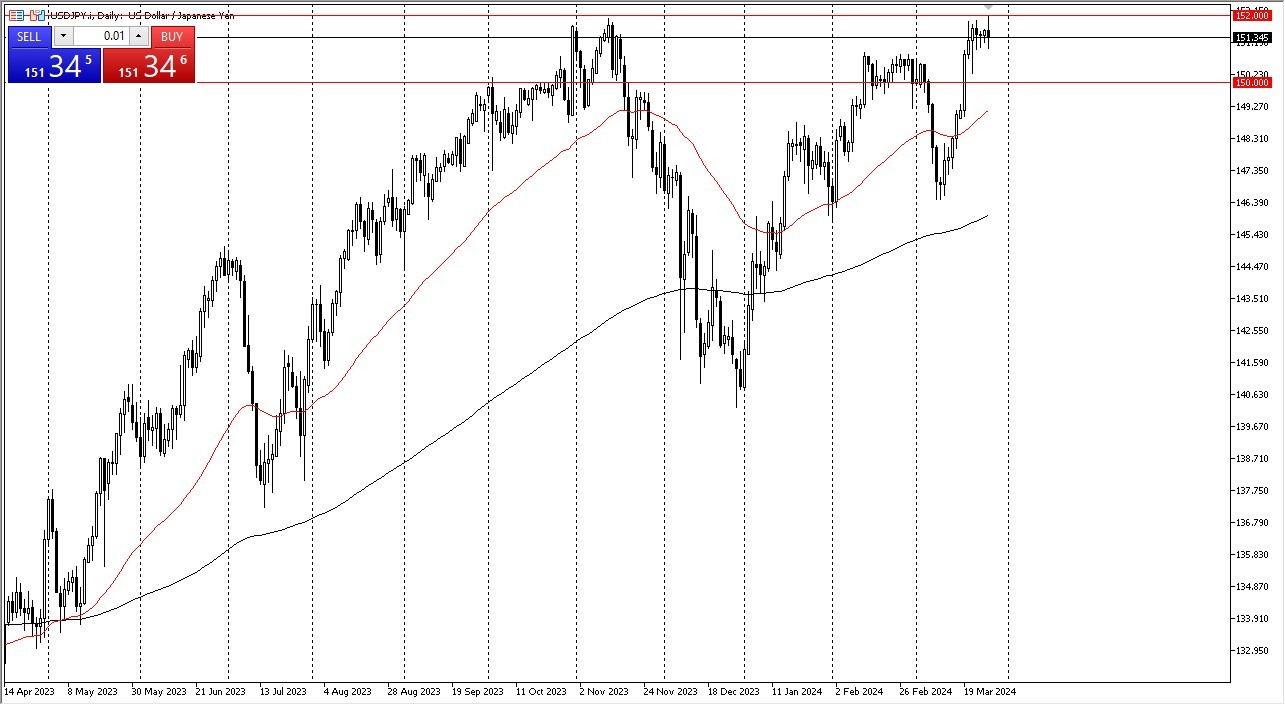

- You can see we initially did try to rally, but the members of the Bank of Japan came out and did their usual jaw boning about monitoring currency fluctuations, which is code for please stop shorting the yen.

- Yes, they could get involved and intervene, but that's just going to end up being a buying opportunity. It's their own fault.

They have 0.1% interest rates. Nobody takes the Central Bank of Japan very seriously. And even if they do intervene, I'll just be buying more on the way down. Ultimately, the interest rate differential continues to be a major problem for the Japanese. And over the long term, I fully anticipate that the USD/JPY market is going to break above the 152 yen level.

Top Forex Brokers

Is 155 Yen in the Cards?

Once it does, it opens up the possibility of a move to the 155 yen level. All things being equal, we may go sideways for a little while just due to the fact that we don't have a lot out there to move the market with perhaps the exception of the PCE, the core PCE numbers coming out on Friday, which the Fed uses as its favorite indication of inflation. So, traders may look at that as a potential market moving event. But it'll be interesting because Wall Street won't even be at their desk. So it'll be interesting to see how that plays out. Either way, I think at the moment we have support at 150 yen, the 50 day EMA and several points below. If and when we break above 152 yen, I think it opens up a move to 155 yen. And if the central bank of Japan does intervene, I'm just waiting for the initial push to slow down, and I'll buy more.

I understand that the Federal Reserve will be cutting later this year, but at the same time, I understand that the Japanese have no way whatsoever to tighten much more, as the debt levels of Japan simply won’t allow it to be a thing at this point in time.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.