Signals for the Lira Against the Dollar Today

- - Risk 0.50%.

Best Buying Points:

- Open a buy order at 32.20.

- Set a stop-loss order at 32.05.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.50.

Best Selling Points:

- Place a sell order at 32.50.

- Set a stop-loss order at or above 32.65.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 32.30.

Turkish lira Analysis: the USD/TRY pair rose during early trading on Thursday. The pair continued its slow ascent towards the peak recorded last week, which settled lower after the Turkish Central Bank decided to raise interest rates last Thursday. The lira seems to struggle to maintain its limited gains against the dollar despite the significant governmental efforts, in collaboration with the Turkish Central Bank, to control lira depreciation and curb inflation.

Meanwhile, Turkish President Recep Tayyip Erdoğan's statements continued, reaffirming his confidence in the economic team responsible for economic affairs in the country. In statements issued yesterday, he expressed full confidence in Finance and Treasury Minister Mehmet Şimşek, adding that his government comprises a strong team of highly competent individuals in the field of economics. Additionally, President Erdoğan promised positive outcomes for the current economic program being implemented during the second half of 2024.

Top Forex Brokers

In other news, credit rating agency Standard & Poor's raised its economic growth forecasts for Turkey from 2.4% to 3% for the current year. Similarly, the agency increased its growth forecasts for the country next year from 2.7% to 3%, while expectations turned negative for 2026, projecting a decline in Turkey's economy from 3% to 2.8%.

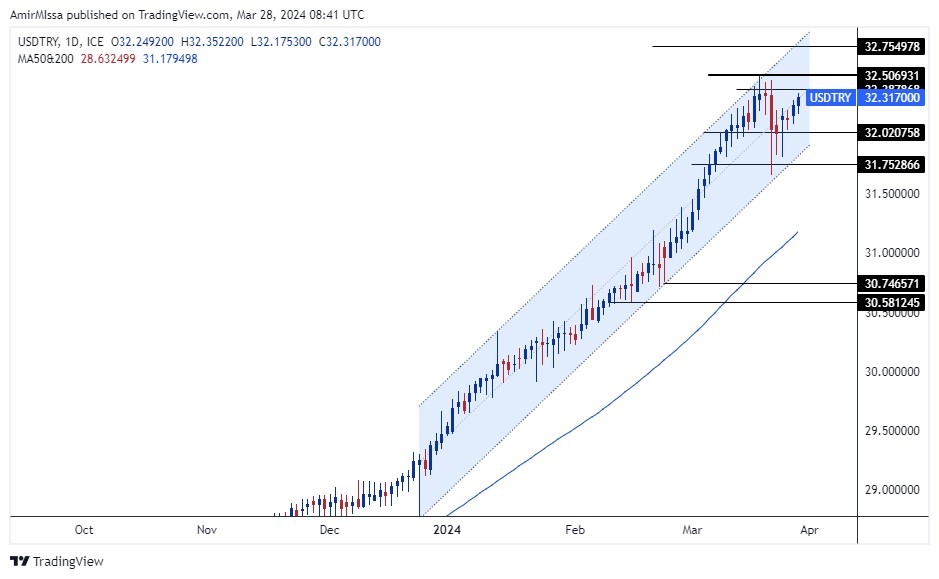

USD/TRY Technical Analysis and Expectations Today:

USD/TRY rose during early today trading, marking its second consecutive day of gains albeit at a slow pace. With the pair stabilizing within the ascending price channel on the daily time frame, as shown in the chart attached. Currently, the pair is trading at 32.30 lira per dollar, which is higher than the 50 and 200 moving averages, which are positively intersecting, on most time frames from four hours to the weekly time frame, in a clear indication of the dominance of the general upward trend on the pair. Therefore, if the pair rises, it targets 32.50 and 32.65 levels, respectively. Furthermore, if the price falls, it will target 32.15 and 32.05 levels, respectively.

Eventually, the forecasts for the Turkish Lira include the continuation of the pair's rise targeting levels of 32.50 lira, as each dip represents an opportunity to reinforce buying contracts. Finally, we recommend adhering to the mentioned recommendations and maintaining capital management rules.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.