- The US dollar has initially fallen during the trading session on Thursday, only to turn around and show signs of life again.

- By doing so, it looks as if the market is trying to sort itself out and figure out where it wants to go longer term.

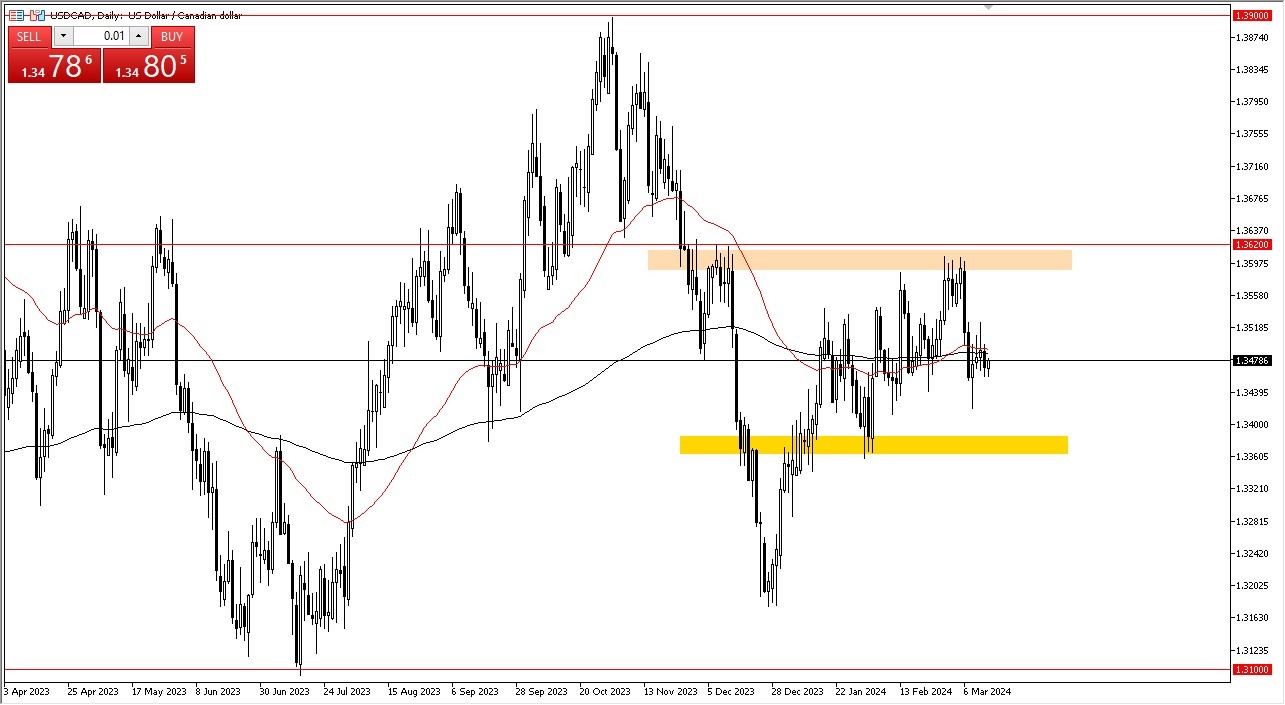

- Keep in mind, the USD/CAD pair is in a major consolidation region.

Technical Analysis

The US dollar initially fell against the Canadian dollar during the trading session on Thursday, but it looks like we are doing everything we can to turn around and hang on to any signs of life. The 50-Day EMA’s is just above, and I think that is an indicator that you will have to pay close attention to. After all, the 50-Day EMA is quite popular, and is something that a lot of technical systems run on. Furthermore, you should also pay attention to the fact that the 50-Date EMA is currently flat, and that suggests that perhaps we are going to see a real lack of momentum.

Top Forex Brokers

This does make a certain amount of sense, due to the fact that the US and Canadian economies are so heavily intertwined. Because of this, they quite often will see the currency’s grind sideways, and essentially do nothing. Keep in mind that the Canadian dollar is also highly influenced by crude oil, so there is the possibility that it picks up due to the fact that crude oil is doing everything he can to break out, but that correlation against the US dollar is not as strong as it once was as the US is presently producing some of the largest amounts of oil it ever has.

If we can break above the shooting star from the Tuesday session, that will open up the possibility of the US dollar traveling to 1.36 over the longer term, while a break down below the lows of the last couple of sessions open up the possibility of a move down to the 1.34 level underneath which of course is a major support level as marked on the chart. I remain fairly neutral, but if you are short term range bound trader this could be a good pair for you.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers in Canada for beginners to trade Forex worth using.