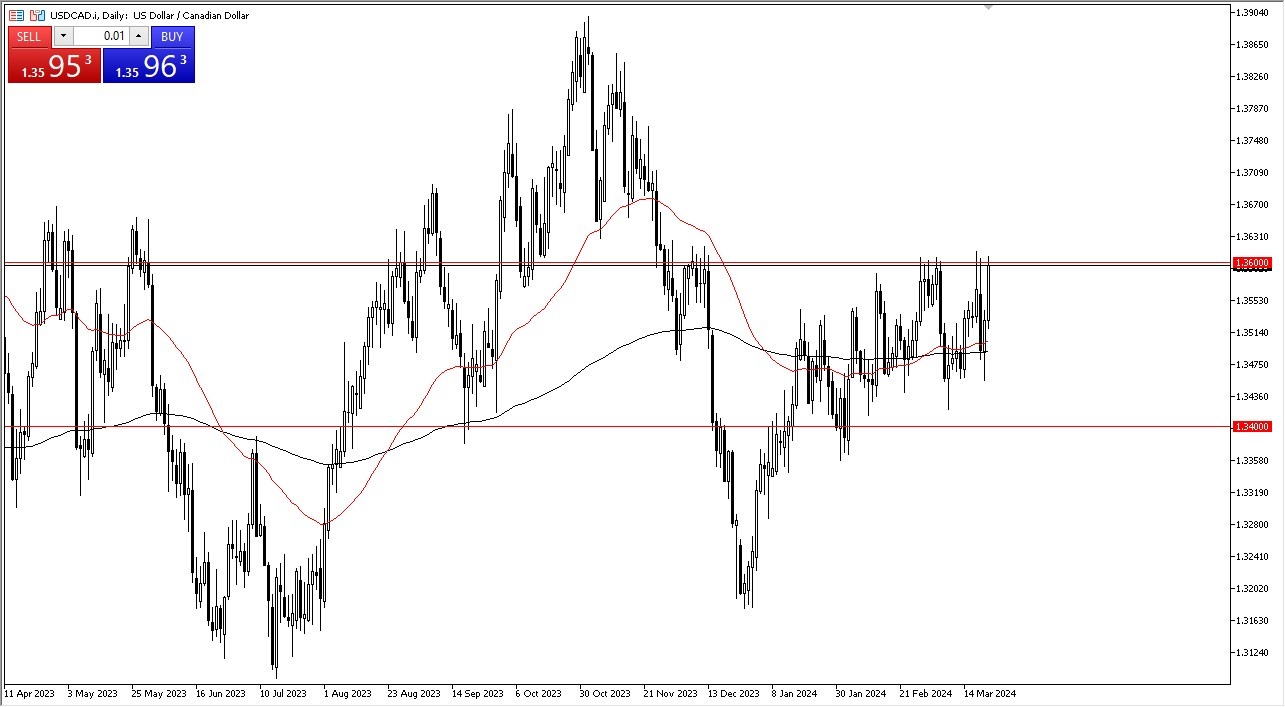

- The US dollar is shot higher during the trading session on Friday, and as we are looking at the market testing the top of its overall range against its northern neighbor.

- All things being equal, the US dollar has shown itself to be fairly strong during the session, but we face a significant amount of resistance just above.

Despite the fact that crude oil has done fairly well, the Canadian dollar seems to be on its back foot. This makes a certain amount of sense as the Canadian economy is featuring a bit of stagnation, but at the same time still has a bit of inflation. Quite frankly, the US dollar seems to be strong against almost everything, and the fact that it has been strong against the Canadian dollar for some time also suggests that if we get any US dollar strength at all, the Canadian dollar will continue to suffer in general.

Crude Oil, and the Technicals

Despite the fact that crude oil is a major factor in the Canadian dollar itself, the reality is that the world is paying close attention to interest rate differentials. At this point, the US interest rate is attractive in comparison to many of its contemporaries, and that includes Canada. However, the 1.36 level is an area that has been significant resistance multiple times, and the fact that we are getting here at the very end of the week suggested perhaps we are quite ready to break out. If you saw signs of exhaustion in this area, it could be an opportunity to start shorting this pair.

Top Forex Brokers

That being said, it is difficult to go against the US dollar in general, but if we see some type of big move in oil then traders may start to focus on crude oil more than anything else and that could be what helps the Canadian dollar. On the other hand, if we find ourselves breaking above the 1.37 level, then it’s likely that this market truly takes off, perhaps heading to the 1.39 level, which is also a major resistance barrier in this pair. To the downside, I would assume the 50-Day EMA offers support, and most certainly the 1.34 level does.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.