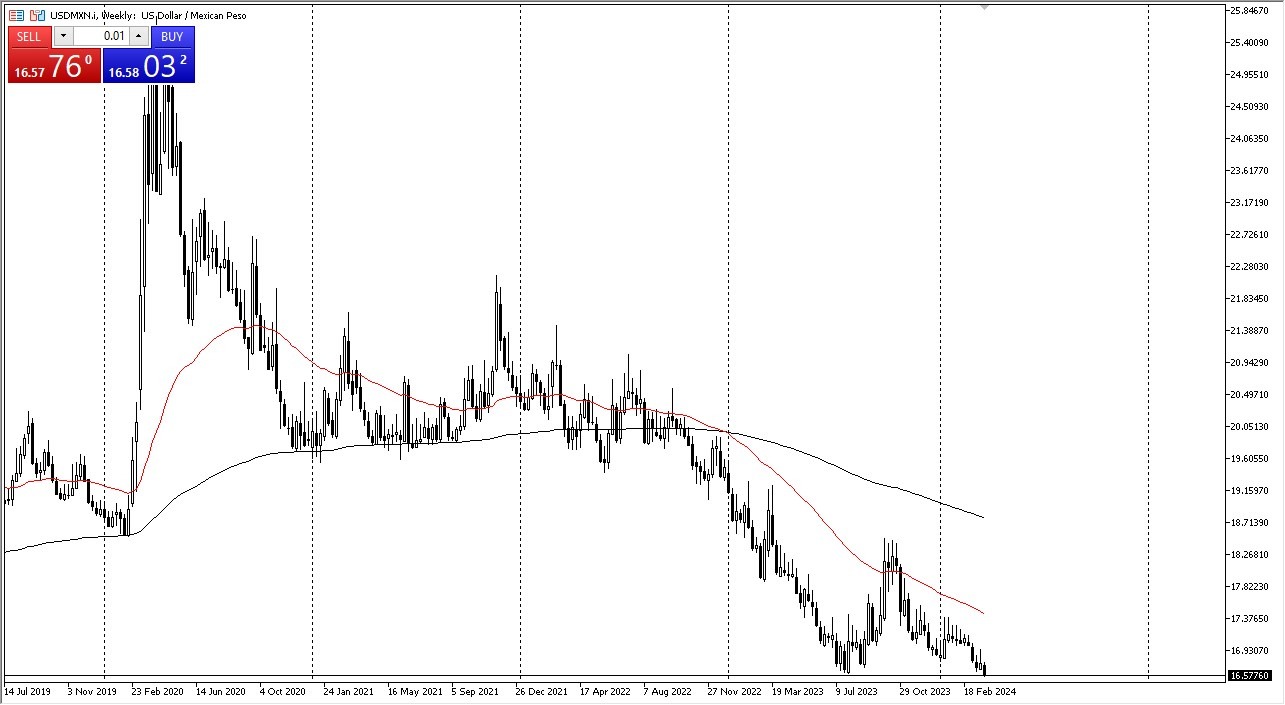

- The US dollar has continued to drop against the Mexican peso during the month of March, which is truly interesting considering we have just made a “lower low”, on the weekly chart.

- That being said I still see a lot of noise between here and 16 pesos that we need to watch out for, so the month of April could be one that is going to be crucial as to where this pair goes for the longer-term.

The US dollar has been struggling for some time against the Mexican peso, mainly due to the interest rate differential. After all, in this world we like to get a lot of interest whenever we can, and the fact that the central bank in Mexico offers 11.25%, makes the Mexican peso a currency that a lot of people will be interested in. However, that doesn’t mean that we get a straight shot down.

Pay attention to America

Ironically, if the economy in the United States starts to crumble, that can actually work against the value of the Mexican peso, despite the fact that the interest rate differential will be massive. After all, most of Mexico’s economy involves the United States one way or another, as Mexico is now the largest exporter to the US. Furthermore, it’s probably worth noting that the pair also has to deal with remittances, which is just another way to talk about Mexicans sending money home that are presently working in the United States.

Top Forex Brokers

At this point, rallies are probably selling opportunities with the 50-Week EMA near the 17.50 pesos level, but if we were to break down below the 16.00 pesos level, I think we could see a huge flush in the US dollar, perhaps sending it much lower. If that’s the case, it means that there will probably be a major “risk on” attitude around the world, and it does make a certain amount of sense that we could see that happen with the Federal Reserve looking to cut rates this year. However, you should also be aware of the fact that the Mexican peso is considered to be an emerging market currency, meaning that traders won’t want to hold it if we are in a sudden “risk off” type of attitude.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.