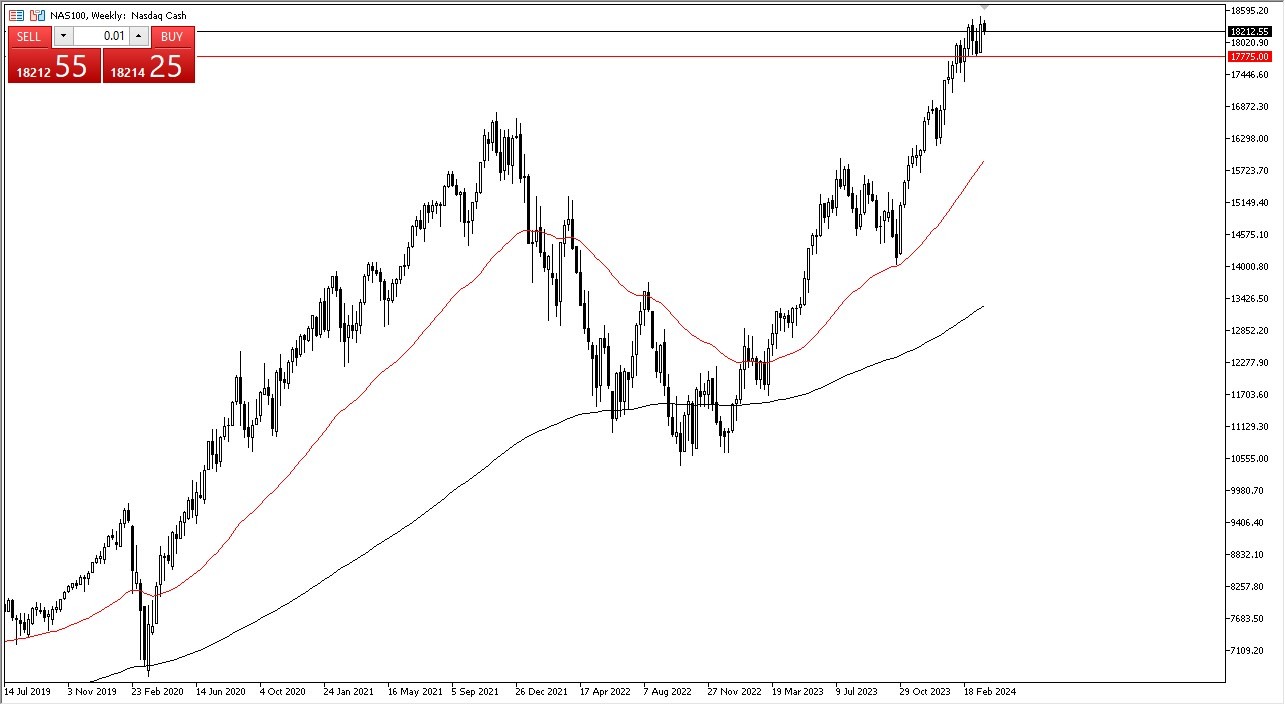

- The NASDAQ 100 has seen a very choppy month of March, but quite frankly we have shot straight up in the air so little bit of consolidation was exactly what the market needed.

- Whether or not that holds for the longer-term remains to be seen but I am watching the support level from the month, the 17,775 level, for signs of where we go next.

- As long as we can stay above that area, then I don’t think much has changed and quite frankly we may be looking at a market that is just trying to sort out where it goes next.

Ultimately, I do think that this market will go higher but we may need a little bit of a reset. That reset could take the form of a month or two of grinding, as we work off some of the excess froth. Furthermore, we are starting to get a little closer to the summer season, which typically is a bit quiet. Nonetheless, I still think that the market is very much the same market that we have been in for a while, meaning that you can either be on the sidelines and simply out of the market, or you are looking to buy dips. Shorting the NASDAQ 100 has been tantamount to blowing up your account on purpose every time you do it.

Top Forex Brokers

Look for Value

I think the only thing you can do on this index is to simply look for value as it occurs. Short-term pullbacks will come from time to time, and as long as you are not betting the entire account that you have on that pullback, you should be fine. There’s nothing wrong with building up a position over time, but quite frankly I think this is a market that has gotten so far ahead of itself that we could see a 10% correction. Dad 10% correction would be an excellent buying opportunity but I just don’t see anything on the chart right now that suggests we are about to have it. When I say that there could be a 10% correction, is just a simple statement that we had shot straight up in the air so rapidly.

Ready to trade our NASDAQ monthly forecast? We’ve made this stocks brokers list for you to check out.