- Due to buyers reentering the market on Wednesday to make up for Tuesday's losses, silver prices are still quite erratic.

- It's still unclear whether I can keep going, but it appears that the market will stay generally positive.

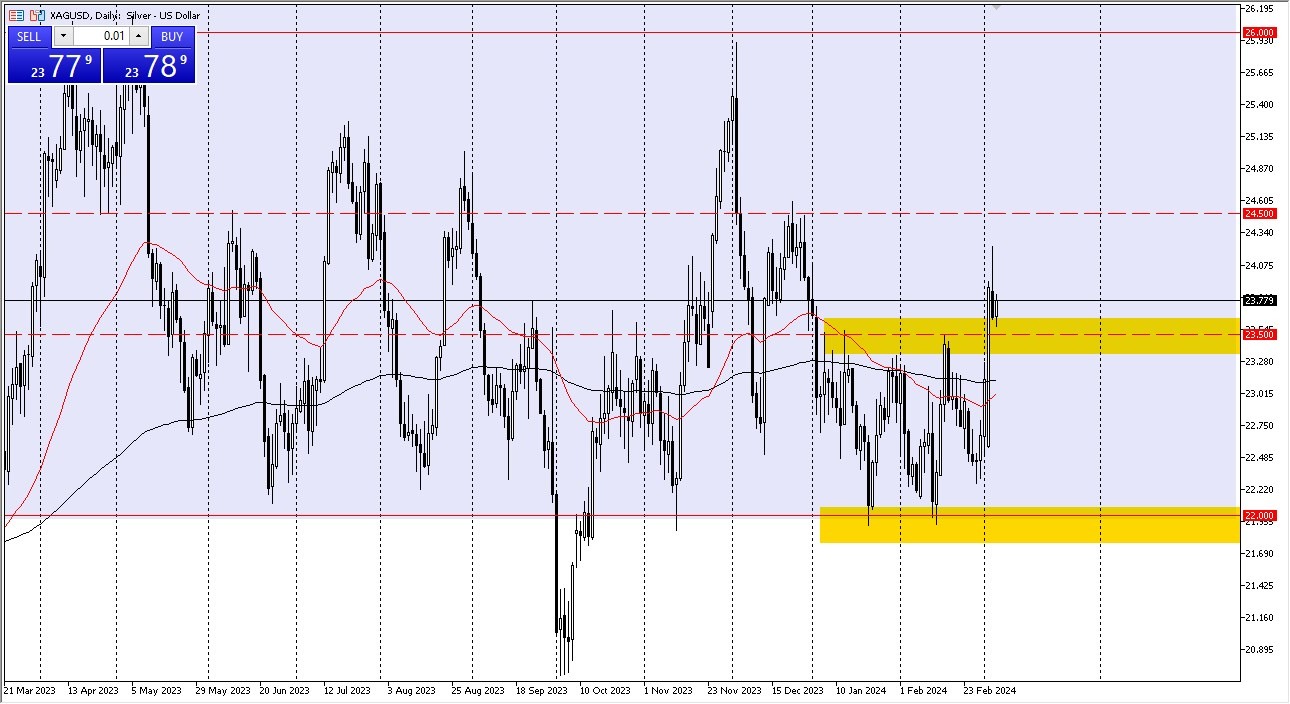

As you can see, silver made a small rally in the early hours of Wednesday, but the $23.50 level remains a location that is based on market memory. After all, there had been a lot of resistance before, and it appears that support is now being offered. Because of this, I think that a lot of traders are interested in getting long yet again.

Of course, the significant breakout on Wednesday is encouraging for silver bulls. And I do believe that the market will likely see much more of an upward trajectory in the near future. However, I also understand that it will likely be challenging to break above the $24.50 mark; if and when we do, I believe you have a good chance of reaching the 26 level.

Top Forex Brokers

The 200 day EMA and the 50 day EMA enter the picture very quickly to provide support if we break below the $23.50 mark. Just as the $26 level represents the absolute top of the market, it is closer to the $22 level at its absolute bottom. We will essentially trade in this range for the majority of the year, in my opinion.

Silver is a Beast

Remember, even in the best of times, this is a market that is typically volatile. You must therefore exercise caution when choosing the size of your position. In my opinion, if you have enough time, you can view dips in this market as opportunities to seize value and do so. Having said that, we might need to temporarily suspend the silver market in this region in order to burn off some of the extra froth because we were a little overextended on Monday.

Observe interest rates, and their typically negative correlation to the silver markets. The US dollar and industrial demand should be closely monitored, as they both have a significant impact on the state of the silver market. Remember that this is an extremely volatile and dangerous market at times, so the most crucial thing you can do is be mindful of the size of your position.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.