- During the early hours of Wednesday's trading session, silver saw a small increase as it appeared that buyers were returning to the market.

- Money has generally been flowing into precious metals for a number of weeks now.

Silver still a beast overall

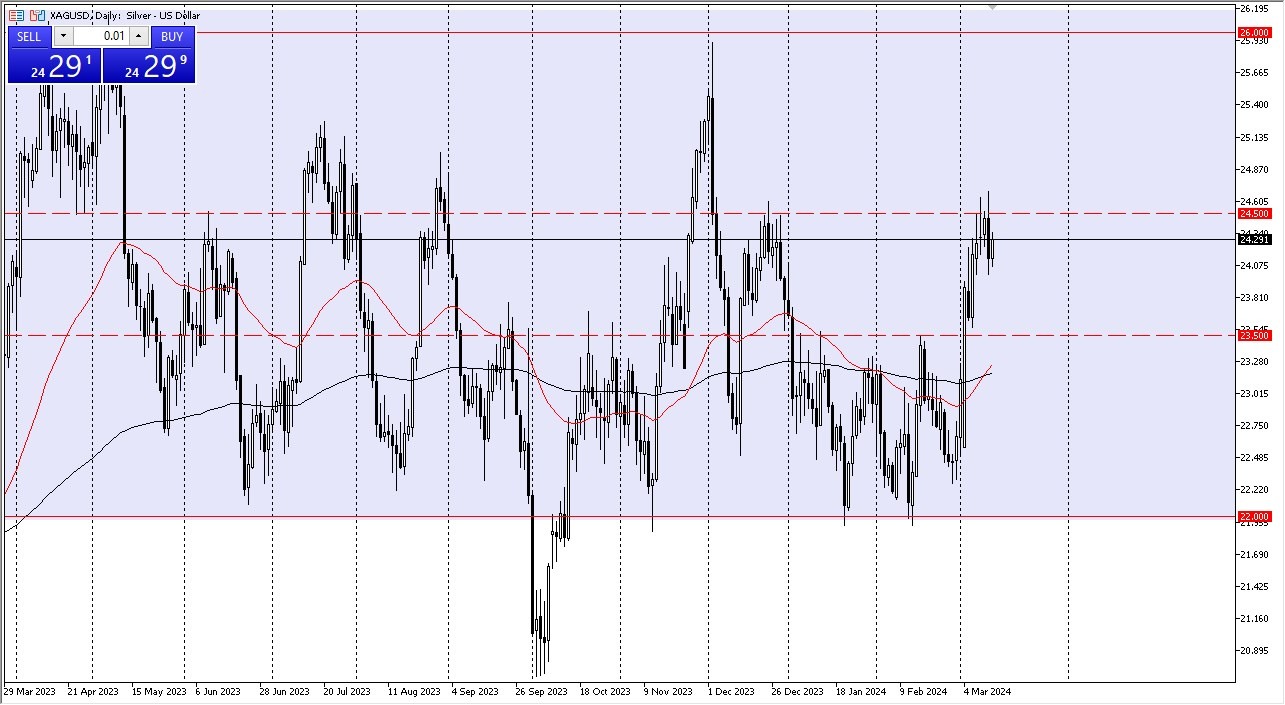

As you can see, Silver made a small rally during this Wednesday's session. It appears that we will keep making every effort to rally at this time. How this turns out will be interesting to watch due to the fact that is has been so volatile and impressive lately. Momentum can be a fickle thing here though, so please keep that in mind.

Top Forex Brokers

There is a lot of resistance in the area just above $24.50, and I believe that this level needs to be respected. If we can break through and move higher, there's a chance that we could reach $26. The $23.50 mark, which was formerly a barrier of resistance and is now expected to be support, is located below. We have experienced the so-called Golden Cross, which is something to be aware of as it obviously affects market behavior.

In light of this, I believe you need to approach this from the perspective of a market that you are purchasing on dips. And we could really start to move higher toward the $26 mark if we can break out to the upside and move past the recent highs. We probably see the US dollar being hammered against most things in that environment.

I think gold rallies too. Keep in mind that silver is very industrial, so you need to consider whether or not there is a lot of industrial demand for it right now. It appears that rate cuts by central banks worldwide will occur shortly, which will also drive up prices for precious metals. Naturally, over the past few weeks, this market has seen a lot of extremely strong momentum.

There could just be a simpler follow-through here. Until silver falls below $23.50, I have no interest in shorting it. Even then, I would want to see how the fundamentals held up before investing a significant amount of money, so I believe you do need to exercise some caution.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.