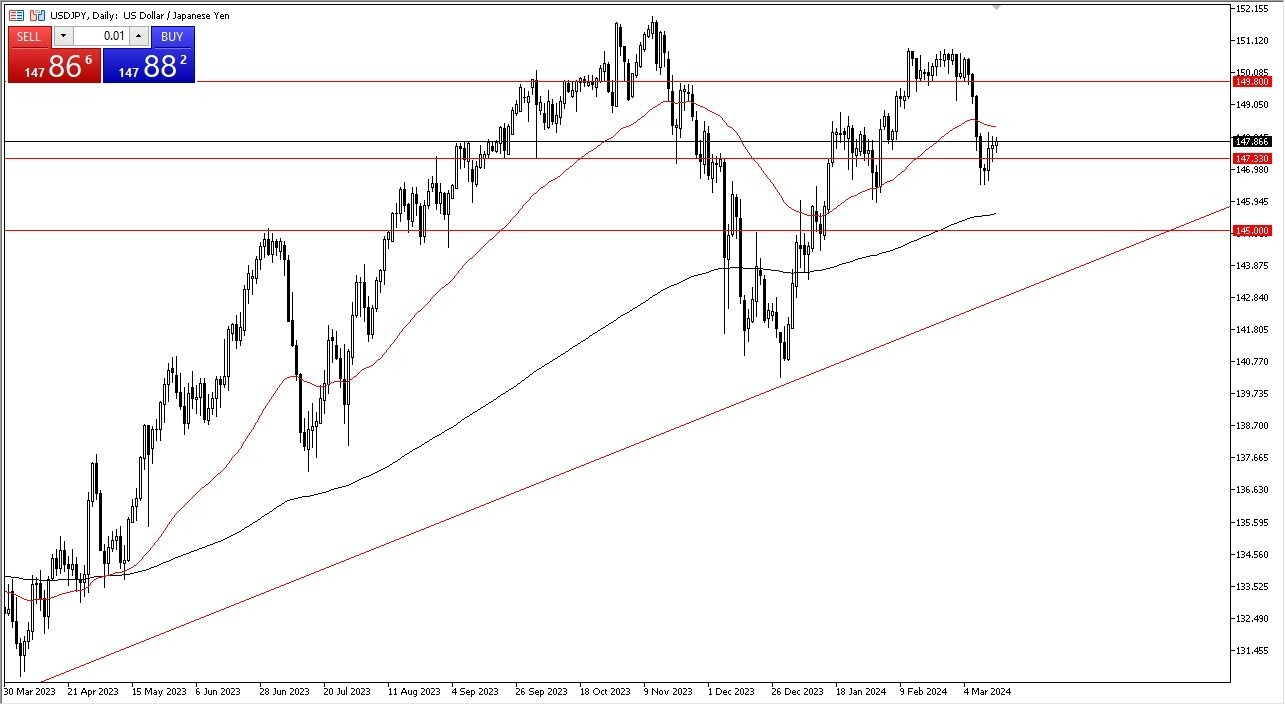

- The US dollar has continued to consolidate against the Japanese yen during the trading session on Thursday as we see quite a bit of support underneath.

- Even if we do break down from here, I think there are multiple points where buyers may reemerge.

Top Forex Brokers

The US Dollar Remained Supported

The dollar yen has gone back and forth during the trading session here on Thursday, as we are just simply waiting around to see what happens next. Ultimately, the pair USD/JPY is a market that continues to see a lot of upward pressure due to the interest rate differential between the United States and Japan. I think that continues to be the story here. And therefore, you need to look at it through the prism of a market that is going to take advantage of that. I think you continue to get paid to hang onto this pair. And I think most big traders are looking at it as well in that light. Ultimately, even if we do break down below the lows that we made the last couple of sessions.

There is still the 200 day EMA that comes into the picture to sort things out. And I would also point out that the 50 day EMA above is a potential resistance barrier that opens up the possibility of a move to the 149.80 level. All things being equal, this is a market that I think is probably more of an investment than a short-term trade.

But with the interest rate differential at the end of every day, you do get paid a little bit. So longer term big money traders will appreciate that. Furthermore, the Bank of Japan is nowhere near tightening monetary policy. And even if they did, they would just then be getting to zero rates. The Federal Reserve, on the other hand, even though it may cut rates later this year, and even claims that it's going to, the reality is we are light years away from the interest rate differential tipping in favor of Japan. Because of this, I remain bullish of this pair, but I also recognize that the easy money has already been made.

Potential Signal: I am ok with buying here. I would have a stop loss of 100 points, but I would be looking for 250 points in a return. The 200-day EMA will be watched closely.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.