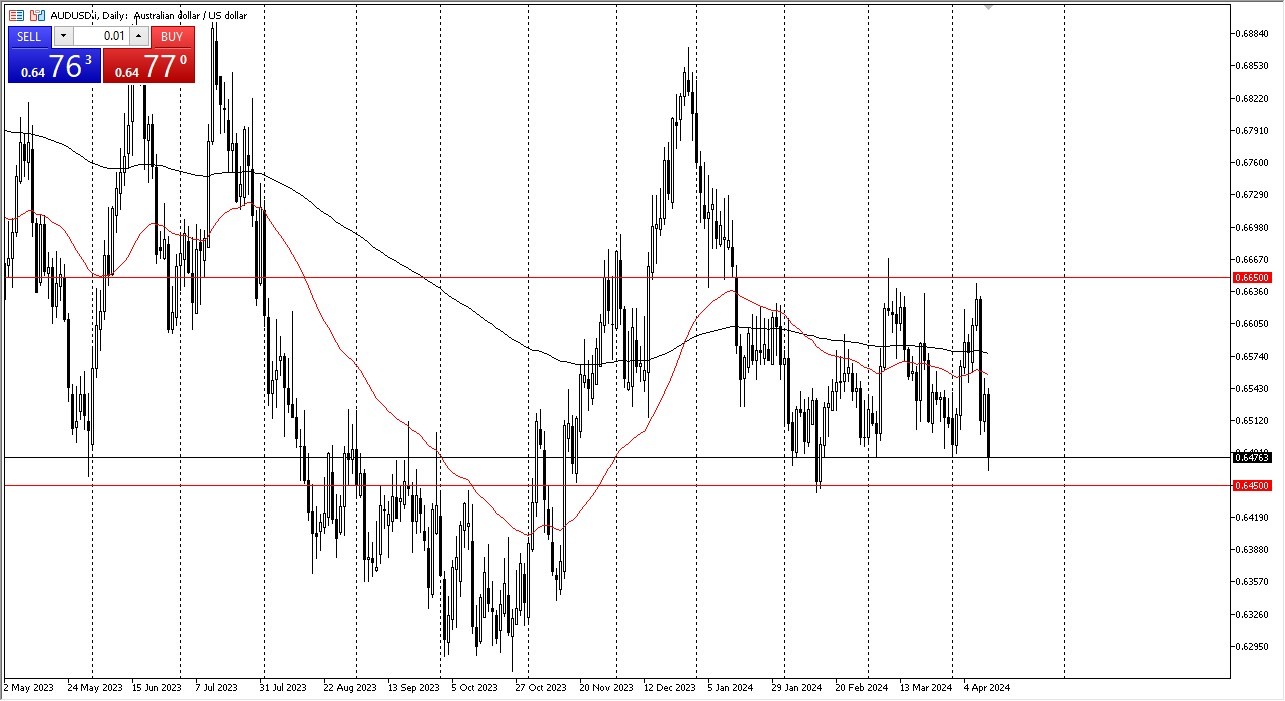

- The Australian dollar has fallen rather significantly during the Friday session again, as we continue to see the U S dollar strengthen against most things.

- At this point, the market is now focusing on the 0.6450 level.

- The 0.6450 level is an area that a lot of people will be paying attention to as it is a major support level.

If we are watching this, then it's important to see how we close. If we were to close below the 0.6450 level, then it's likely that we go much lower, perhaps dropping down to the 0.62 level. On the other hand, if the market were to turn around and rally from here, it's likely that we could see a move toward the 50-day EMA.

Top Forex Brokers

A Turnaround?

If we break above there, then we have the possibility of a move to the 0.6650 level. All things being equal, a lot of this comes down to the US dollar more than anything else. The AUD/USD is a very noisy market, but at the same time, it's obvious that the sellers are much more aggressive than the buyers, at least at this point. I wouldn't be surprised at all to stay in this overall consolidation area though which would dictate that we need a little bit of a bounce.

That bounce isn't necessarily something that I want to buy for a significant position, but maybe a short-term trade, it might be possible to do so. Keep in mind that the Australian dollar is highly influenced by China and of course risk-taking. So, we need a lot of that out there as well.

This is probably a US dollar story more than anything else, as the Federal Reserve may have to wait a little longer to cut interest rates. If that continues to be the case, this is a market that will continue to see a lot of interest rate watching more than anything else. The markets continue to favor the greenback overall, at least as long as rates remain high in America.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.