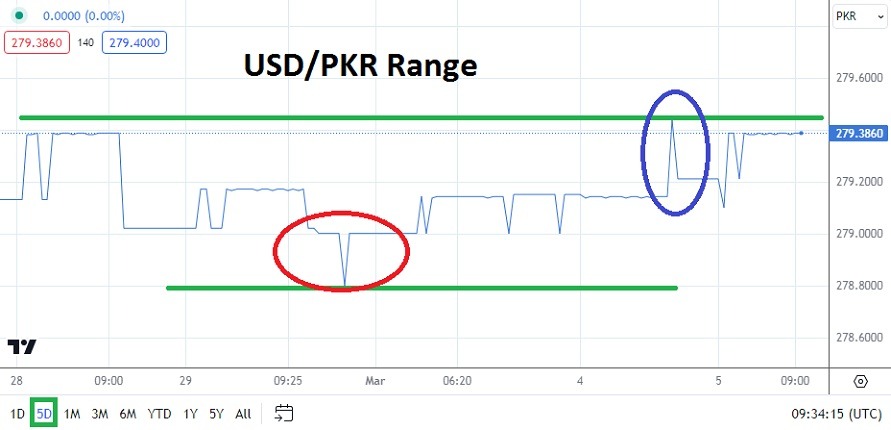

- The current price listed for the USD/PKR is near the 279.3860 value as of this writing.

- A high was touched in the USD/PKR yesterday near the 279.4390 value briefly.

- Speculators who are pursuing the currency pair need to use entry price orders, along with stop loss and take profit order to engage in wagering.

- The rather ‘stiff’ value range in the USD/PKR does exhibit price movement, but it needs to be understood this the currency pair suffers from a lack of volume.

Yesterday’s lows in the USD/PKR touched the 279.1000 ratio, but then a reversal higher developed. Intriguing the USD/PKR produced a low of nearly 279.0000 on Friday. Thursday’s low was near the 278.8000 ratio. Looking for correlations in the USD/PKR to the broad Forex market remains challenging. The ability to trade lower last week is noteworthy considering the belief the USD should be trading lower over the mid-term from global financial institutions, but it may not play a huge part in the current value of the USD/PKR.

Tight Range Persisting and Speculative Notions in the USD/PKR

In order to take advantage of changes in price via the USD/PKR a trader should have a solid plan of action. This may have to include carrying a trade overnight to produce the speculative goal. The USD/PKR is not moving in a manner that mirrors the broad Forex market and its change of values are not incredibly fast. The tight trading range creates opportunities in the USD/PKR, but is also creates a chance that the currency pair can languish and not have enough price action.

Traders who are willing to hold a position overnight should make sure from their brokers about the price charged for transactions for such an endeavor. Because the USD/PKR carries risks for brokers due to the sudden potential of volatility, they are likely to charge their clients for the opportunity to speculate on the currency pair, particularly when a position is going to be carried into the next day.

Top Forex Brokers

The 279.0000 to 279.6000 Range in the USD/PKR

A price range between the 279.0000 to 279.6000 marks, with definite outliers has been a heavily traded terrain the past few weeks in the USD/PKR. Traders who have the ability to wager on support and resistance levels may find opportunities if they use cautious leverage and are patient.

- Pursuing the USD/PKR via support and resistance levels which are known is speculative, and a trader may have to hold a position overnight to hit a target that is wanted.

- Leverage should be thought about carefully taking into consideration overnight charges, and the potential of trades becoming expensive if they take too long to create the desired results.

Pakistani Rupee Short Term Outlook:

Current Resistance: 279.4500

Current Support: 279.2450

High Target: 279.5550

Low Target: 279.0160

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.