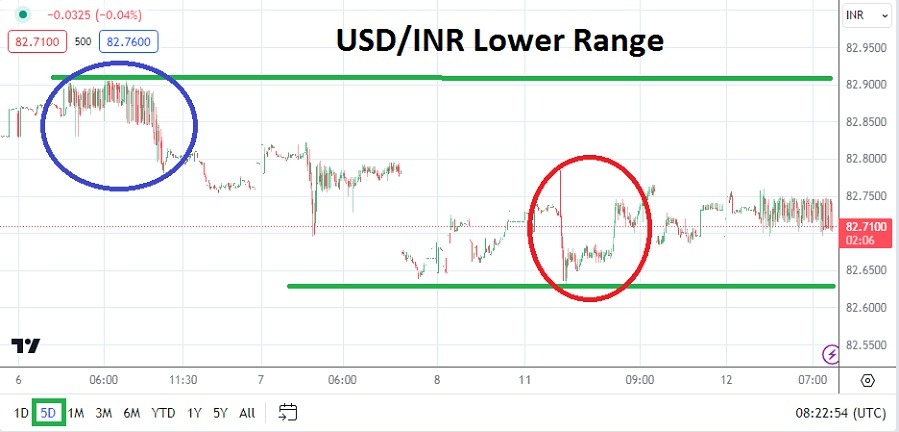

- The USD/INR has displayed the ability to trade lower in the past week and this will get the attention of the currency pair’s speculators.

- The USD/INR is near 82.7200 as of this writing depending on the bid and asks being displayed by brokerage platforms.

- Traders of the currency pair need to remember the USD/INR remains lightly traded in the global Forex sphere, so they must use solid entry orders to get into the market if they are specifically trying to take advantage of quick hitting positions.

The healthy correlation to the broad Forex markets in the USD/INR is a solid sign for the currency pair, this as the USD has weakened also against many other major currencies. Today the U.S will issue important inflation numbers via the Consumer Price Index results. Last month’s inflation outcome via the CPI statistics caused nearly two days of bedlam for Forex traders, so today’s reports should not be taken lightly.

Short-Term Comparison to Mid-Term Outlook for the USD/INR

Day traders want an opinion on what will happen the next moment, they want suggestions regarding price movements they can take advantage of and find profits. However short term perspectives come with dangerous qualifications because timing the exact moment a currency pair is going to suddenly fluctuate is often a wild guess. The USD/INR has produced a sincere downturn since the middle of December, but it has come with rather hard to predict reversals upwards too.

The mid-term outlook for the USD remains weaker. The forecast is due to the notion the U.S Federal Reserve is expected to begin decreasing its Federal Funds Rate late this spring or early this summer. Today’s CPI data from the U.S will be part of the outlook the Federal Reserve uses for timing its interest rate cuts. The Fed will not cut its interest rate next week when it conducts its next FOMC meeting.

Top Forex Brokers

Volatility in the USD/INR

Day traders looking for more momentum lower in the USD/INR must be careful. Gaps still occur within the USD/INR on a daily basis. The currency pair also has a habit of trading in a very tight manner and then suddenly spiking, this is due to large transactions taking place via financial institutions acting for a major corporate client. The Reserve Bank of India cannot be forgotten in this potentially volatile mix either, the central bank certainly believes it is important to maintain strong supervision of the USD/INR.

- Today’s CPI results from the U.S will be felt, but the big reactions from the USD/INR may come early tomorrow after the results can be dealt with by financial institutions in India.

- The 82.7000 mark may be seen as important support for the USD/INR technically. This mark was challenged and lows near 82.6300 and 82.6250 were seen the past couple of days, but trading below the ratio of 82.7000 has not seen serious sustained speculative action since August of 2023.

USD/INR Short Term Outlook:

Current Resistance: 82.7410

Current Support: 82.7100

High Target: 82.8050

Low Target: 82.6520

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.