Signals for the Lira Against the Dollar Today

- Risk 0.50%.

Best Buying Points:

- Open a buy order at 32.10.

- Set a stop-loss order below support levels at 32.00.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.50.

Best Selling Points:

- Place a sell order at 32.50.

- Set a stop-loss order at 32.65.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 32.30.

Turkish lira Analysis:

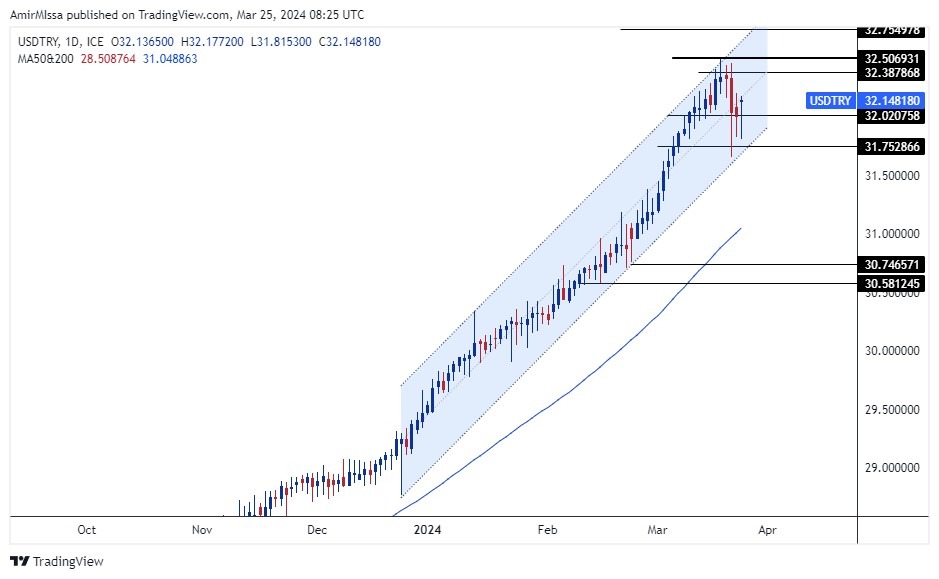

The USD/TRY pair rose during early trading on Monday, after declining for three consecutive days following the Turkish Central Bank's decision to raise interest rates. Recently, the pair failed to surpass the peak recorded during the previous week at 32.50 Turkish Lira per dollar.

Unexpectedly, the Turkish Central Bank raised interest rates by 500 basis points during last Thursday's meeting, bringing interest rates to 50%. Analysts at Goldman Sachs commented on the Turkish Central Bank's decision, stating that the approved increase is a one-time hike and does not signify the start of a new cycle of interest rate hikes, with the aim of controlling the currency's decline and curbing inflation towards previous expectations. Also, the report mentioned that the recent interest rate hike works to increase the credibility of the Turkish Central Bank regarding the shift in monetary policy, aimed at ensuring price stability.

Top Forex Brokers

Meanwhile, Goldman Sachs' report regarding inflation expectations suggests that those rates may see a sharp decline starting from the second half of the current year. Added, with expectations reaching 33% by the end of 2024 compared to the current levels of 67%. Ultimately, it is expected that the Central Bank of Turkey will begin transitioning to a less restrictive monetary policy as inflation declines during the third quarter of the current year, with interest rates in Turkey expected to decrease to levels of 32.5% by the end of the year.

USD/TRY Technical Analysis and Expectations Today:

USD/TRY: The pair rose slightly during early trading today, while remaining within the upward price channel on the daily timeframe, as shown in the chart. Currently, the price is trading at levels of 32.14 lira per dollar, which are higher than the 50 and 200 moving averages, intersecting positively, on most timeframes starting from four hours up to the weekly timeframe, indicating a clear dominance of the overall upward trend on the pair. In case of an upward movement, the pair targets levels of 32.25 and 32.50 respectively. Moreover, in case of price decline, it targets levels of 32.05 and 31.90 respectively.

Eventually, the forecasts for the Turkish Lira include the continuation of the pair's rise targeting levels of 32.50 lira, as each dip represents an opportunity to reinforce buying contracts. Finally, we recommend adhering to the mentioned recommendations and maintaining capital management rules.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out