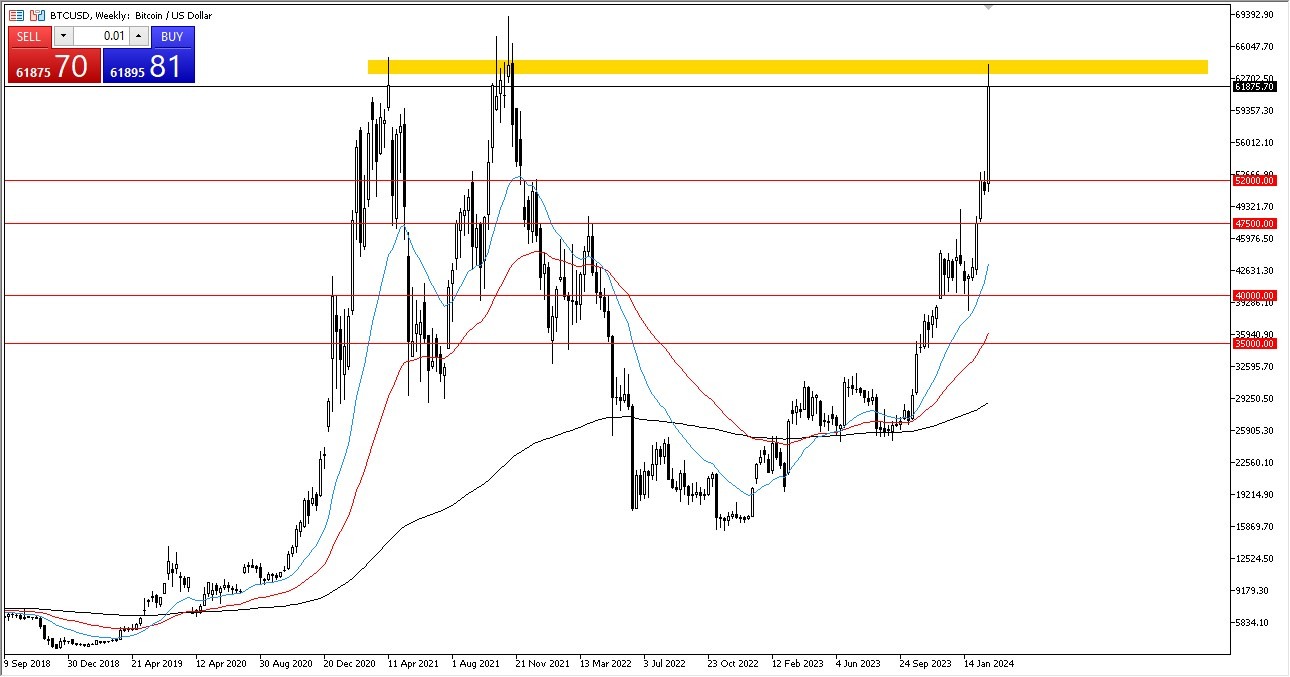

BTC/USD

The bitcoin market has shot straight up in the air during the course of the week, to go looking to the $63,000 level. That being said, the market continues to see a lot of exuberance, and I think at this point it is becoming somewhat dangerous. Short-term pullbacks more likely than not will continue to be buying opportunities. The $52,000 level underneath will without a doubt be an area of extreme support and I think at this point we are getting very close to a significant pullback in a market that is overdone.

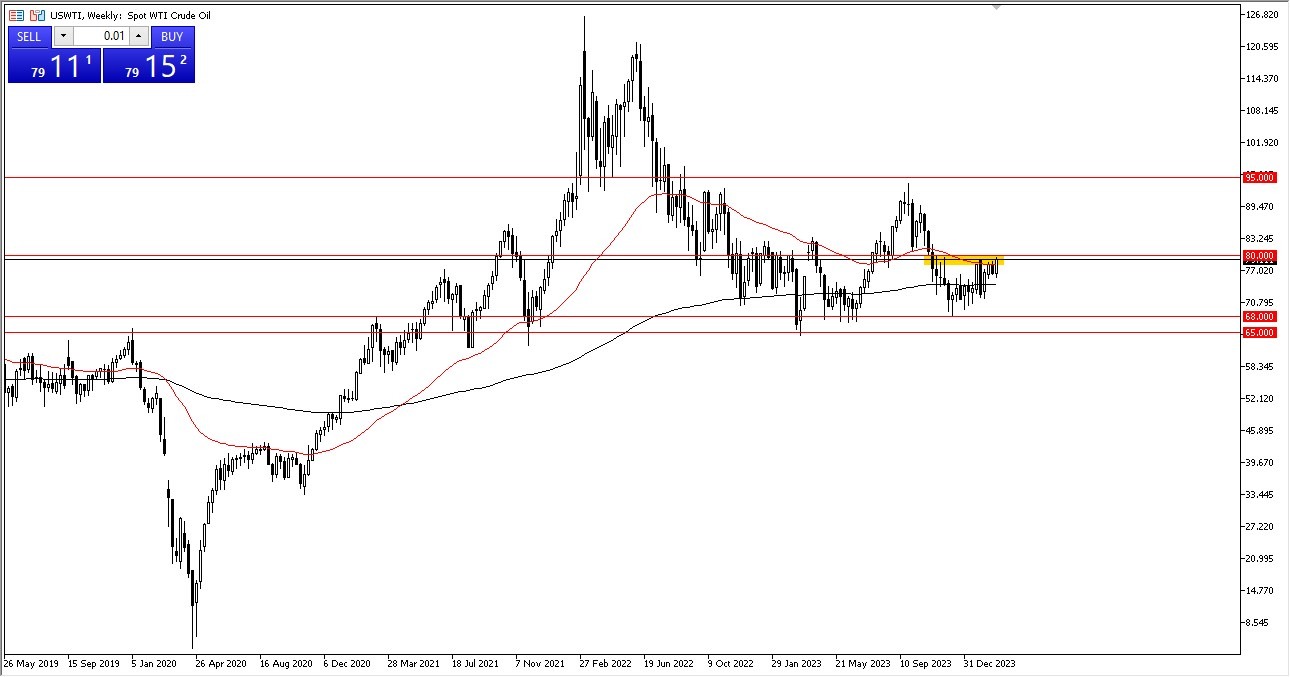

WTI Crude Oil

The West Texas Intermediate Crude Oil market rallied during the week to reach the $80 level. $80 level courses a large, round, psychologically significant figure, and therefore it’s likely that a market breaking above their could open up the possibility of a “chase the trade” potential move. At this point in time, the market is likely to go looking to the $90 level above. Short-term pullbacks will continue to be buying opportunities, and I think it is only a matter of time before we get value hunters coming back in.

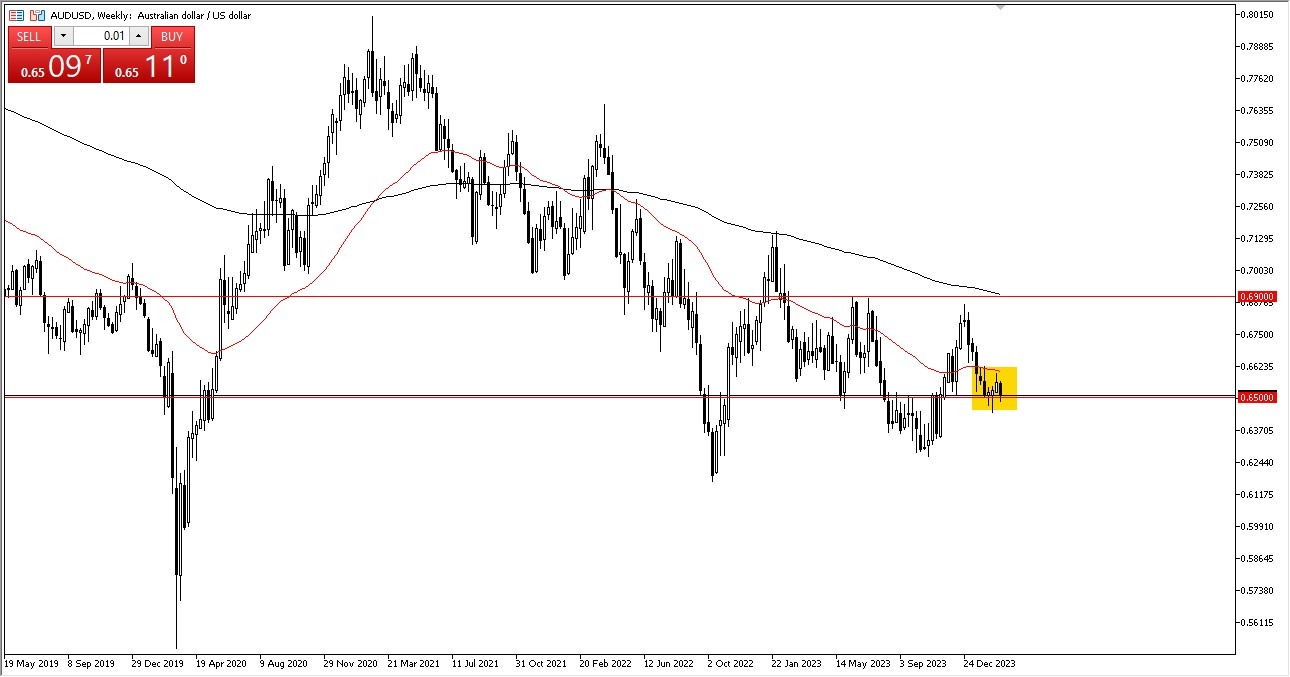

AUD/USD

The Australian dollar has fallen significantly during the course of the week to reach down to the 0.65 level before turning around and showing signs of life. The 0.65 level is an area that has been important more than once, and therefore it makes quite a bit of sense that we could see buyers coming back into the market. If we turn around a break above the 50-Week EMA and a 0.6650 level, then the Australian dollar will more likely than not continue to go higher. That being said, the market is going to continue to see the 0.6450 level as an area of extreme support.

Top Forex Brokers

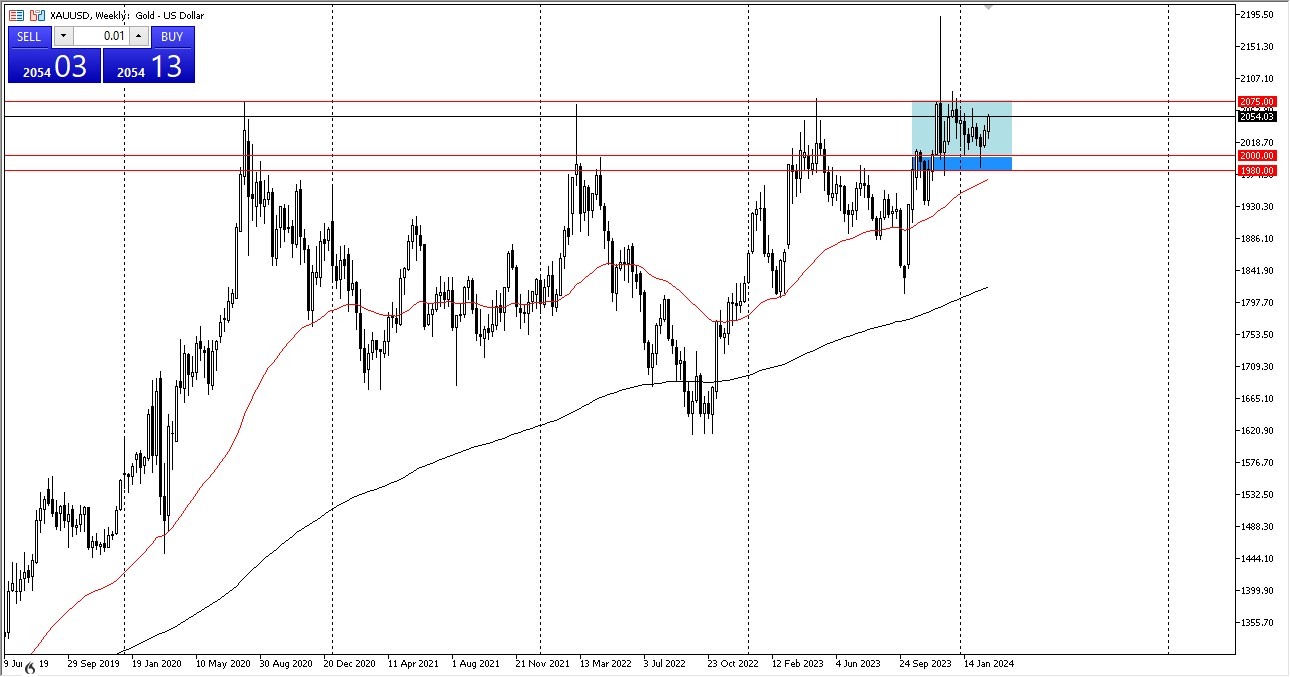

Gold

Gold rallied significantly during the week after initially pulling back, and it looks to me like the old market is probably going to go looking to the $2075 level above. The $2075 level is an area that is likely to be a major barrier. If we were to break above there, then the market then continues to see a lot of momentum. Short-term pullbacks will continue to be value opportunities from what I see, and I still look at this as the $2000 level being the floor in the market.

NASDAQ 100

The NASDAQ 100 has rallied significantly during the course of the trading week as we are now at fresh all-time highs yet again. At this point, the market continues to be one that you just simply jump in and buy the dips every time they occur as it is most certainly a “FOMO market” at this point. I have no interest in shorting this market and I believe that it’s probably only a matter of time before we go looking toward the 19,000 level. With that being said, the market is likely to continue to be overdone at points, but that would just be an opportunity to pick up every dip as value.

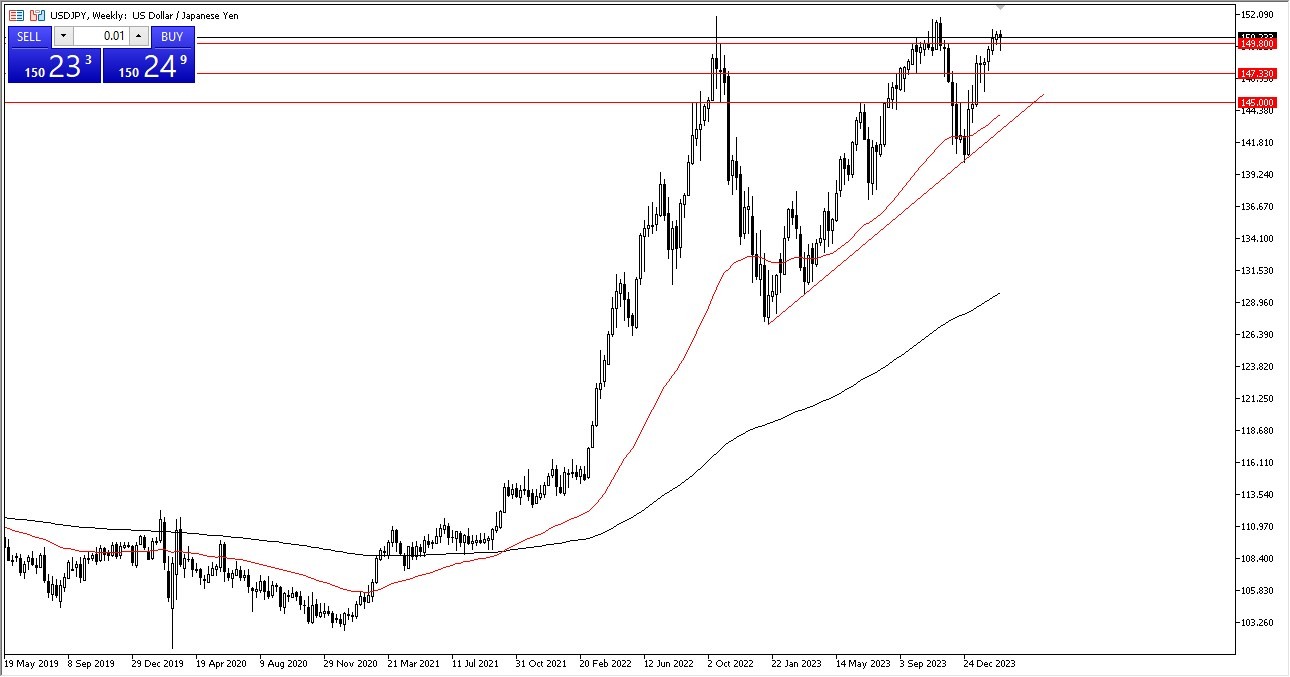

USD/JPY

The US dollar has initially fallen during the course of the week, only to turn around and show signs of life. Ultimately, this is a market that I think continues to find buyers on dips, which makes quite a bit of sense considering that the Bank of Japan still offers negative interest rates. On the other hand, the Federal Reserve is relatively hawkish, despite the fact that they are expecting a few rate cuts later in the year. The interest rate differential loan will continue to make this a “buy on the dips” type of situation.

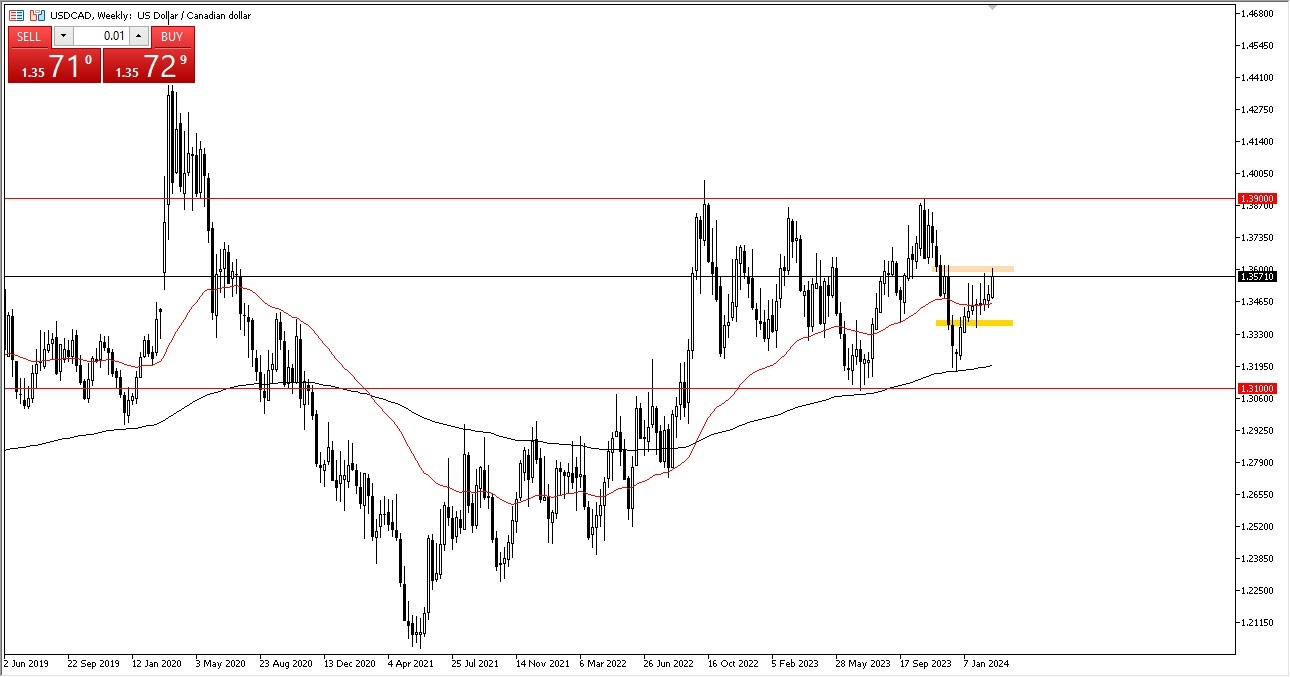

USD/CAD

The US dollar has rallied significantly during the course of the week to reach the 1.36 level, only to turn around and show signs of hesitation. That being said, we are relentless in our upward mobility in this pair and is probably worth noting that we are closing in the top 75% of the candlestick, for the first time in almost 2 months. After all, we have rallied multiple weeks, only to turn around and pull back later before printing the candle. This week of course has shown a little bit more resiliency and favor the US dollar. If we can break above the 1.36 level, anticipate a breakout to the 1.39 level over the next several weeks.

DAX

The German DAX has rallied significantly during the week again, as it looks like this is one of the more bullish indices at the moment. That does make a certain amount of sense, as people are expecting the European Central Bank to loosen monetary policy, at least sometime later this year as the German economy is in a recession. This is the same usual liquidity chase that we see across stock markets globally. I like the idea of buying dips, and I believe that the €17,000 level is now the floor in the market.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.