- Given how little interest the Japanese yen pays, it is not surprising that the US dollar continues to look very strong against it.

- Even though Monday's rising momentum was a little more muted, I believe this to still be the case for the majority of yen-related pairs.

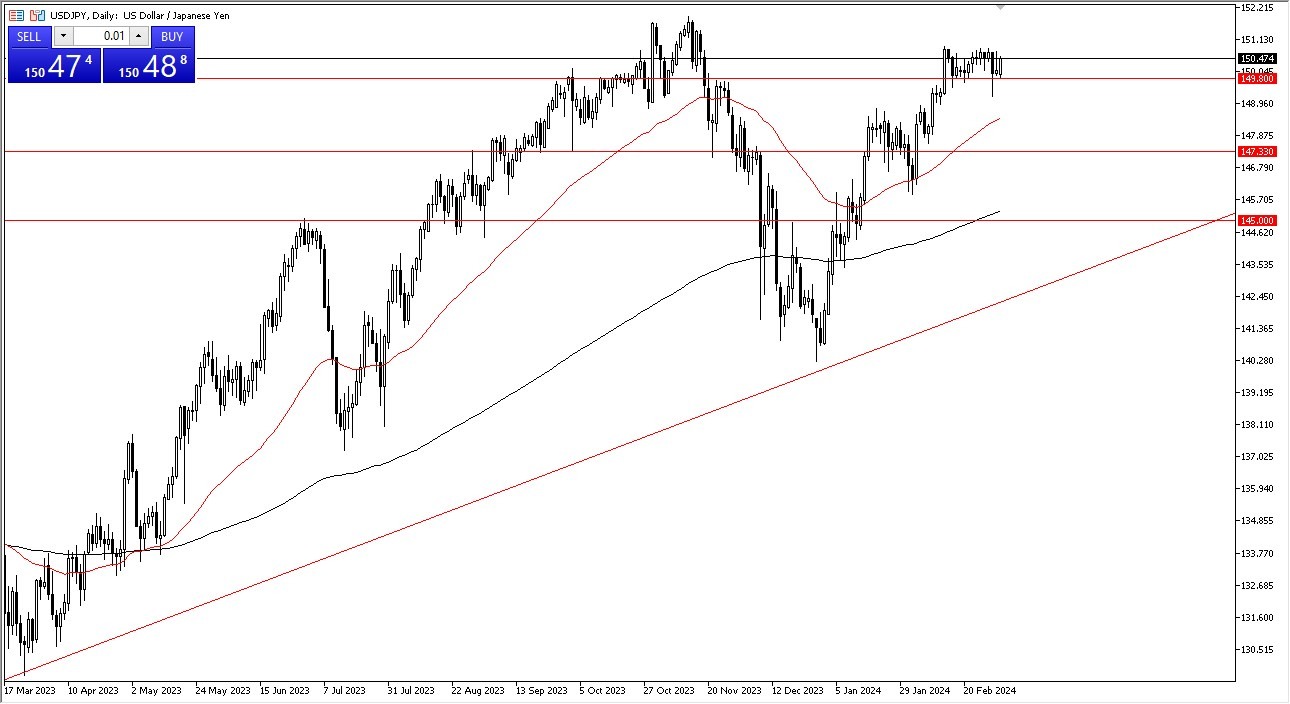

USD/JPY

When the US dollar declines relative to the Japanese yen, buyers continue to come in. Using the 149.80 yen level as something of a bottom, the US dollar made a small increase in value during the early hours of Monday. And it appears that we will keep swinging back and forth in an attempt to gather enough momentum to keep moving upward. I think this continues to be the overall attitude of this market going forward.

The 50-day EMA is there to provide plenty of support if we close the week below the candlestick's lower boundary. Next in line is the 147.33 level, which provides a floor. It appears that the 152 yen level above is currently a significant resistance barrier and breaking that may undoubtedly result in a significant amount of FOMO.

Top Forex Brokers

You should anticipate a swift rise to the 155 yen level once we break above there. In any case, we're on the rise, but we've also been clearing out some of the extra foam lately, which is something that naturally occurs occasionally when you start to boom like we have. I believe that going forward, the US dollar will continue to benefit from the interest rate differential that works against the Japanese yen.

The interest rate is still significantly higher than what is seen in Tokyo, even though the Federal Reserve is anticipated to lower rates at some point this year. You are compensated to hang onto this pair as a result, and as a result, I believe you find yourself in a scenario where people are always looking for good deals when you draw back. In the long run, the interest rate differential pays out handsomely, and many institutional players are profiting from this by engaging in what is known as a carry trade. Having said that, I'm not interested in selling these moves at the moment.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.