- The West Texas Intermediate Crude Oil market has been slightly positive during the month of March, and it is very likely that we will continue to see upward pressure during the month of April.

- After all, there is a cyclical trade that you need to pay close attention to here, as demand for petroleum picks up as drivers and flyers start to travel much more.

- This is a well-known cycle that traders will play, so I think at this point in time it’s easy to say that April should, all things being equal, end up being a rather positive month.

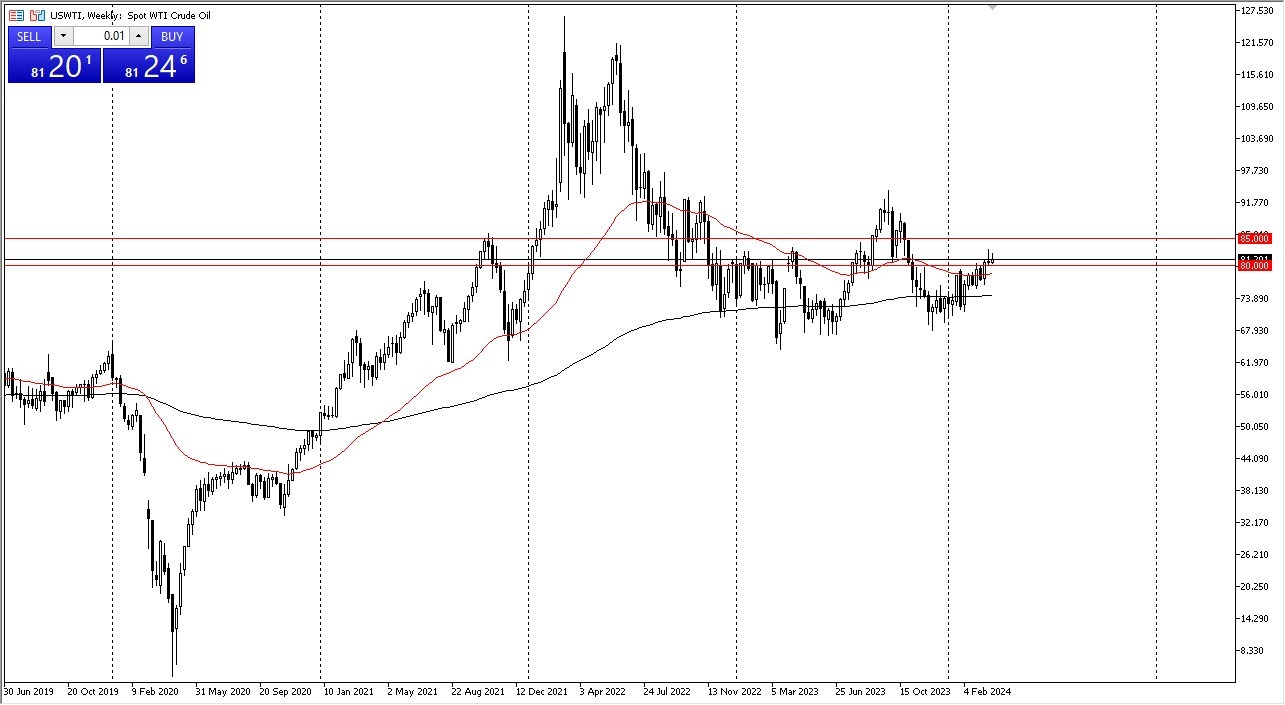

That doesn’t necessarily mean that we take off straight up in the air on April 1, but it does suggest that perhaps we could see a continuation of the overall grind to the upside. This is a market that has been extraordinarily noisy until late, as we finally broke above the $80 level, and now it looks like the $80 level is trying to offer a little bit of short-term support. For what it is worth, I do believe that the $85 level is a bit of a target at this point, and as long as we can stay above the $80 level, we should continue to find plenty of people willing to step in and by this market.

Top Forex Brokers

Technical Analysis

The market continues to see a lot of volatility, but not only do I think that the $80 level is support, I also recognize that the 50-Week EMA is sitting just below there as well. All things being equal, this is a market that short-term pullbacks will continue to attract a certain amount of attention, and therefore I do think that you are looking to “buy the dip.” Crude oil also has plenty of external factors to make it go higher, not the least of which would be the central banks around the world looking to cut interest rates. If they do, that typically means that you will see more industrial demand as manufacturers start to ramp up engines. In general, this is a market that I think will be bullish for the next several months, and April will just be the beginning of what should be a good season for petroleum going forward. I have no interest whatsoever in shorting this market, and even if we were to break down below the 50-Week EMA, I would just look for an area where we bounce from later.

Ready to trade WTI/USD monthly forecast? Here are the best Oil trading brokers to choose from.