AUD/USD

The Australian dollar has gone back and forth during the course of the trading week, and I think that continues to be very much the same. The 0.6450 level underneath offers plenty of support, and I think as long as we stay above there, traders will continue to be buyers of dips but for short-term moves only. If we were to break higher, the 0.6650 level will be a significant resistance barrier that should keep a lid on this market until something fundamentally and structurally changes.

DAX

The German DAX continues to rally rather significantly, and I think at this point in time a pullback will be a buying opportunity. All things being equal, the €18,000 level offer a significant amount of support. If we were to break down below the €18,000 level, then we need to step to the sidelines and wait to see a certain amount of stability to get involved. We could of course continue to go straight up in the air, but at this point in time it seems to be very overstretched and therefore you need to pay close attention to it.

Top Forex Brokers

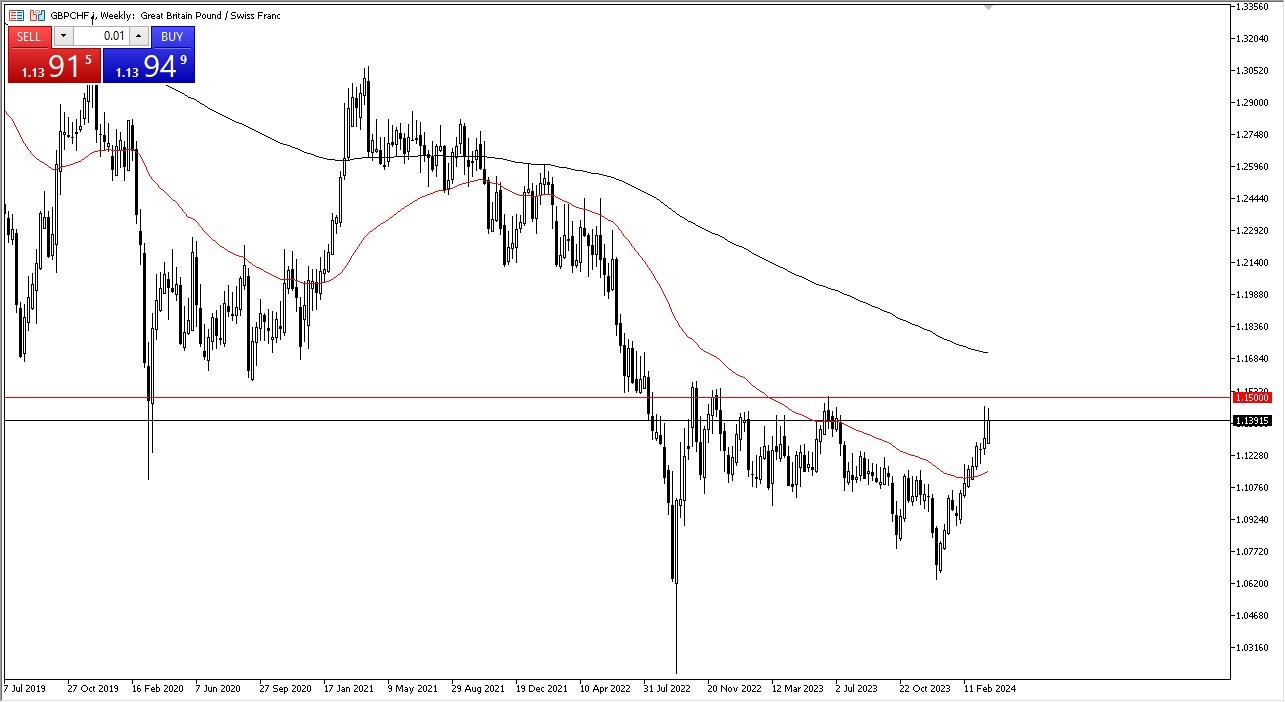

GBP/CHF

This is a pair that I think you need to pay close attention to. If we can break above the 1.15 level, then there is the possibility of the market going higher suddenly increases. At that point in time, the market then is likely to continue to go much higher, perhaps even as high as the 1.20 level. Short-term pullbacks are very possible, but those short-term pullbacks will end up being buying opportunities more than anything else. Furthermore, you need to pay close attention to the idea that you get paid at the end of the day as the interest rate differential continues to be massive.

GBP/JPY

The British pound has rallied slightly against the Japanese yen for the last week; therefore, I think you got a situation where every time we pullback it is a buying opportunity. That being said, the ¥190 level underneath is a significant support level based on psychological importance, and of course structural importance. Underneath there, then you have the ¥188 level as well. All things being equal, I think this para continues to go much higher, as the interest rate differential continues to see a lot of inflows into this market.

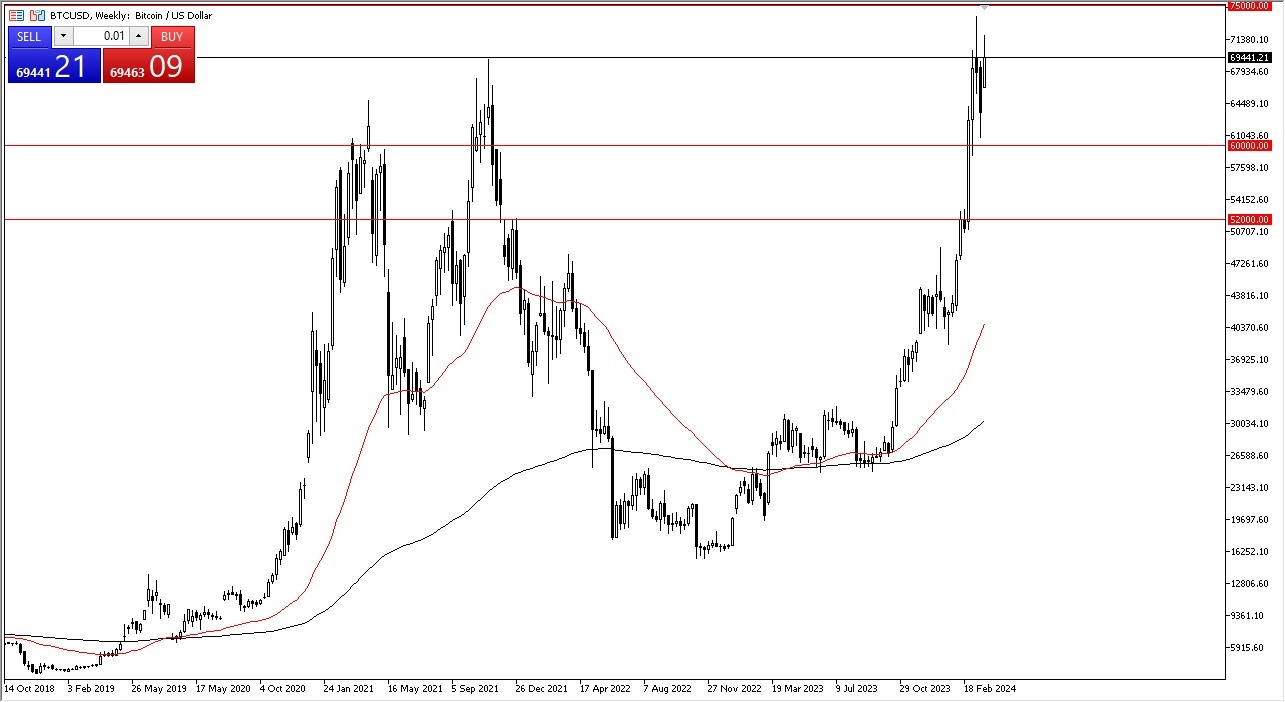

Bitcoin

Bitcoin has had yet another bullish week, but at this point time I think we are trying to set into some type of consolidation. The $60,000 level underneath is going to end up being a massive floor, right along with the $75,000 level above being a significant resistance barrier. In general, this is a market that I think continues to be very noisy, but I think short-term pullbacks will continue to be buying opportunities. If we were to break down below the $60,000 level, then it is likely that we could go down to the $52,000 level.

Gold

Gold markets have rallied significantly during the course of the week, and I think at this point in time it is probably only a matter of time before we go much higher. I love the idea of buying short-term pullbacks in the gold market, as the situation still looks very much like a bullish market that’s ready to take off, and I think it’s probably only a matter time before gold reaches the $2500 level. Underneath, the $2075 level is a support level, and perhaps the bottom of the overall uptrend. I don’t think we get anywhere near there, and it is probably worth noting that we broke above the top of the shooting star from the previous week, which is an extraordinarily bullish sign.

NASDAQ 100

The NASDAQ 100 has pulled back just a bit during the course of the week, and at this point in time it is a very volatile market that I think is going to continue to go sideways and work off a lot of the excess fraud. The 17,775 level underneath is a significant floor in the market, so I think if we drop at this point, there will be plenty of buyers to come in and pick this market up. Remember, the NASDAQ is driven by just a few stocks, so make sure you pay attention to all of the usual ones.

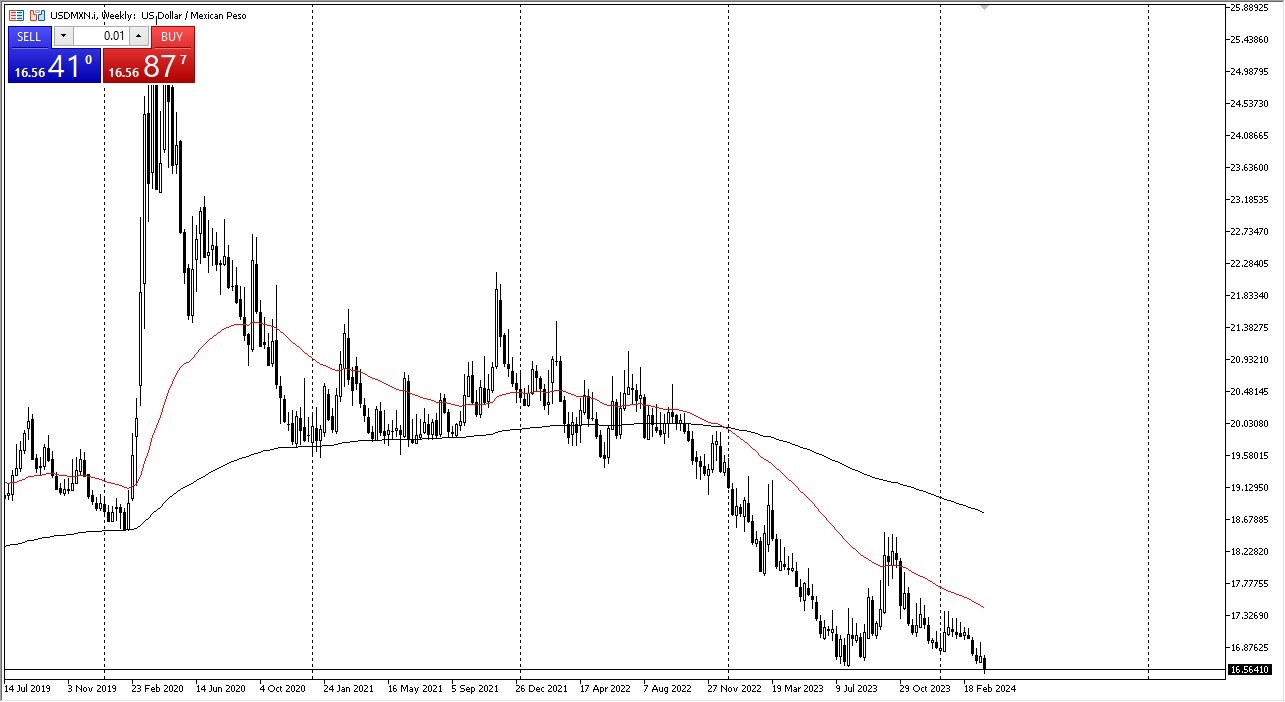

USD/MXN

The US dollar has fallen significantly during the course of the trading week, as it is now testing very serious support against the Mexican peso. If we were to break down below the 16 pesos level, the US dollar will continue to go much lower. On the other hand, we rally from here, you’ll be looking for signs of exhaustion that you can start shorting.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.