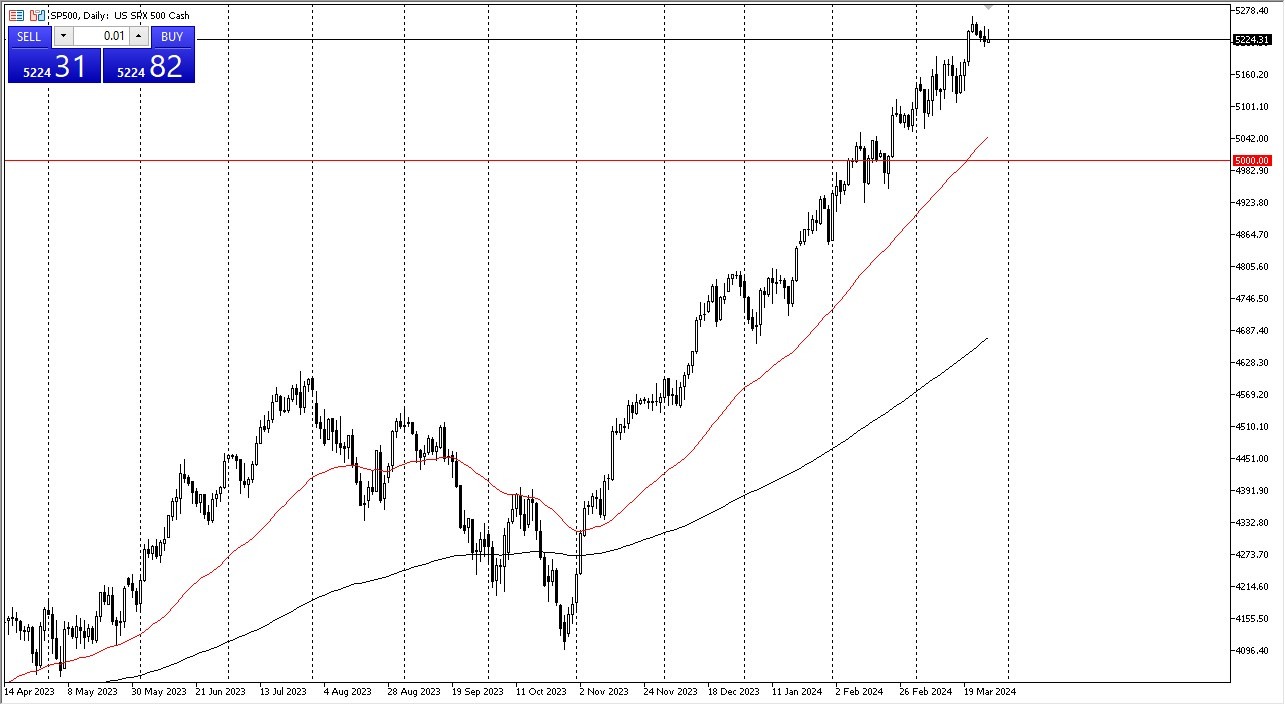

- The S&P 500 has been very noisy during the early hours on Wednesday, shooting higher but then selling off.

- Quite frankly, I think there are a lot of people out there concerned about the over exuberance of the markets right now, and it is worth noting that when New York opened, we saw a flood of selling.

- I don’t necessarily think that this is going to be a longer-term change, just that it’s likely that we will continue to see a lot of volatility at this point.

The S&P 500 of course is not an equal weighted index, so it does make a certain amount of sense that all of the usual stocks that everybody owns will continue to be a major influence on what happens here. Underneath, I see the 5200 level as a potential support level, followed by the 5150 level, and then the 50-Day EMA. The 5000 level right now for me determines the overall trend, so it’ll be interesting to see if we can hang on to it.

Choppiness Should Continue

I believe the choppiness will continue due to the fact that there aren’t many economic announcements out there to move the markets right now, and therefore they are just simply looking for some type of reason to move. We do get the Core PCE Index numbers coming out on Friday, which of course is the Federal Reserve’s favorite inflation metric, but I also recognize that Wall Street will be closed on Friday, so there won’t be much of a reaction until Monday. I think at this point it does make a certain amount of sense that people are trying to get out of the market ahead of that potential volatile session, especially considering they will be able to react to it.

Top Forex Brokers

Nonetheless, this is a market that you continue to buy dips in as the trend is so strong, and unless something changes quite drastically, I just don’t see how that will change anytime soon. The fundamental still favor higher stocks due to a loosening monetary policy, but I also recognize that sooner or later we will get a deeper correction, something that quite frankly I think the market desperately needs.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.