Signals for the Lira Against the Dollar Today

- Risk 0.50%.

Best Buying Points:

- Open a buy order at 32.10.

- Set a stop loss at close level below the support level of 31.95.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 points.

- Close half the contracts at a profit of 70 points and leave the rest until the strong resistance levels at 32.75.

Best Selling Points:

- Place a sell order at 32.75.

- Set a stop loss is above 32.85.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 points.

- Close half the contracts at a profit of 70 points and leave the rest until the support levels at 32.60.

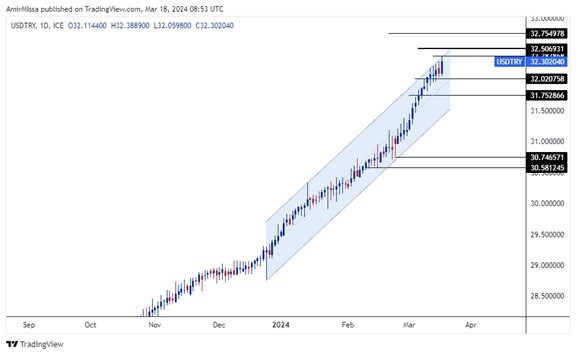

Turkish lira Analysis: The USDTRY pair rose during Monday's trading to record its all-time high at 32.38 Turkish lira per dollar. The Turkish Central Bank issued its weekly statement, which includes the reserve position. Currently, the foreign currency reserves at the Central Bank decreased from March 8th by about $2.726 billion to reach $77.785 billion compared to approximately $80.511 billion at the beginning of this month. Conversely, Gold reserves at the bank increased by about $2.34 billion, reaching a total of $52.748 billion. Finally, the total reserve of the Central Bank increased by about $386 million in the week ending on the 8th of this month compared to the previous week.

At the same time, investors followed a report from HSBC Bank, which revealed stability in Turkey's economic policy expectations in the period following the anticipated local elections at the end of this month. Economic growth is expected to reach 3.5 percent during 2024, compared to previous expectations of 2.5 percent. Also, the bank raised its economic growth forecast for the next year from 3.1 percent to 3.6 percent. As for inflation expectations, bank analysts expect inflation to decrease to 49.4 percent by the end of this year, falling to 29 percent by 2025.

Top Forex Brokers

USD/TRY technical Analysis and Expectations Today:

The pair rose during early trading this morning, with the pair trading near its all-time high at 32.38 Turkish lira per dollar. Currently, the price is trading at the upper limit of the ascending price channel on the daily timeframe, as shown in the chart. Additionally, the pair has maintained its trading above the 50 and 200 moving averages, which are intersecting positively upwards across most timeframes from four hours to the weekly timeframe. Clearly, this indicating a clear dominance of the overall upward trend on the pair. In the event of a rise in the pair, it targets levels of 32.50 and 32.75 respectively, while in the event of a decline in price, it targets levels of 32.25 and 32.10 respectively.

Ultimately, the Turkish lira price forecast is for the pair to continue rising, targeting levels of 32.75 and each dip represents an opportunity to reinforce long positions. Furthermore, we recommend adhering to the mentioned recommendations and maintaining capital management rules.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.