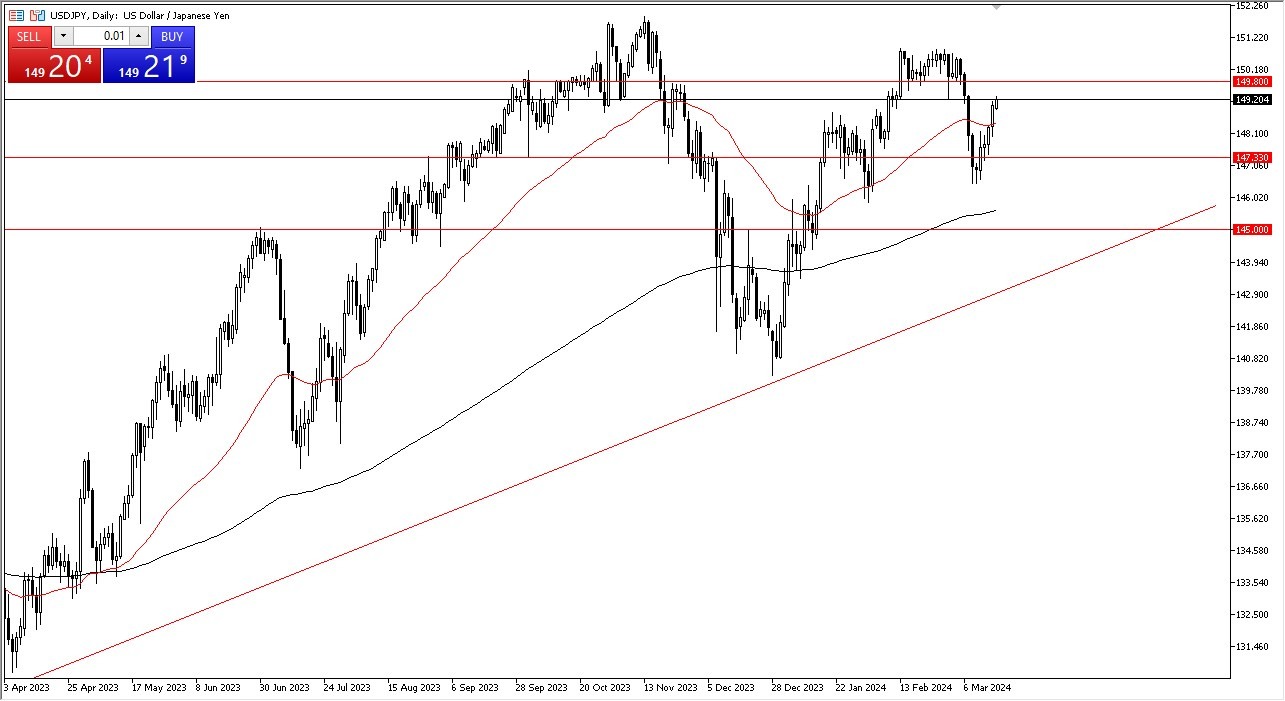

- The US dollar has rallied pretty significantly during the early hours on Monday, but we still find quite a bit of resistance above.

- Furthermore, and you have to be very cautious this week due to the fact that we have the Bank of Japan coming out with an interest rate decision, followed about a day to a day and a half later by the Federal Reserve doing the same.

- All things being equal, this will be like Ground Zero for volatility in the markets this week, as there is so much speculation about what the Bank of Japan might do.

High Volatility Ahead

Top Forex Brokers

So, with that being the case, I think you have a high probability of extreme volatility and therefore you have to be cautious. Nonetheless, this is a scenario where, given enough time, we probably will break to the upside and to a fresh new high because the Bank of Japan could tighten interest rates, but it would just be to zero. If they fail to do so, that's going to send this pair through the roof as well as all other yen denominated currency pairs. Pullbacks to the 50 day EMA should be buying opportunities right along with the ¥147.33 level. In general, we are in an uptrend and have been for a long time and therefore I don't see a reason to fight this.

I do believe that the US dollar is not done against the yen. And of course, if the inflation numbers in the United States stay the same as they have been, it's very likely that the Federal Reserve will have to push back their timetable of interest rate hikes. No interest whatsoever on my part in trying to sell this pair, as the momentum should continue to be a major factor. I think this pair will continue to pay you to hold onto it via swap, and a lot of people will be focusing on that.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.