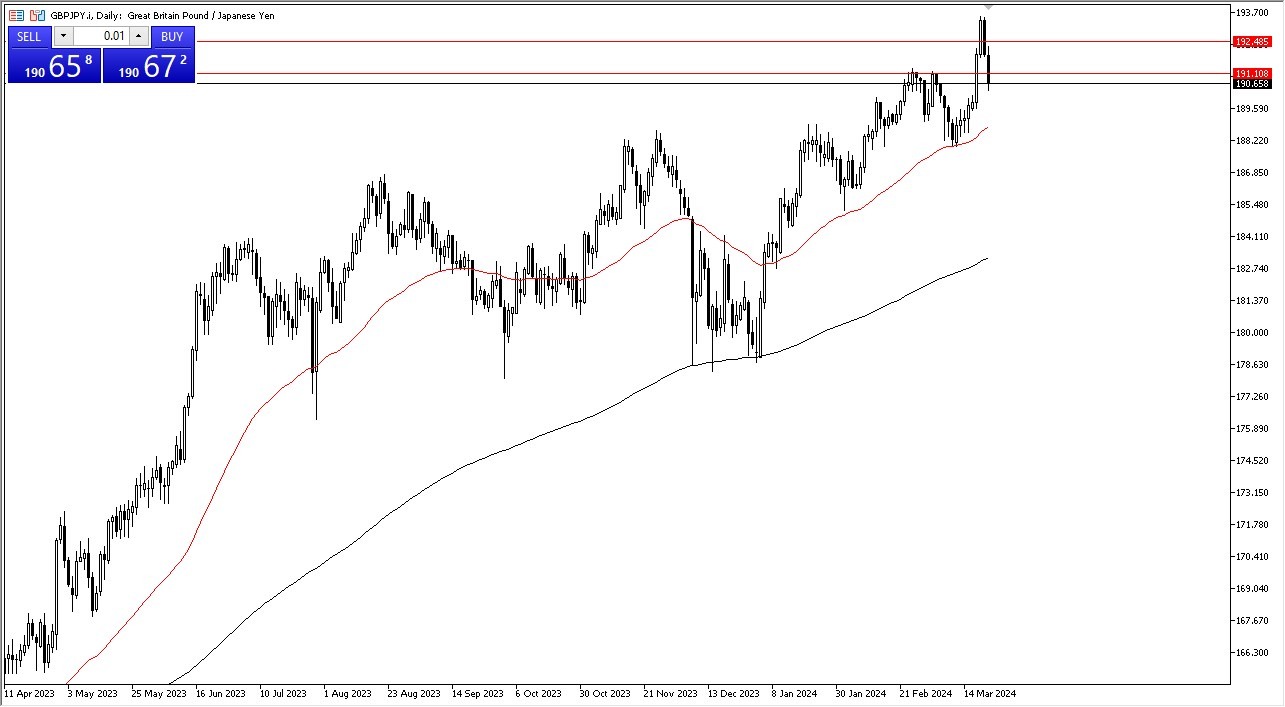

- The British pound has fallen again during the trading session on Friday to pull back against the Japanese yen.

- However, there are several levels underneath that I am watching for potential buying opportunities and quite frankly I do not think that the overall trend has changed.

- Quite frankly, I think this is going to end up being a nice buying opportunity.

Buying the dips

I continue to be a buyer vault it’s in anything with the “JPY” at the end of it, and that of course includes this pair. The Bank of Japan had its monetary policy meeting this week, and it suggested that the interest rate hike was a “one and done” type of situation. Quite frankly, the Japanese have far too much in the way of debts to be able to raise interest rates vary significantly. The market knows this, the Bank of Japan knows this, and quite frankly any jawboning at this point in time is a bit of a joke.

Top Forex Brokers

The ¥193.50 level seems to be an area that offered a little bit of resistance, although I don’t necessarily think that it holds any particular value. This is more or less the market pulling back from an extended run over the last several days, and now I think a lot of longer-term traders will be looking at this pair and licking their chops because it gives them an opportunity to bind the British pound “on the cheap” against the Japanese yen. Remember, you get paid to hang on to this pair over the longer term and institutional traders to pay close attention to this. At this point in time, I am more than willing to jump into this market and buy it hand over fist, in small increments in order to build up a bigger position.

There is no interest on my part in shorting this pair, but if we did break down below the 50-Day EMA, it might capture a little bit of attention from me, and perhaps have me a bit concerned, but that would just mean that we are more likely than not going to get a bit of a deeper correction that we can take advantage of to the upside.

For additional & up-to-date info on brokers please see our Forex brokers list.