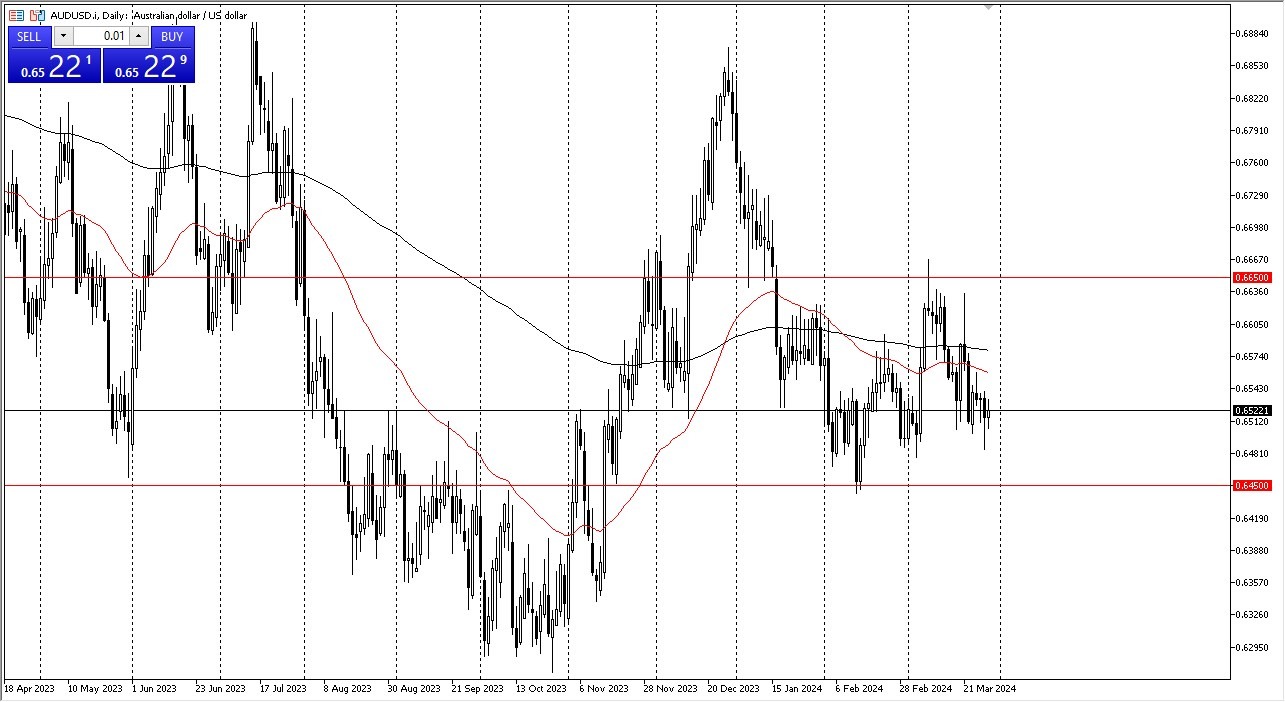

- The Australian dollar has gone back and forth during the trading session on Friday, as we continue to see a lot of noisy behavior.

- All things being equal, this is a market that I think will be very noisy and continue to see a lot of consolidation more than anything else.

- After all, both of the central banks are essentially looking at the possibility of cutting later this year, so there’s nowhere for this pair to go.

Technical Analysis

The technical analysis dictates that we are in a range between the 0.6450 level underneath, and the 0.6650 level above. Between here and the highs, there are a couple of moving averages including the 50-Day EMA and the 200-Day EMA, and therefore you will have to think of it as a somewhat sideways market.

Top Forex Brokers

At this point in time, the Australian dollar has to be thought of through the prism of “risk on behavior”, and therefore if we get more risk on behavior the Australian dollar should turn out to be a little bit stronger than the US dollar. Whether or not it is massively stronger is completely different, and therefore I think you’ve got a situation where we are to simply going to grind back and forth, perhaps with a slightly bullish twist. That being said, I don’t necessarily think that we are going to break out anytime soon, so in general this is a situation where you’re just trading back and forth.

If you have a nice range bound system, this is probably a great way to play this market, and is not until we break out of this 200 PIP range that you start to talk about bigger moves. I see no real reason for that to happen anytime soon, so this point time I remain somewhat neutral in this pair, but if I choose to trade a short-term chart, this might be a place where I start to put money to work.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.