- Early on Wednesday morning, gold markets saw a small increase in trading activity as traders from all over the world continued to show a great deal of interest in the market.

- Interest rates, central banks, and geopolitical unrest all play a role in the movement of gold.

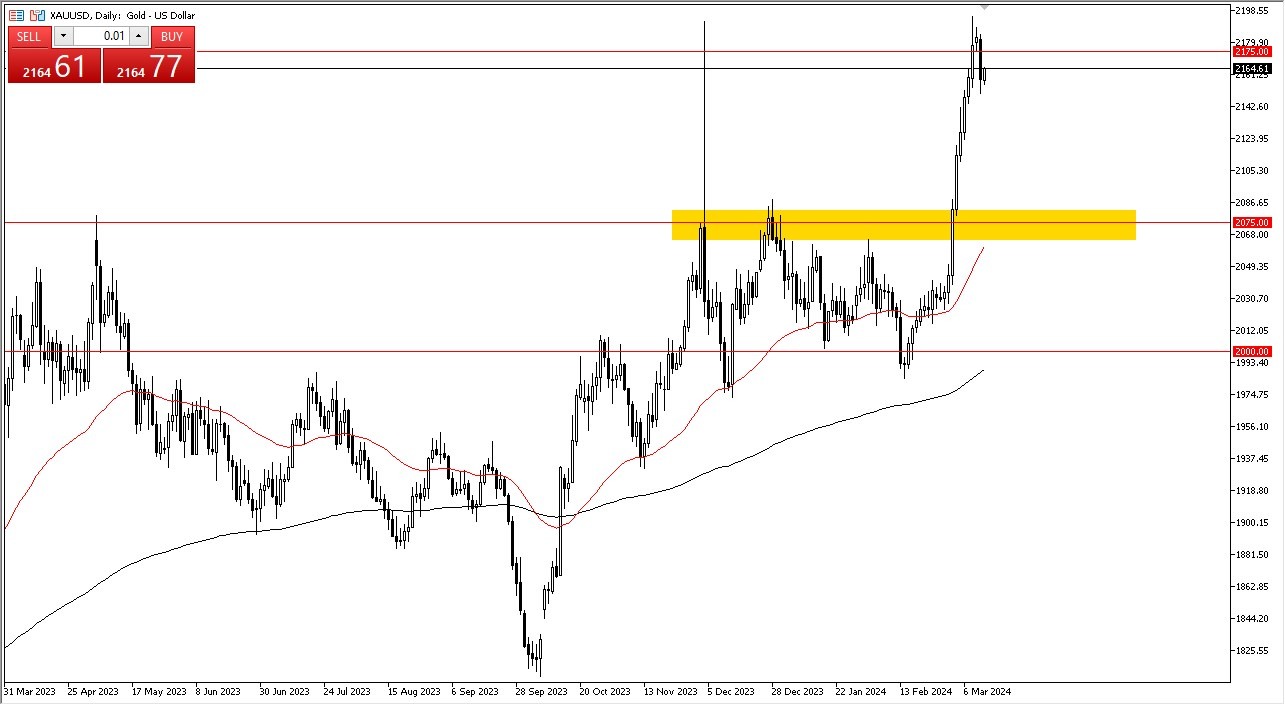

Gold Attempting to Break Higher Again

Looking at the gold market, we can see that while we attempt to break through the highs once more, gold has shown itself to be fairly positive in the early hours of Wednesday.

Given the current state of affairs, I believe that gold will remain one of these markets in which you are purchasing dips. After all, the situation could involve a number of different geopolitical concerns. Of course, interest rates are also expected to decline globally as central banks continue to appear inclined to start reducing.

Top Forex Brokers

The sharp increase in altitude has been relatively unheard of. Thus, we'll have to see if we can keep going higher or if we have to turn around. The third possibility is that, given how strong the market is right now, we might need to move sideways. In this case, I would have no interest in trying to short this market. If you were to buy down to the previous resistance level of $2,075, that would be my preference.

And I believe there is a lot of market memory associated with that area. In such a setting, I believe a lot of bargain hunters would become involved and would probably drive this market higher. In any case, all I do is keep an eye on the daily candlestick to see what it looks like and to see when I should next enter the long position.

Since gold is so strong right now and, there are a lot of reasons to believe that it will continue to rise much higher, it is not something you should sell. I believe that this is a situation where there will be a lot of noise for some time to come, but in the end, anytime it pulls back, you have to consider it a possible buying opportunity.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.