- The British pound has been slightly positive during the early hours on Tuesday against the Japanese Yen, but right now it looks like we are essentially killing time, perhaps looking for the next major catalyst.

- As things stand right now, this is a market that I think is severely lacking any catalyst, which does make a certain amount of sense considering that the economic calendar is somewhat light for the week.

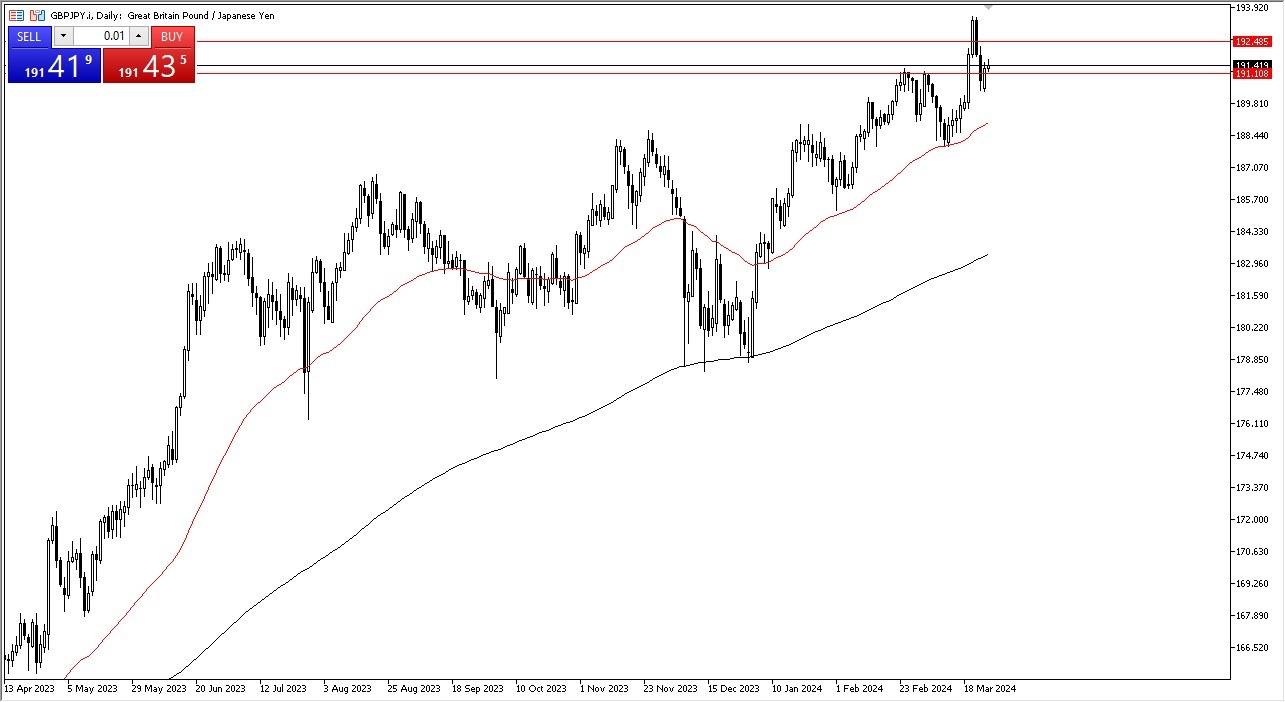

- Ultimately, this is a market that has been in the long term uptrend anyway, so I think at this point it’s probably only a matter of time before we get a bit of continuation.

The Bank of Japan recently raised interest rates, but the interest rate in Japan is still a paltry 0.1%, meaning that the interest rate differential between the United Kingdom and Japan is still extraordinarily wide. With that being the case, traders get paid to hang on to this pair, something that retail traders don’t pay enough attention to. It is in fact a “carry trade pair”, something that institutions take advantage of for longer-term gain. Ultimately, I do think that we will reach the highs again.

Top Forex Brokers

Technical Analysis

The ¥191 level is an area that has been important for a while, as it was a previous micro double top. Underneath there, we have the 50-Day EMA coming into the picture, and I think a lot of people will be paying close attention to it. In general, this is a market that has been extraordinarily bullish so a little bit of sideways action might make some sense, but it should not be perceived as weakness. In fact, the longer we hang around these higher levels, the better off this market is going to end up being as far as a strength situation is concerned, due to the fact that it shows that traders are comfortable at these lofty levels. In fact, this is one of my favorite pairs at the moment, at least as far as currencies are concerned.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.