- The USD/RUB is trading near the 90.5400 mark as of this writing, depending on the bid and asks ratios being offered by brokers.

- Traders need to understand that when they are pursuing the USD/RUB they must use entry price orders in order to get a fill they ‘expect’.

- Because the USD/RUB does not have as much volume as the major currency pairs, speculators need to be patient.

- However, if a decision has been made to trade the USD/RUB it is also likely the trader has experience within the currency pair and a good instinct for the dynamics involved.

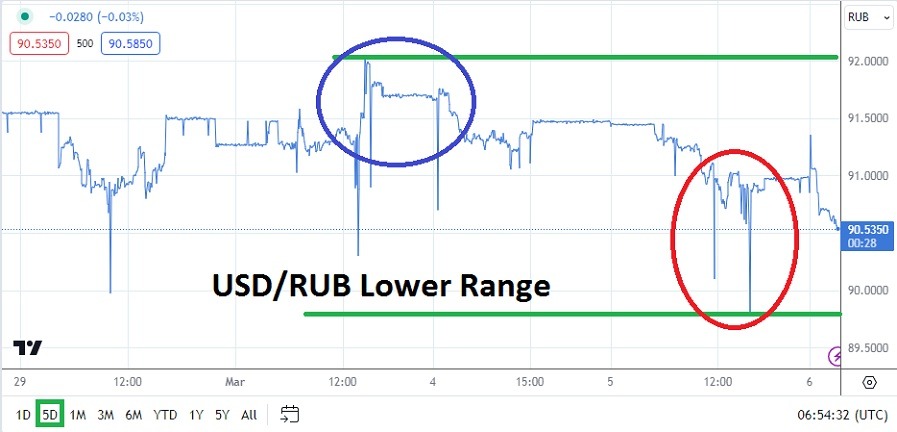

The USD/RUB continues to produce a rather consistent incremental trend lower. On Friday of last week the USD/RUB moved above the 92.0000 level briefly, but then following the momentum higher started to reverse lower swiftly. By Monday of this week the USD/RUB had penetrated the 91.5000 level and started to show an ability to sustain lower values. Yesterday’s trading saw the 91.0000 ratio become vulnerable.

Spikes Lower and the Use of Take Profit Orders in the USD/RUB

Because trading action in the USD/RUB is not extremely heavy this leaves the door open to sudden spikes in the currency pair. The swift changes of value are due to large transactions taking place which change the equilibrium of the USD/RUB value in the blink of an eye. To take advantage of these lightning quick changes in value and profit, traders need to have their take profit orders already working on their trading platform.

The movement of the USD/RUB often does NOT allow for a trader to simply look at current price action and enter a market order to try and get the price they see on their screen, they need working take profit orders which will be hit and executed by their brokers faithfully. Yesterday’s spike lower to the 89.8040 mark is an example. Unless a trader had an order to get out of their selling position and take profits at a value slightly above this level when the USD/RUB bolted lower, they likely lost their chance to cash out their winnings.

Top Forex Brokers

USD/RUB Day Traders and the Art of Patience

Because the USD/RUB has been showing a tendency to trade lower as of the 23rd of February, perhaps traders may believe there is enough reason to simply allow the currency pair to incrementally move downwards and then decide to cash out a position that is in the money. Unfortunately day traders are not going to find live market opportunities lurking in the USD/RUB often. Speculators need to work with solid tactical insights and have working orders functioning to trade the USD/RUB effectively.

- The broad Forex market continues to lean towards a weaker USD outlook for the mid-term, but this doesn’t guarantee short-term results in the USD/RUB.

- U.S Fed Chairman Powell is speaking today and tomorrow, this will affect USD sentiment and likely impact the direction of the USD/RUB over the near-term.

USD/RUB Short Term Outlook:

Current Resistance: 90.9830

Current Support: 90.3010

High Target: 91.5700

Low Target: 89.6100

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.