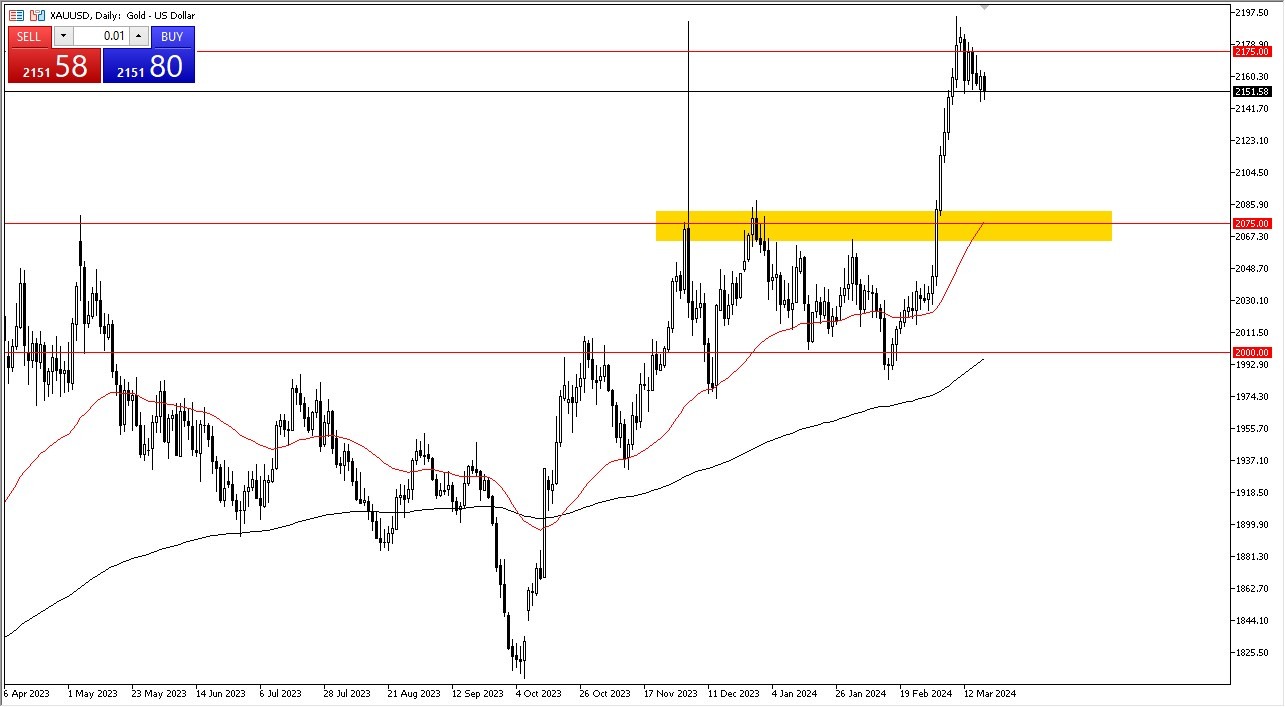

- Gold markets have fallen a bit during the trading session on Tuesday, but it does look like we have quite a bit of support just below.

- Therefore, I think we've got a situation where you have to look at this through the prism of gold, trying to form a little bit of a base for this bullish flag.

- Whether or not it actually ends up forming remains to be seen, but it should be a thought in the background of the markets.

The $2175 Level Above

The $2,175 level is an area that a lot of people were paying close attention to, and it was the fulcrum for the most recent resistance. I think the market is attracted to that area, but we also need to keep in mind that the Federal Reserve meeting on Wednesday will have a massive influence on what happens next. This is an important event that a lot of people will be concerned about, so between here and there, it could be somewhat lackluster trading.

With that being the case, you have to be very cognizant of the idea that traders will try to join this uptrend, but there may be something to spook the market. I would love to see that because it gives you the opportunity to pick up gold on the cheap. Gold is, of course, explosively bullish this year, and it should be, given the fact that central banks are major buyers.

Central banks are going to be cutting rates later, and then of course, there are plenty of geopolitical concerns. In general, I do think that gold eventually breaks out to a fresh new high and goes looking to the $2,250 level. If we pull back from here, we could go looking all the way down to the $2,075 level, which was recent resistance and therefore, it should have a certain amount of market memory. The 50-day EMA also sits right there as well, so it is worth paying attention to. With that being said, I'm cautiously optimistic.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.