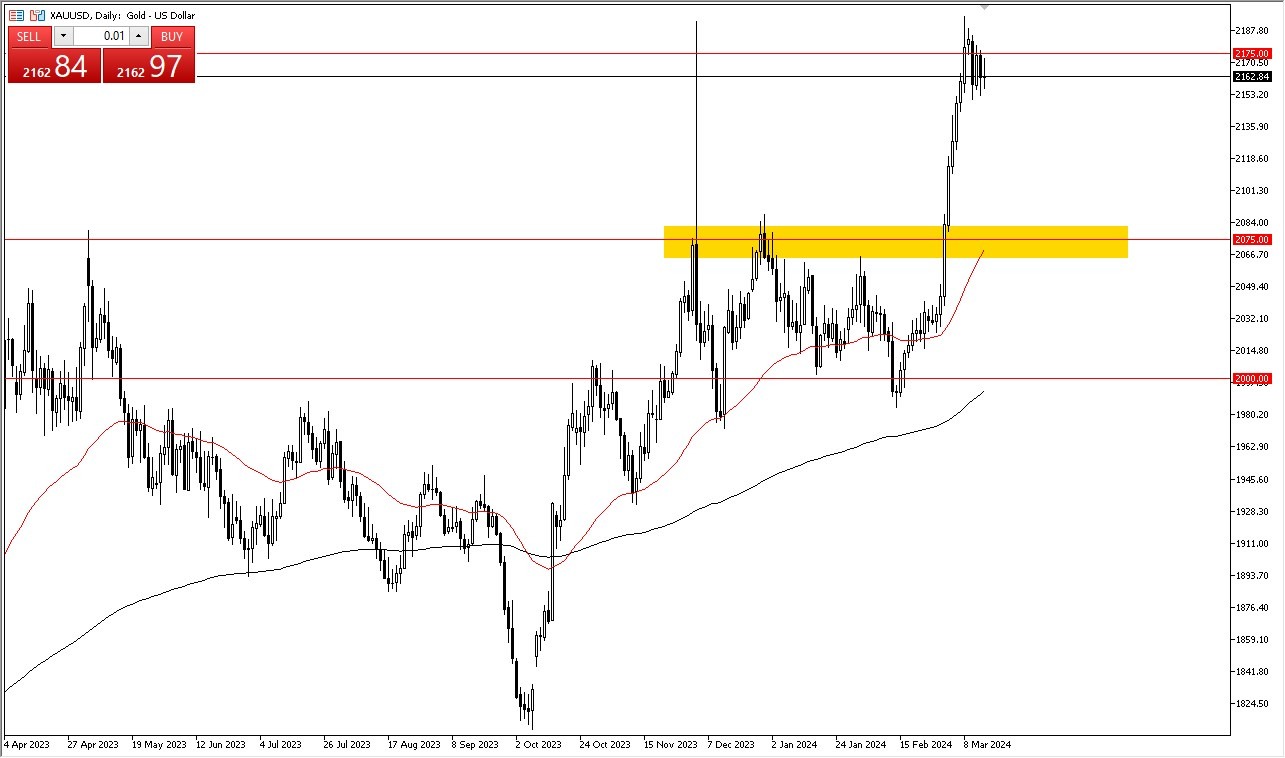

- Gold markets have gone back and forth during the trading session on Friday as we continue to dance around just below a major resistance barrier.

- Keep in mind that the market has been very bullish until recently, so it does make a certain amount of sense that we would have to hang out and consolidate to work off some of the excess profit.

The trend remains

Keep in mind that the trend is still very bullish, and therefore you need to pay close attention to the idea of whether or not the market is offering any type of value. All things being equal, this is a scenario where we have a lot of volatility that we have to keep in mind, but this is also in a situation where a pullback is probably necessary. After all, the gold market shot straight up in the air recently, so to work off some of this froth does make sense.

I believe that the $2075 level underneath continues to be a major support level, based upon the fact that it had previously been resistant. All things being equal, this is an area that we need to pay close attention to as the 50 day EMA is sitting there as well. If we break down below there, then we can start to talk about the trend changing, but right now it just doesn’t look like we are ready to see that happen.

Top Forex Brokers

The geopolitical concerns out there continue to see traders looking toward gold for safety, as we have various points of conflict around the world, and of course we have a lot of concerns when it comes to central banks cutting rates, which in and of itself will drive the value of gold higher eventually. Ultimately, this is a market that also is supported by massive amounts of central bank buying, so all things put together does suggest that we are going higher over the longer term. If we can break above the $2200 level, then I think it becomes more of a “buy-and-hold” scenario until we get to the $2500 level which would be the target.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.