Fundamental Analysis & Market Sentiment

I wrote on 10th March that the best trade opportunities for the week were likely to be:

- Long of the NASDAQ 100 Index following a daily close above 18288. This did not set up.

- Long of the S&P 500 Index following a daily close above 5157.

- Long of Bitcoin. This fell by 5.01% over the week.

- Long of the GBP/USD currency pair following a daily close above $1.2854. This did not set up.

The overall result was a net loss of 5.01%, resulting in a gain of 1.25% per asset.

Last week saw lower directional volatility in the Forex market, which has been relatively low since 2024 started. There was important action in some stock markets and Bitcoin, while the Forex market was relatively quiet.

US stock markets ended last week notably lower, with the S&P 500 Index standing out as it briefly made a new record high. The effect of higher-than-expected US inflation data released last week was a strengthening of the US Dollar over the past week, which seems to have sent other risky assets lower as well.

Bitcoin was a standout asset last week as it also briefly touched a new record high not far from $74,000 last Thursday before falling quite strongly over the past few days.

US inflation ticking up from 3.1% to an annualized rate of 3.2% has sent the chance of a May rate hike to only 6% and a June hike to lower than 60%.

There were several other important economic data releases last week:

- US PPI – much higher than expected, showing a month-on-month increase in producer prices of 0.6% compared to the expected 0.3%. This will kindle fears of persistent US inflation.

- US Retail Sales – a little weaker than expected.

- US 10-Year Bond Auction – brought a higher yield.

- US 30-Year Bond Auction – brought a lower yield.

- UK GDP – as expected, with a month-on-month increase of 0.2%.

- US Unemployment Claims – fractionally better than expected.

- The US Empire State Manufacturing Index is worse than expected, suggesting a slowing manufacturing sector.

- UK Claimant Count Change (Unemployment Claims) – roughly as expected.

- US Preliminary UoM Consumer Sentiment – roughly as expected.

Top Forex Brokers

The Week Ahead: 18th – 22nd March

The most important items over the coming week will be the policy meetings at several central banks: the US Federal Reserve, the Bank of Japan, the Bank of England, the Swiss National Bank, and the Reserve Bank of Australia. Apart from this, there are a few other important items:

- UK CPI (inflation)

- Canadian CPI (inflation)

- New Zealand GDP

- US, German, UK, French Services & Manufacturing PMI

- Chinese Industrial Production

- UK Retail Sales

- Australian Unemployment Rate

- US Unemployment Claims

Monthly Forecast March 2024

I did not make a monthly forecast for March, as no obvious long-term trend in the US Dollar could be relied upon at the start of the month.

Weekly Forecast 17th March 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy.

I again give no forecast this week.

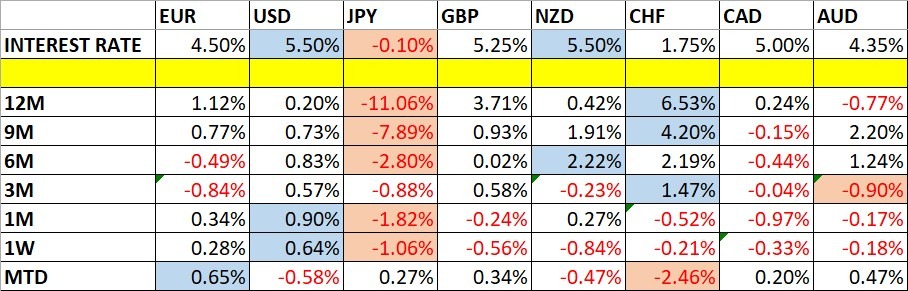

Directional volatility in the Forex market fell last week, with only 22% of the most important currency pairs fluctuating by more than 1%.

Last week, relative strength was observed in the US dollar, and relative weakness was observed in the Japanese yen.

You can trade these forecasts in a real or demo Forex brokerage account.

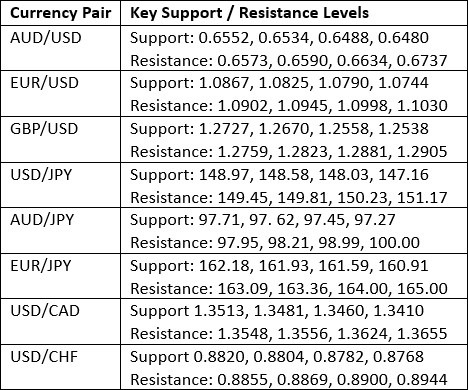

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed a bullish inside bar last week. The weekly close presented a mixed long-term trend, as it was higher than 3 months ago but lower than 6 months ago.

Zooming out to look at the long-term price action shows that the US Dollar is still trading within a consolidative long-term pattern; in fact, there is a narrowing triangle pattern which will have to produce a breakout within the next few weeks.

I think it makes sense to ignore the US Dollar over the coming week. It has no trend, although there is some short-term bullish momentum. It will likely be wise to look to trade non-USD assets and maybe even avoid Forex as an asset class until we see more direction here.

NASDAQ 100 Index

The NASDAQ 100 Index printed another bearish candlestick last week, despite making a new record high the previous week. There is bearish momentum here, evidenced by the fact that the close is so near the low of last week’s range,

Expectations of a Fed rate cut have fallen again after higher-than-expected US inflation data was released last week. This rally might run out of steam.

Before entering a new long trade, I want to see a new record high daily close above 5157.

S&P 500 Index

The S&P 500 Index printed another bearish candlestick last week despite making a new record high the previous week. Last week’s candlestick was both an inside bar and a pin bar, both of which have bearish implications.

Expectations of a Fed rate cut have fallen again after higher-than-expected US inflation data was released last week. This rally might run out of steam.

Before entering a new long trade, I want to see a new record high daily close above 5157.

One reason I still see the long-term outlook as bullish is that its first break to a fresh all-time high, as happened just a few weeks ago, has historically generated an advance of a median of 13% over the following year. Traders and investors should seriously consider going long once the price breaks to new highs.

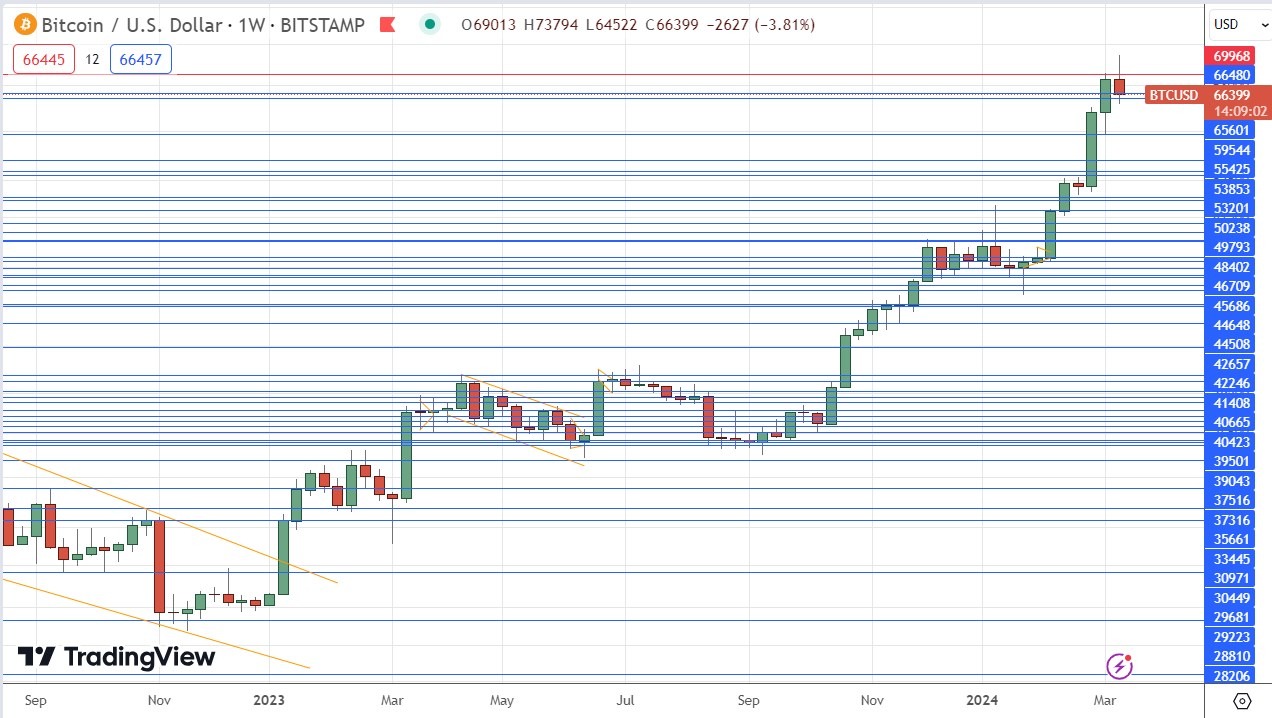

Bitcoin

Bitcoin briefly reached a new record high just below $74,000 last week before falling back, ending this week with a candlestick close to a bearish pin bar.

I see Bitcoin as a buy, given legs by the recent approval of Bitcoin ETFs, which attracts more retail investment. However, this rejection of the resistance just below the big round number at $70k could be a major bearish reversal, so I would want to see the price close at new highs above $74,000 before entering any new long trade here.

It is important to use a trailing stop in this kind of trade due to the high volatility and unpredictability inherent to even major cryptocurrencies such as Bitcoin.

Gold

After reaching a new all-time high price the previous week and closing near the high of its range, Gold fell somewhat last week, closing lower and printing a bearish inside bar.

The US Dollar is stronger again, and stock markets are lower, both pushing the price down. Don't be fooled by talk of Gold as a hedge in bearish markets—gold has historically shown a strongly positive correlation with major stock markets!

We still have enough of a valid long-term bullish trend here, potentially reaching much further into blue sky, that it makes sense to keep looking for a long trade. I would wait for a bullish breakout to a new daily high close.

USD/CHF

I had expected the level of $0.8748 to be support for the USD/CHF currency pair. The H1 price chart below shows how this level was rejected right at the start of last Tuesday’s London/New York session overlap by a very large doji candlestick, marked by the up arrow in the price chart below, signalling the timing of this bullish rejection. This can be an excellent time of day to enter a trade in a major currency pair, especially one such as this one, which involves the US Dollar.

This trade has been profitable so far, with a maximum reward-to-risk ratio of more than 1 to 1 based on the size of the entry candlestick. It would have been much better if the entry candlestick had not been so unusually large. Sometimes, in these cases, it can make sense to set a tighter stop than that suggested by the entry candlestick's price action.

EUR/JPY

I had expected the level of ¥160.23 might act as support in the EUR/JPY currency cross. The H1 price chart below shows how this level was rejected early during last Monday’s London session by a bullish inside bar, marked by the up arrow in the price chart below, signalling the timing of this bullish rejection.

This trade was nicely profitable, giving a maximum reward-to-risk ratio of more than 6 to 1 based on the size of the entry candlestick structure.

Cocoa Futures

Cocoa Futures made a strong bullish move last week and rose again by almost 24% this week alone to a new multiyear high. The price closed at the top of its range, which is bullish.

You can apply a linear regression analysis to the start of these price rises in September 2022. Since then, the price of Cocoa futures has risen by 260%!

Cocoa is trading right at its all-time high, so it can be bought right now as a breakout, although there is always a risk of a sudden bearish reversal. It is important to use a trailing stop in this kind of trade. It should also be noted that the price is extended well above the upper boundary of the applied linear regression, so it seems overdue for a sudden bearish retracement.

Copper ETF

The Copper ETF CPER made a strong bullish move last week, closing near the high of its range to end the week at a new 1-year high price.

Precious metals, especially Gold, have been mostly bullish, but we begin to see industrial metals like Copper starting to catch up.

A note of caution can be found by looking at the zoomed-out weekly price chart below, which shows that although the price has risen strongly to a new 1-year high, the long-term price action is quite rangy and choppy.

Before entering a new long trade, I will wait for another higher daily close, above $25.71.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index following a daily close above 18288.

- Long of the S&P 500 Index following a daily close above 5157.

- Long of Bitcoin following a daily close above $74,000.

- Long of Gold following a daily close above $2183.

- Long of Cocoa Futures, but with only half a normal position size.

- Long of CPER (Copper) ETF following a daily close above $25.71.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms.