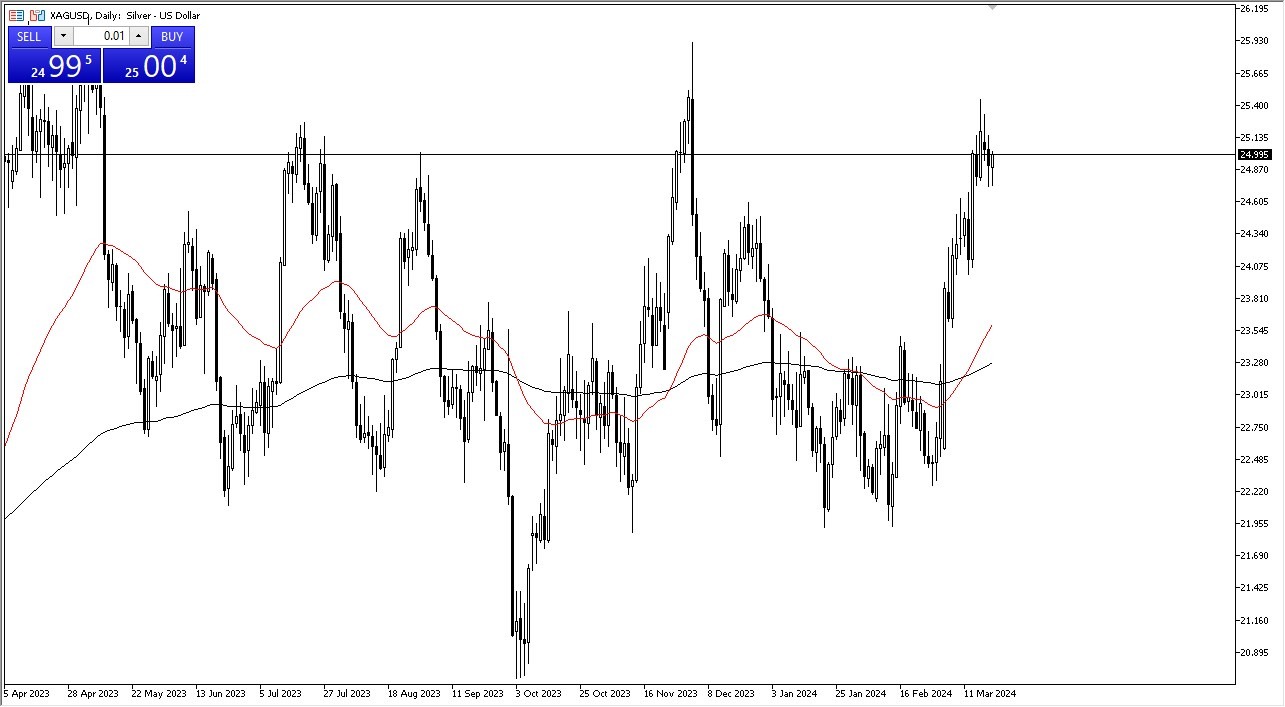

- Silver initially pulled back a bit during trading on Wednesday, but it does look like we are trying to hang on to some support, and therefore, I think it makes quite a bit of sense that traders will continue to bounce around this same consolidation area.

- There are some things that I would watch very closely when it comes to this market.

- Number one is going to be the reaction to the Federal Reserve statement and press conference during the session. It's also worth noting that there are a couple of crucial levels that traders have been paying attention to for some time and they have proven to be quite reliable.

The Levels

Top Forex Brokers

The first one is the $26 level. The $26 level is a major ceiling in this market, going back multiple years. And as we are getting somewhat close to it, I have to wonder whether or not we have the momentum to punch through there and go higher. We may or may not, only time will tell, but if we do, it would obviously kick off a major FOMO trade. Short-term pullbacks at this point in time do make a certain amount of sense and the $24.50 level is another area I would be paying close attention to as it has shown itself to be important multiple times.

Recently, we have seen a lot of upward momentum in this market, so I do think that we will get a little bit of follow through, but the question is what the path will be. I don't necessarily think that markets are going to suddenly find themselves shooting straight up in the air, but I suppose if the Federal Reserve does shock the market, you may see interest rates fall and if that's the case that certainly would help silver. Look at a pullback at this point as a potential buying opportunity.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from