- For all of the discussion that sanctions would cripple the Russian economy over the past two years due to the wars with Ukraine, one thing is for certain – the Russian economy has not fallen on its knees.

- The USD/RUB trading the past couple of days has again demonstrated clearly the currency pair has enough traction within financial institutions to move in a correlated manner with the broad Forex market.

- The results in the USD/RUB since Tuesday’s U.S Consumer Price Index numbers are not a coincidence.

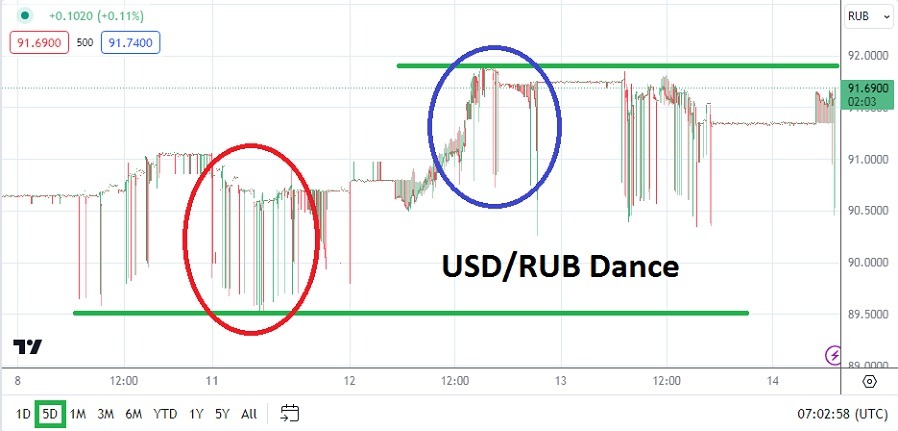

Upon the slightly stronger than expected inflation data from the U.S, the USD got stronger across the board and the USD/RUB witnessed the same type of move upwards as folks bought the currency pair. Trading in the USD/RUB the past two days has fought near resistance around the 91.8000 level. There have been outliers with trading above this ratio, but the price has mostly spawned reversals lower.

Current USD/RUB Value and U.S Data to Come

The USD/RUB is trading near the 91.7050 level as of this writing and over the past couple of days, including this morning spikes lower to the 90.5000 ratio have been displayed. Support at this depth looks intriguing as a potential place to aim for bearish moves in the USD/RUB in the short-term. Today’s trading in the USD/RUB is likely to remain potentially volatile because of U.S data that is on the schedule. Traders need solid risk management to engage in the currency pair.

The Producer Price Index numbers will come from the U.S today, along with Retail Sales. Both of these reports will provide impetus in the broad Forex market and the USD/RUB will react to the results. Traders should remember that transaction volumes in the USD/RUB are not gigantic, so the reactions in the currency pair will deliver technical volatility. The use of adequate stop loss and take profit orders should be considered by traders.

Top Forex Brokers

Behavioral Sentiment in the USD/RUB

The U.S Federal Reserve is still expected to aim for a cut to its interest rate potentially this June. Today’s data will be important because if there is another slight increase in inflation, this will help create the notion the U.S central bank may not be able to cut the Federal Funds Rate as much as they had hoped over the remainder of this year.

- Financial institutions have been counting on a few cuts to the U.S interest rates. Today’s inflation number if it is weaker than expected would help sellers of the USD/RUB.

- A stronger number will not be received warmly and could cause the USD to pick up additional momentum in the USD/RUB.

USD/RUB Short Term Outlook:

Current Resistance: 91.8010

Current Support: 91.4050

High Target: 92.0030

Low Target: 90.2430

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.