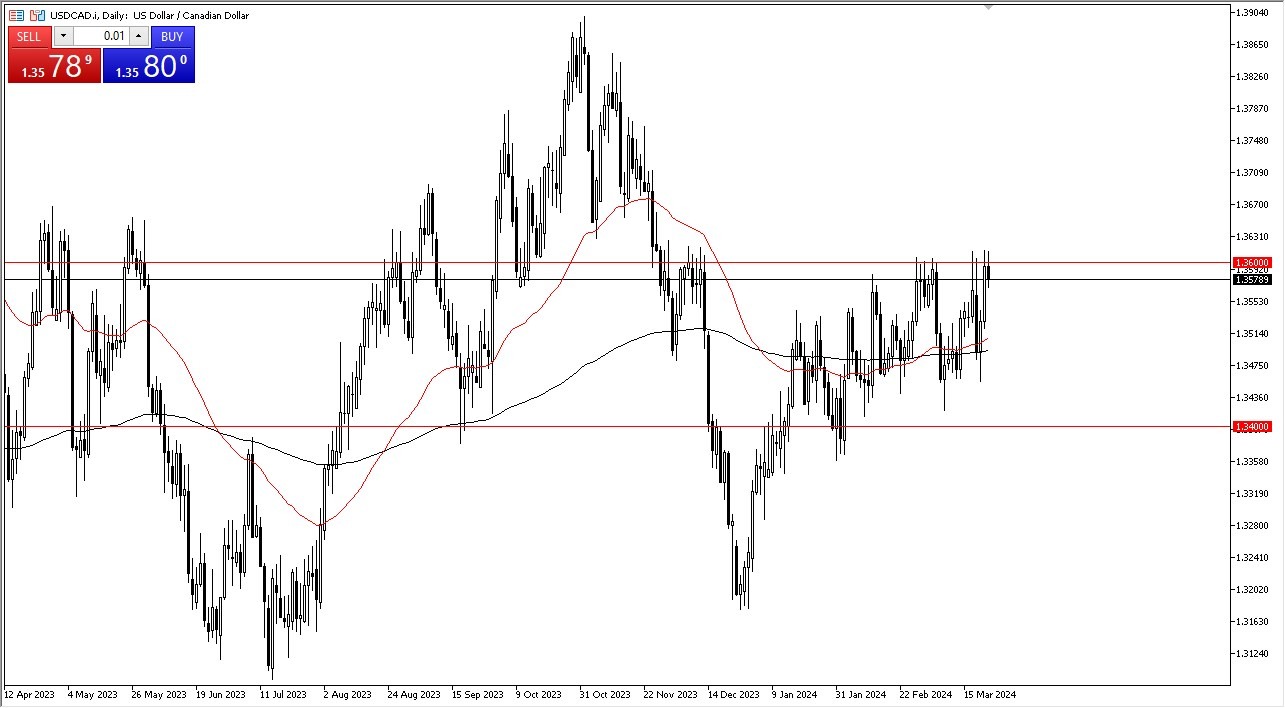

- The US dollar has initially tried to rally during the trading session on Monday but gave back gains above the 1.36 level.

- This is not a huge surprise, considering that this is a major resistance bear, and we had expended quite a bit of energy to get to this level on Friday.

- Ultimately, this is a market that I think we get to buy pullbacks going forward, but we do need those pullbacks to occur occasionally.

- Whether or not we can truly break out for a longer-term move remains to be seen, but right now it certainly looks as if we are going to try to do that.

Canadian dollar weakness

Overall, the Canadian dollar is a bit lackluster, so I’m not wanting to short this pair. Furthermore, I think a lot of what we are seeing here is the fact that the Federal Reserve may have to delay loosening monetary policy, so that could keep the US dollar stronger for longer. In general, I like the idea of buying dips every time they occur, and I most certainly will get aggressive to the upside if we get a breakout above the highs of the Friday candlestick. That being said, what I find interesting is that one of the most common correlation seems to be breaking down.

Top Forex Brokers

Crude oil

Crude oil typically does a lot for the Canadian dollar and its perceived value, but recently we have seen that correlation break down just a little bit, as traders begin to come to grips with the idea that the US economy is starting to produce more crude oil that once did, so in this pair it may behave a little bit differently. In general, I think this is a situation where you continue to look for value on these dips, but ultimately, we will breakout to the upside. If and when that happens, I believe that the Canadian dollar goes looking to the 1.39 level over the longer term.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.