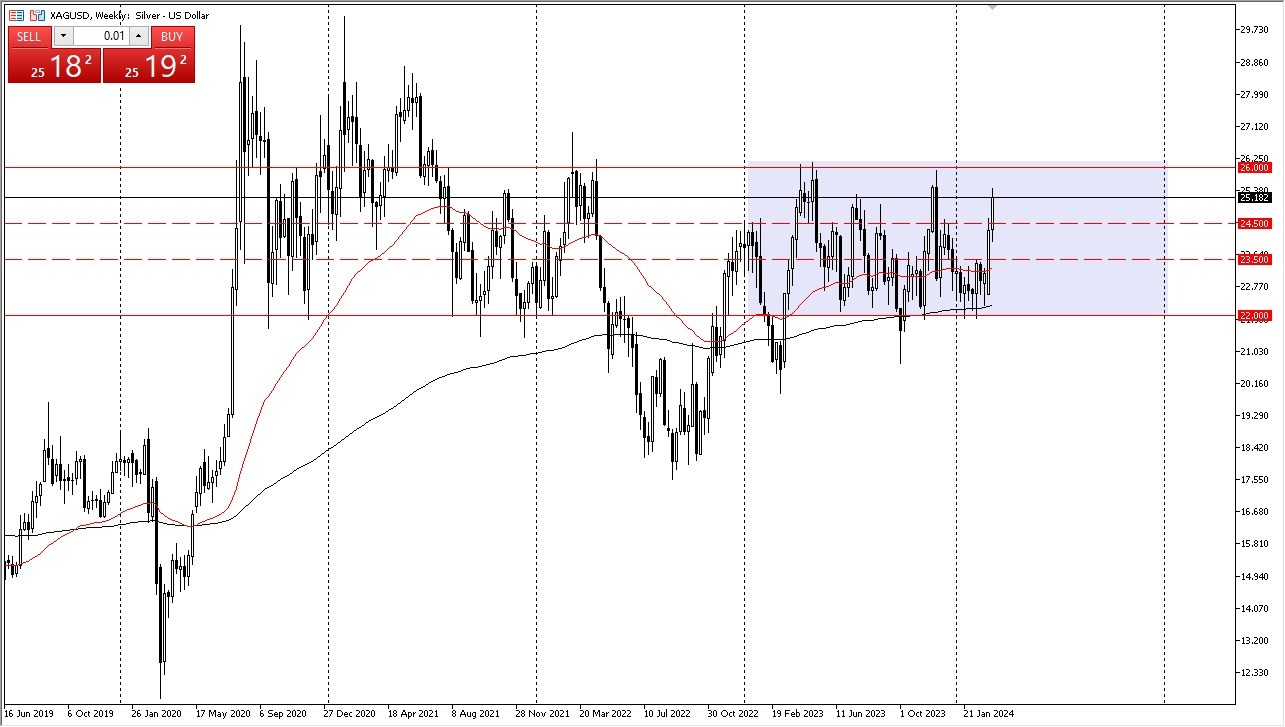

Silver

Silver has shot straight up in the air during the previous week, as we now are threatening to break above the $25.50 level, perhaps running to the $26 level. I think that’s the actual target, the $26 level, but whether or not we can break above there is a completely different situation altogether. If we were to break above the $26 level, it could send a lot of FOMO trading into this market. More likely than not, we get a short-term pullback that is heavily supported near the $24.50 level.

WTI Crude Oil (US Oil)

The US Oil market has had a very strong week, breaking above the $80 level. At this point in time, it looks like oil is ready to continue going higher and that does make a certain amount of sense considering that cyclical trade does dictate that oil typically rises this time of year. Furthermore, supply has been somewhat tight, and of course we have a lot of geopolitical concerns out there that could continue to send this market higher anyway. I am a buyer of dips, and I do believe eventually we go looking as high as $95 this summer.

Top Forex Brokers

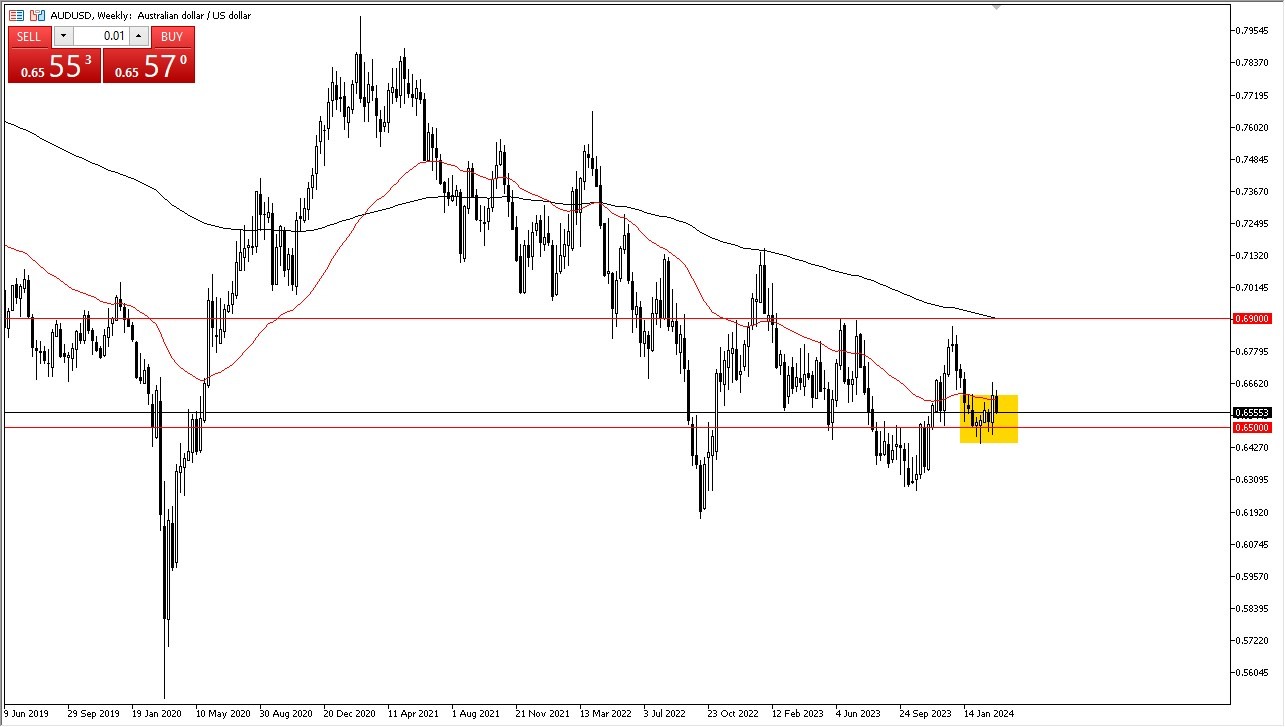

AUD/USD

The Australian dollar initially tried to rally during the trading week, only to turn around in momentum, dropping down to the 0.6550 region. At this point, the 0.65 level should be significant support, and an area that I think a lot of buyers could jump into the market. If we turn around a break above the 0.6650 level, then it’s likely that we could go looking to the 0.69 level. The Australian dollar has been consolidating for some time, and it does make a certain amount of sense that we would see more of the same as there are a lot of different moving pieces around the world as far as risk appetite is concerned.

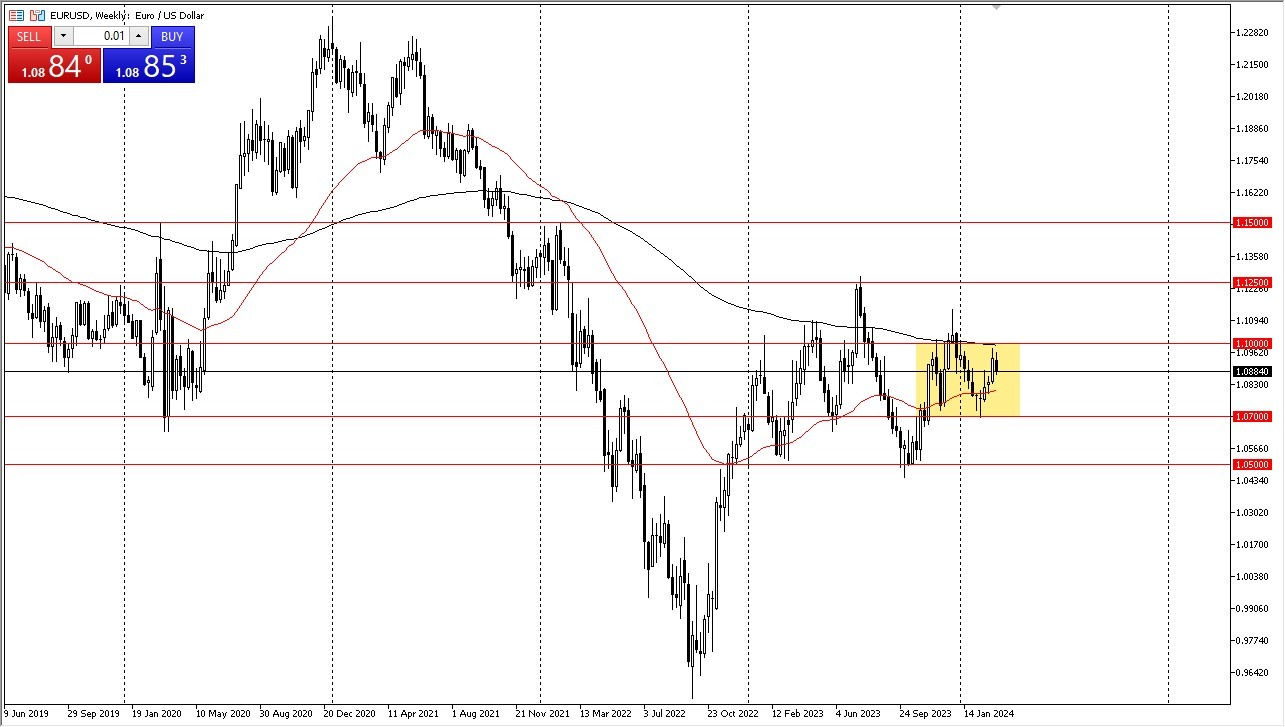

EUR/USD

The euro initially tried to rally during the week, but then pulled back to show signs of negativity. The 1.09 level is an area that a lot of people will look at as “fair value” in this market, as we have seen a lot of volatility. The 1.10 level above I think continues to offer a significant ceiling, while the 1.07 level underneath offers a significant amount of support. I don’t necessarily think that we fall to the bottom of this range, but it would not surprise me at all to see this market drift a little bit lower.

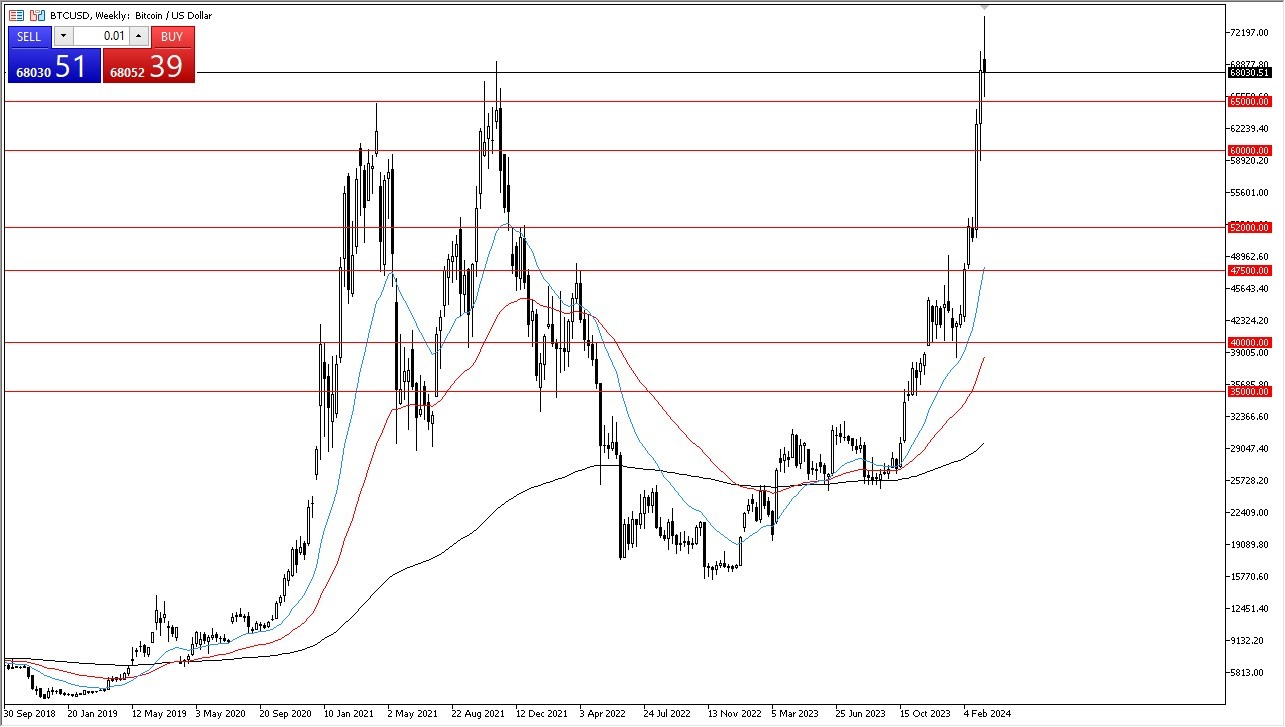

Bitcoin

Bitcoin has gone back and forth during the course of the week to form a massive shooting star. At this point, we could see a significant pullback, and if we break down below the $65,000 level, I think it will start to pick up momentum. That being said, this is still a very bullish market overall, and I think a lot of people will continue to look at it through that prism. The market is one that every time it pulls back there should be plenty of buyers to jump in, but we do need to see some type of gravity return as the market has gotten far too ahead of itself, despite the fact that a lot of this is simply a reaction to Wall Street throwing money into the ETF.

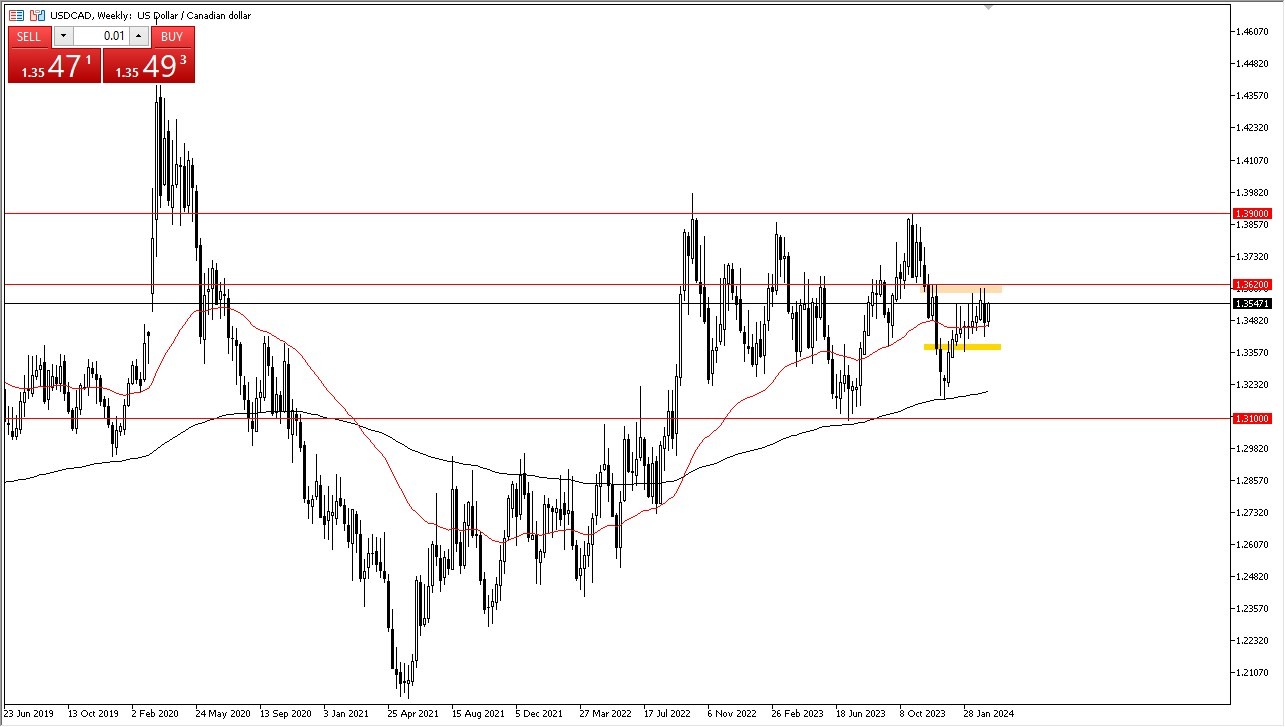

USD/CAD

The US dollar has rallied against the Canadian dollar during the course of the week, using the 50-Week EMA as support. That being said, the 1.3620 level above continues to be a massive resistance barrier. It’ll be interesting to see how this pair plays out, because quite frankly it looks like oil is ready to break out, but at the same time the Canadian dollar is suffering at the hands of the greenback. If we can break above the 1.3620 level, then it’s likely that the US dollar goes looking to the 1.39 level. On the other hand, we could pull back to submit for the week and stay within the range, which of course makes quite a bit of sense as this is a market that typically consolidates more than anything else.

USD/JPY

The US dollar has rallied significantly during the course of the trading week, as it looks like we are going to take out the ¥149 level. The 147.33 and level underneath continues offer support and therefore think you need to look at it through that prism. Short-term pullback should continue to offer buying opportunities as the interest rate differential continues to favor holding this pair more than anything else.

NASDAQ 100

The NASDAQ 100 initially tried to rally for the week, but then fell pretty hard. Ultimately though, this is a market that is still very bullish from the longer-term standpoint, so I don’t have any interest in shorting it. I look at short-term pullback sense potential buying opportunities, and I suspect that the rest of the world does as well. Remember, the NASDAQ 100 is essentially an ETF for about 7 stocks to make sure that you’re paying attention to all of the usual suspects.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.