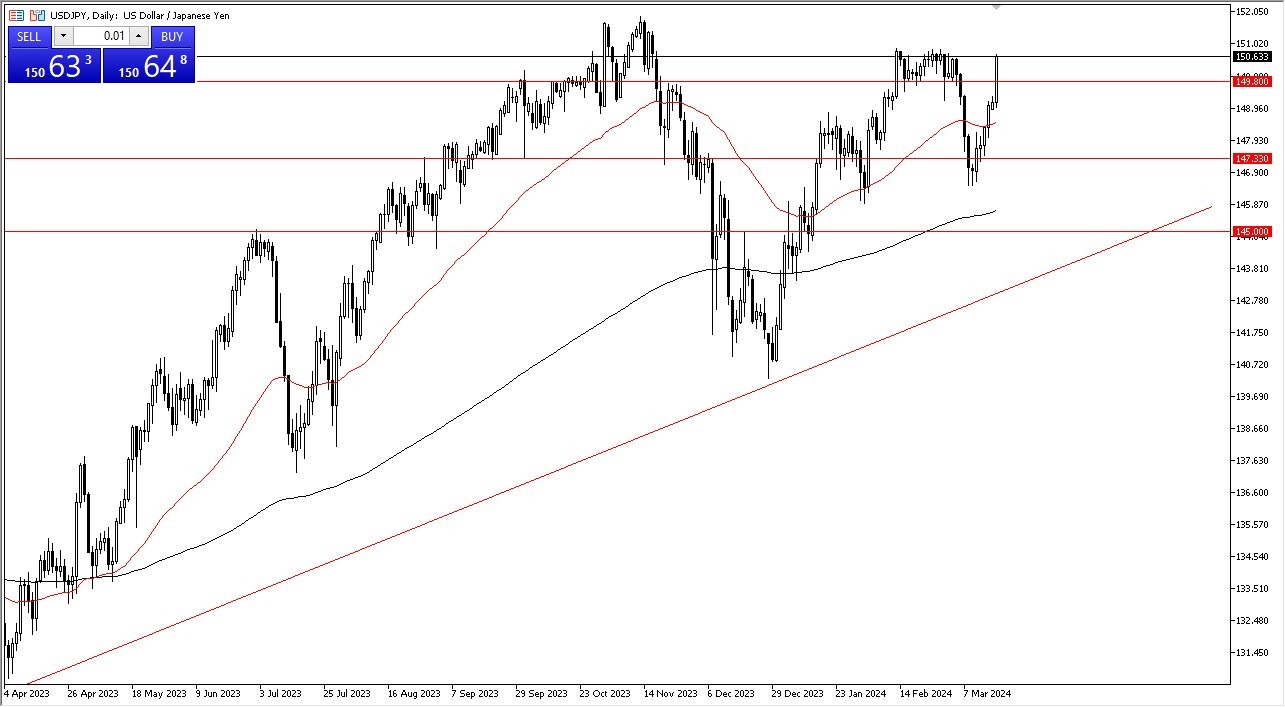

- You can see that the dollar has stretched higher against the Japanese yen overnight as the Bank of Japan raised interest rates to 0.1%.

- That is a positive interest rate coming out of Japan, which is something that we haven't seen in years.

The Interest Rate Differential is Wide Enough to Drive a Bus Through

But ultimately the interest rate differential still favors America and it's very likely that the Japanese won't raise much more than that. So, with that being said, it really hasn't strengthened the yen at all. I think at this point in time, you have to look at it through the possible reality that we will eventually break out. Short-term pullbacks continue to be buying opportunities from everything I see and therefore I will continue to be buyers given enough time. But the 152 level above I think will continue to be very difficult to break.

Top Forex Brokers

Once we break above there, things could change, but right now I just don't see an argument for it. With that being the case, I like the idea of finding value and taking advantage of it. Underneath we have the 149.8 yen level and then we have the 50 day EMA. Underneath there we have the 147.33 yen level, an area that I think a lot of people will be watching. All things being equal, this USD/JPY is a market that you need to be somewhat cautious with but clearly bullish.

Short-term pullbacks continue to offer value, and the fact that we have the Federal Reserve on Wednesday is also something that you need to keep in the back of your mind as well. So do be cautious, but recognize, this is a market that is still very much in an uptrend. Because of this, I look forward to any pullback that the Federal Reserve could cause, as it will be value and a bargain in this pair. It seems very likely that the volatility will offer a decent opportunity in the next day or two.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.