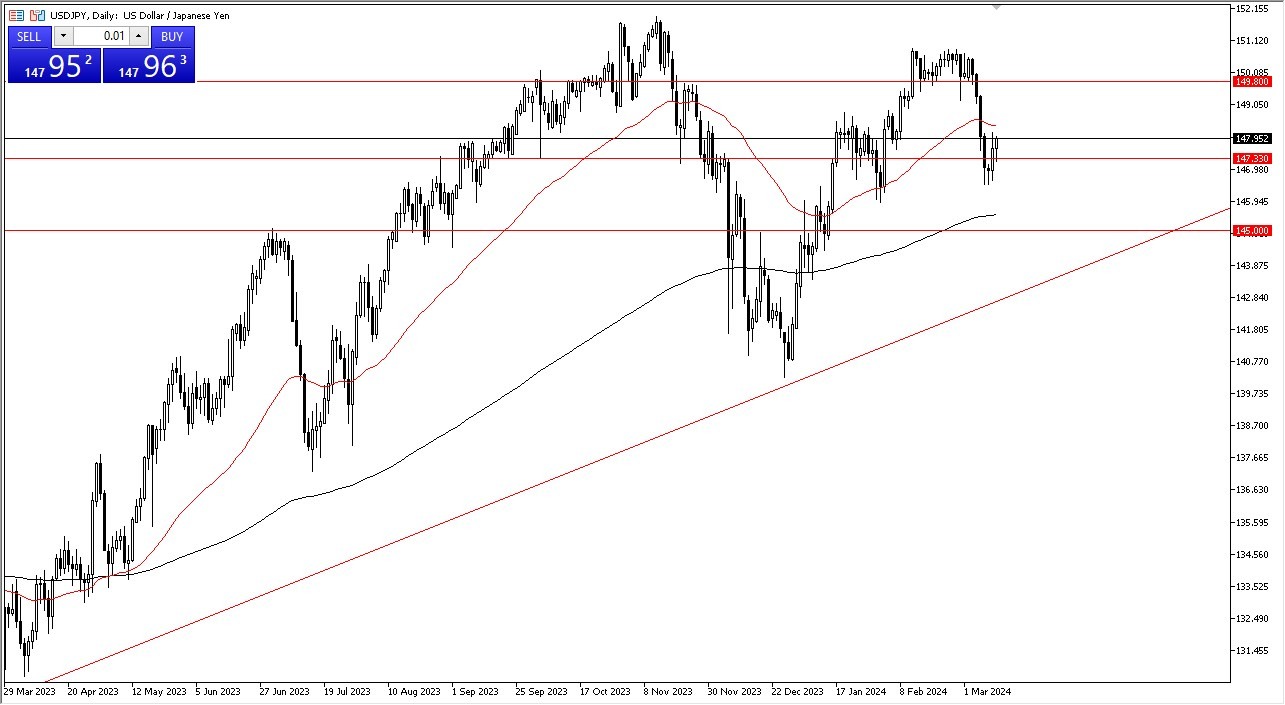

- Every time the US dollar declines versus the Japanese yen, buyers continue to be found, and while Wednesday's candlestick may not be particularly large, it does indicate that there are buyers underneath each time we decline.

USD/JPY is still in an uptrend

As you can see, we slightly reversed course during the Wednesday trading session, but we were able to turn things around and show signs of life at the 147.33 level. At this point, I believe that the 50-day EMA above will provide strong resistance. If and when we break through it, the market may aim for the 149.80 level. Generally speaking, this market is in a much longer term uptrend despite having recently seen a fairly significant selloff.

I believe that many traders will continue to view the market through that lens since, as you may recall, the interest rate differential pays you to stay in this market. In the end, I believe that this market will return to the 149.80 yen mark. Additionally, surpass that point and search for the 152 yen level. This is an area that offered a lot of resistance in the past, and I think it could in the future as well, albeit not as strong as before.

Top Forex Brokers

I view this through the lens of a market that has plenty of support near the 200 day EMA at the 145 yen level and again at an up trending channel, even if we pull back from here. Remember that the PPI data are out on Thursday, which may create some volatility in the US dollar. Overall, though, I think this is a situation where you should be cautious but optimistic.

Recall that you are paid to hold onto this at the end of each day, so having a large position, like an institutional trader, does make a significant difference and contributes to the trend. In the end, you must adopt this perspective of the market, which is rising for a reason and for which there is no justification for resistance. That doesn't necessarily imply that we will take off in the air, but it does offer you a sense of the direction that you should be going in this market.

Ready to trade our Forex daily analysis and predictions? Here are the best Asian brokers to choose from.