- Traders expecting a sudden wave of buying to emerge in the GBP/USD and for the 1.27000 level to become a safe haven for the currency pair had their hopes crushed again the past week.

- Bearish momentum in the GBP/USD continues to flourish as it become clear the U.S Federal Reserve is facing difficult economic realities regarding sticky inflation and growth numbers that do not diminish fast enough.

The GBP/USD saw extremely light holiday trading on Friday and Monday’s price action should be watched suspiciously too, this as most financial institutions remain on holiday working schedules. Tuesday’s trading however should see full volume and reactive moves taking into consideration that another inflation report from the U.S on Friday came in rather mixed. The Personal Consumption Expenditures Price Index met this month’s expectation, but it needs to be pointed out the previous month’s result was revised higher. The Federal Reserve is being tested and so are Forex traders.

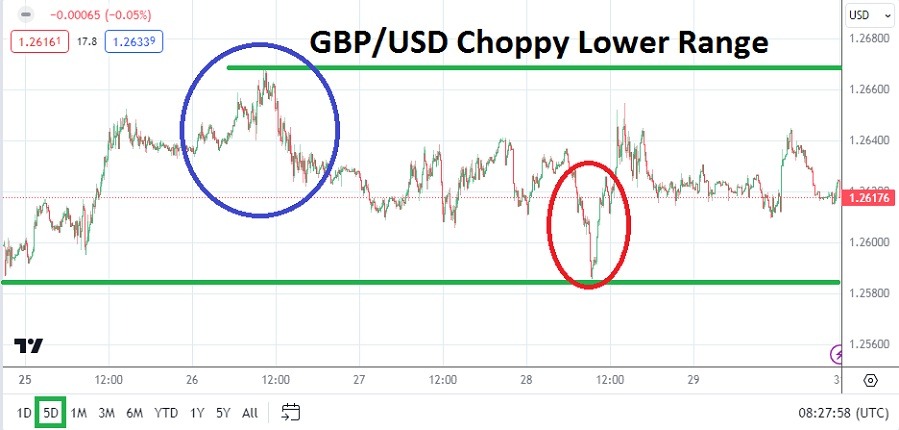

Choppy Conditions within Lower Price Realms

The notion that the GBP/USD is within sight of the 1.26000 is not going to allow for comfortable trading considerations as this week begins. On Thursday the GBP/USD moved to a low of nearly 1.25855. While this depth did not challenge the previous Friday’s lows which hit the 1.25750 ratio, the knowledge that the 1.26000 continues to prove vulnerable is intriguing. The question is if support levels can continue to hold the tide back, or if the 1.26000 to 1.25800 ratios will actually prove weaker.

Because of holiday trading coming tomorrow, traders will be focused on Tuesday’s reactions and need to study technical levels carefully as volumes increase again in Forex. While financial institutions try to gauge their outlooks and find equilibrium, speculators need to also start bracing for the U.S jobs numbers data which will climax on Friday of this week. The Non-Farm Employment Change and Average Hourly Earnings results will prove important. The GBP/USD is certain to react and price changes could become violent in the final hours of trading this coming Friday.

Top Forex Brokers

Lower Price Range and Potential Volatile Conditions Ahead for GBP/USD

The trend in the GBP/USD has been lower, although support seems to have been found in the past handful of days, important economic data is ahead which could cause more reactions which are volatile. Traders may be able to take advantage of technical realms in the middle of this week, but GBP/USD institutional positions will be braced for the potential of more surprises.

- The Federal Reserve is certainly hoping for weaker employment data in the U.S via hiring and wages. If weaker data is seen this could help GBP/USD bullish sentiment.

- However, if Friday’s Non-Farm Employment Change numbers are stronger than expected this could set the tone for more bearish momentum in the GBP/USD to develop.

- Betting on the results of the jobs reports is dangerous, and for those with open GBP/USD positions before the publication of all data need to have risk management working.

GBP/USD Weekly Outlook:

Speculative price range for GBP/USD is 1.25750 to 1.27125

What will the jobs reports say? This is the billion dollar question in Forex this coming week. There have been hints that U.S employment is getting weaker. But the recent ability of U.S statistics to provide unanticipated surprises should worry speculators. If the jobs numbers do come in weaker, traders should be braced for swift upwards momentum, but this remains a speculative wager before the actual data is seen.

The 1.26000 to 1.26500 levels look like a potential playground for the GBP/USD early this week. However if the 1.26000 level is broken lower and is sustained, this will mean bearish sentiment remains strong and marks between 1.25900 to 1.25700 could be tested until there is a reason to spark stronger buying. Stronger hiring U.S employment numbers would cause a strong leg downwards for the GBP/USD, but this potential regarding the data feels farfetched.

Ready to trade our GBP/USD weekly forecast? Here’s a list of some of the top forex brokers UK to check out.