- The NASDAQ 100 rallied early during the trading session on Monday as it looks like traders are coming back with more of a risk on attitude this week.

- It all started in Asia with Asian indices taking off and it looks like the Americans are going to try to follow suit.

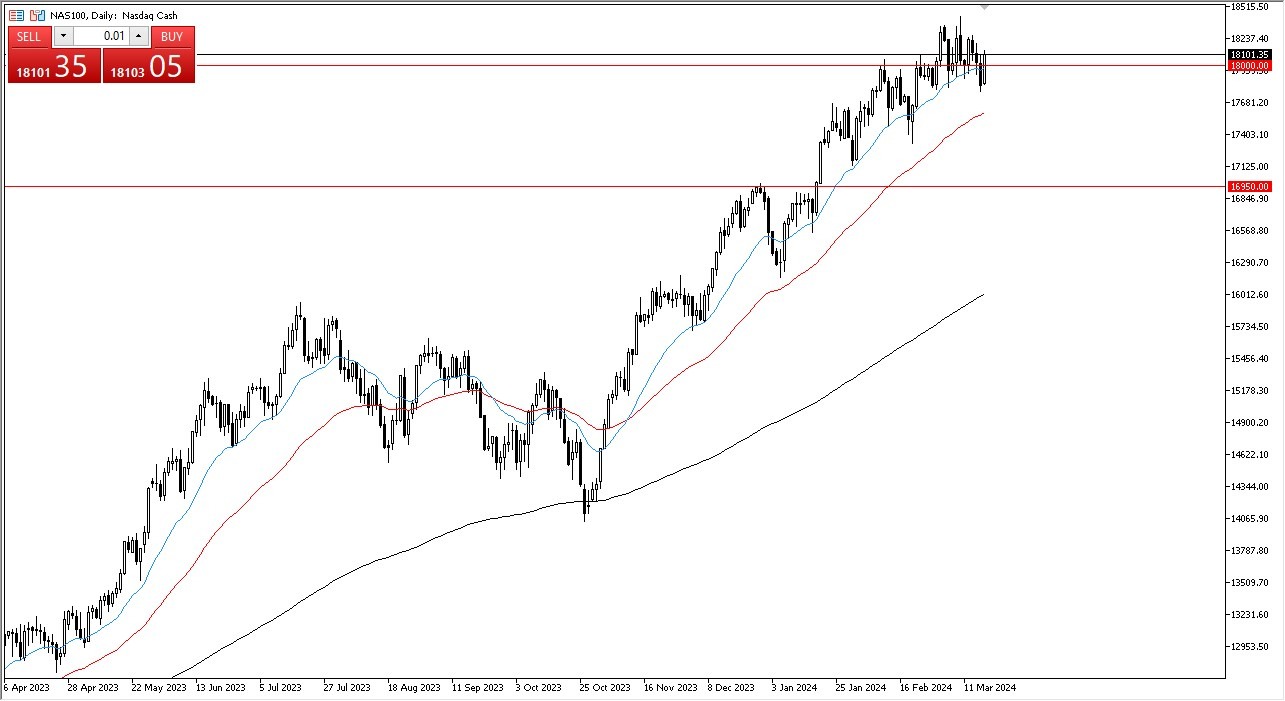

Technicals in the NAS 100

Top Forex Brokers

We are above the 18,000 level and also the 20 day EMA, both of which are positive signs. Ultimately, I think this is a market that you have to look at through the prism of buying dips for value. And I do think eventually we will hit the highs again. Keep in mind that the Magnificent Seven continue to drive the markets higher, but we also have a broadening of the overall rally. And that, of course, is a very bullish sign. Because of this. I think you have a situation where more and more people are going to be throwing money at the market and we may be getting ready to see another melt up. Short term pullbacks will find plenty of support near the 50 day EMA and then again at the 16,950 level. This is an area that I think you find the “max value trade.”

So, it all comes together quite nicely for value hunting. I have no interest in selling in this market. The Nasdaq 100 is far too strong. Yes, we are overdone, but at the same time, the markets more or less run on momentum. These days you cannot fight it. Momentum is something that rules everything. It looks like central banks around the world are going to loosen monetary policy later this year, and a lot of people are trying to get in front of that right now. This is a situation where it seems to be in a bit of a “feedback loop”, and traders will continue to look for some kind of buying opportunity on each drop. The FOMC later this week could cause a lot of noise, but more likely than not won’t do anything on purpose to upset the markets.

Ready to trade the NASDAQ 100 Index? Here are the best CFD brokers to choose from.