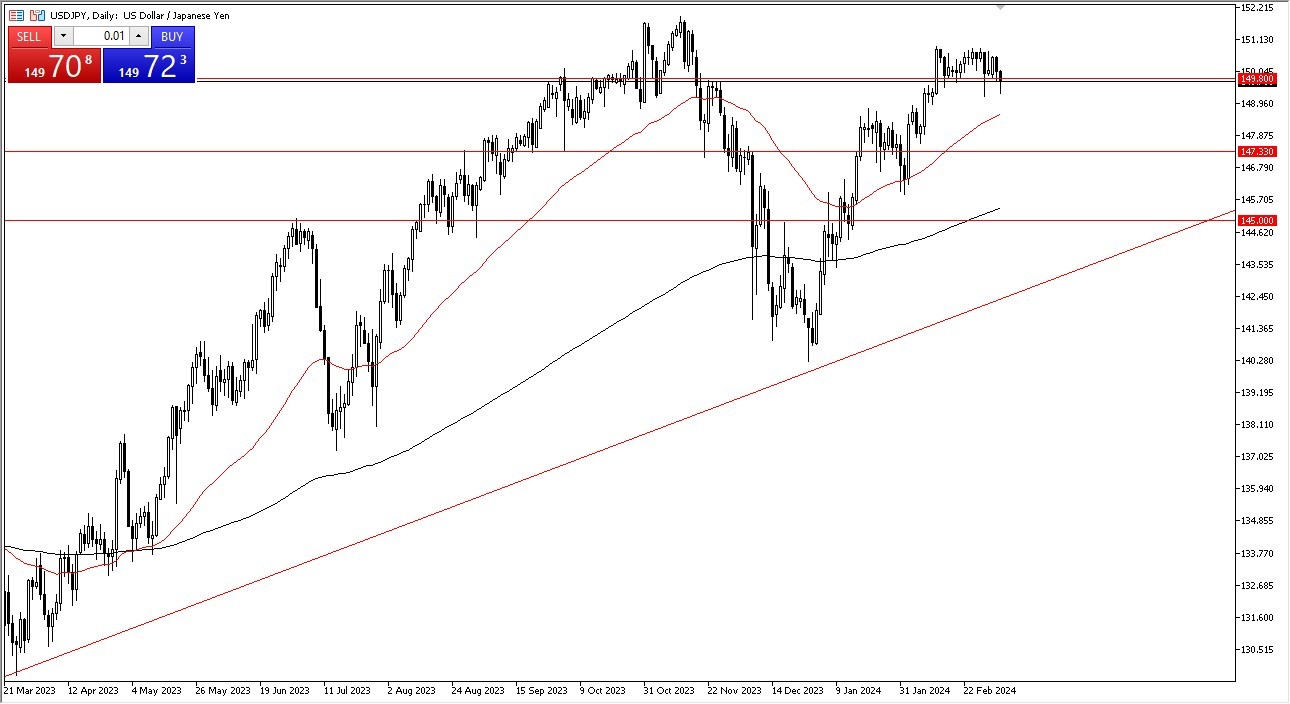

- Overall, the USD/JPY is still showing a "buy on the dip" mentality as the market fell a little bit early on Wednesday but then recovered and showed signs of strength.

- The longer-term outlook for interest rates indicates that this pair will continue to rise.

USD/JPY Continues to Find Buyers on Dips

As you can see, we retreated slightly during Wednesday's early trading session before rising once more. The chart indicates that the 149.80 Yen level is still significant and has demonstrated some degree of support. Given that, I think it makes sense to benefit from "cheap US dollars" whenever we have the chance.

Remember, though, that this is the week of the non-farm payroll, and the announcement of that fact is likely to have a big impact on this market. After all, interest rate differentials drive this market more than others, and that jobs report will jiggle interest rates. Having said that, nothing has changed—this is still an upward trend. The 50-day EMA below will remain a source of assistance.

Top Forex Brokers

Next in line could be the 147.33 level, which presents another obstacle. Though I believe there will always be a lot of noise in this market, I do believe that eventually buyers will not only aim higher but may even hit the 152 yen mark. We probably have more of a buy and hold situation if we break above the 152 yen level. Since that figure is the next big, round, psychologically significant figure, it would not surprise me in the slightest if this pair traveled to the ¥155 region in that context.

Since the interest rate differential is still quite large, you should generally just be looking for value in the US dollar in this situation. Naturally, the US central bank may make cuts later this year, but it won't have as lax of monetary policy as the Bank of Japan. It truly does not make sense to own the yen in the long run, as this chart illustrates, and the Bank of Japan is only now considering switching to neutral interest rates.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.