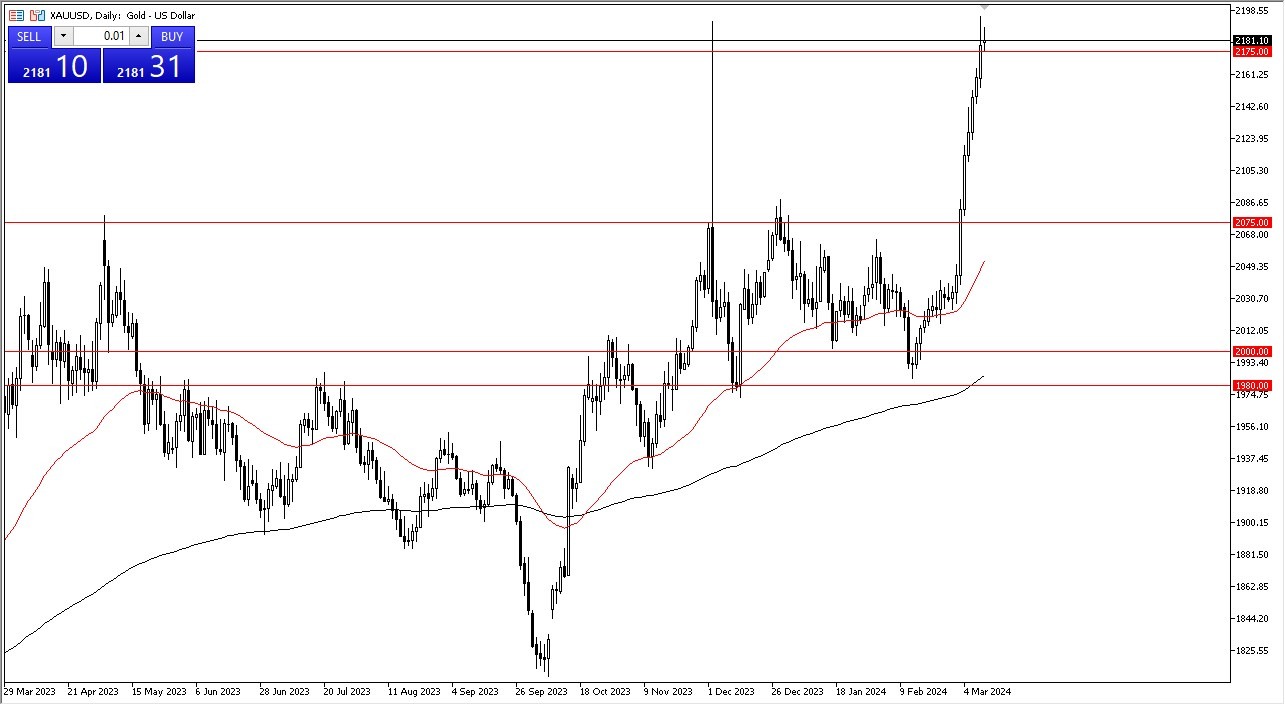

- Because the gold market is becoming very stretched, it has slowed down a little bit during Monday's trading session.

- If that's the case, I believe you have a situation where gold might be preparing for a decline that should be profitable.

Gold

As you can see, I believe that gold is finally beginning to exhibit signs of hesitation in this particular situation. Given that, there's a good chance that gold will continue to draw in money, but we do require some small amount of value. We're essentially at the peak of that absurd peak that occurred on December 4th and caused the market to collapse. I would really like to see it drop to that region, but I'm not sure if we can pull back to $2075. I would expect that there will be some value hunting somewhere in the middle, as I suspect that market participants will try to get it between these two levels of a 2075 and 2,175.

Top Forex Brokers

Having said that, I am unable to short this market. I'm not interested in attempting to accomplish that. I do believe that we will eventually move higher, and given that central banks are lowering interest rates and a host of other geopolitical concerns, gold is likely going to be one of the better performing assets this year.

The trend of central banks purchasing gold on a net basis has not abated. They're prepared to pursue it all the way up here, then. This consequently offers some natural momentum. Pull banks are generally viewed as worthwhile opportunities that you should seize. Although I don't necessarily have a target price in mind, I do believe that 2,200 will be watched carefully. A break above that level could eventually lead to 2500, but for now, we'll just have to wait and see as we search for brief declines to profit from.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.