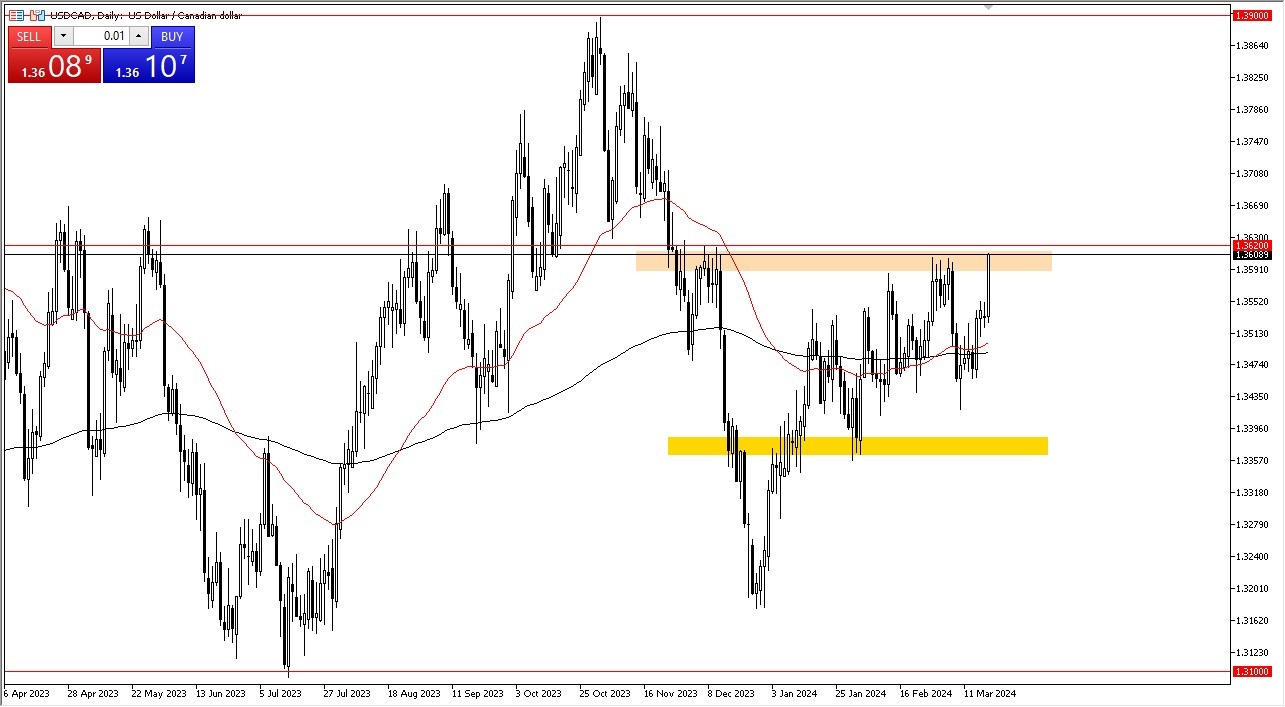

- The US dollar has shot straight up in the air against the Loonie during trading session on Tuesday as the 1.3620 level is now being threatened.

- If we can break above there, it's likely that we will continue going much higher with the first area of interest being the 1.3750 level followed by the 1.39 level.

That being said, we are a little extended, so it is going to be crucial that you pay attention to whether or not the market can find its footing here. If it can, then we might be in for a significant move. If we cannot, then it's likely that we just continue to see a lot of the same choppy consolidation that we had been in previously. Keep in mind that the market participants are very cognizant of the idea that crude oil is heavily influential on the Canadian dollar, so that is worth paying attention to.

Top Forex Brokers

The Crude Oil Connection

Crude oil looks very strong and ironically it hasn't helped the USD/CAD, but there might be a little bit of a shifting perception at this point due to the fact that the US is producing so much more oil these days. Because of this, it is possible that traders are starting to focus elsewhere, like the idea that the Bank of Canada suggested that it isn’t able to raise rates again, due to a weakening economy – which also has a lot of inflation as well.

With that being said, I like the idea of buying a breakout, but only if we get a daily close above 1.3620. Keep in mind though, the Federal Reserve meeting is on Wednesday, and that's going to have a major influence on what happens next, so you have to be very cautious with any position sizing. All things being equal, this looks bullish, but you do have to keep that volatility in the back of your head. This is a pair that is quite often choppy, as the two countries are so intertwined, and therefore you need to keep that in mind when it comes to trading the Dollar against the Loonie.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.