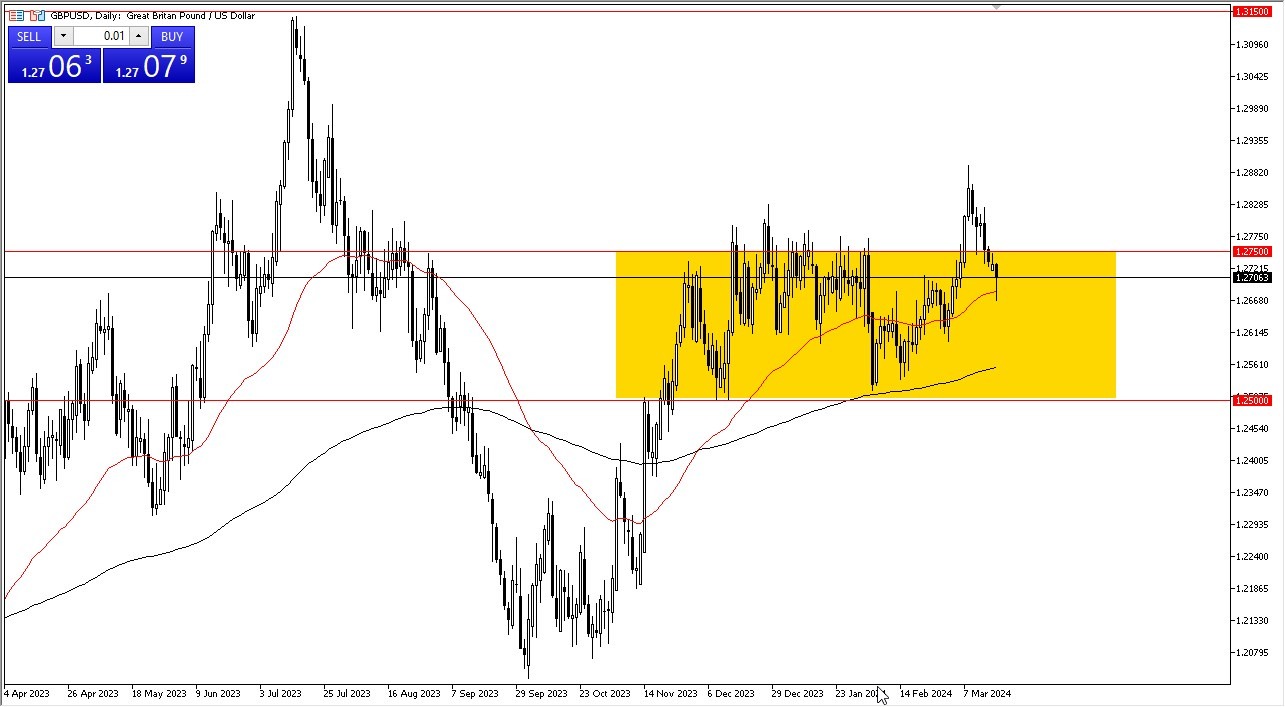

- The British pound initially fell during the trading session on Tuesday to reach the 50-Day EMA.

- However, we have turned around to show signs of life as it looks like we are going to continue to see a lot of volatility.

Ultimately, the British pound will more likely than not recover, especially as the Federal Reserve is likely to cut rates later this year. Granted, so is the Bank of England, but the Bank of England has to deal with more inflation than America at the moment, so I think you get a situation where eventually we go higher.

The crucial 1.2750 level

The 1.2750 level continues to be an area that I think is crucial, and if we can recover that level I am a buyer of this pair. I think at that point in time, the market is likely to go look into the 1.29 level above. The 1.29 level is an area that I think if we can break above, then it opens up a move to the 1.3150 level. Short-term pullbacks at this point in time continue to find buyers, but I think given enough time it’s likely that there will be value hunters trying to pick up Sterling.

Top Forex Brokers

If we do continue to fall from here, then the 200-Day EMA comes into the picture as support, followed by the crucial 1.25 level which I think is a massive “floor the market.” If we were to break down below there, then it’s likely that we would see a complete flush of the British pound, and in that scenario I suspect that the US dollar is likely to truly strengthen against most currencies, not just this one. That being said, it’s interesting that the Tuesday candlestick is starting to form a bit of a hammer, and I think that hammer is simply a sign of the underlying pressure that will almost certainly come into the picture and push this thing higher. In general, this is a market that I am bullish of, but I also recognize that we have a situation where volatility continues to be a major issue going forward and therefore you need to be cautious with your position size.

Ready to trade our daily Forex analysis? Check out the best forex trading company in UK worth using.