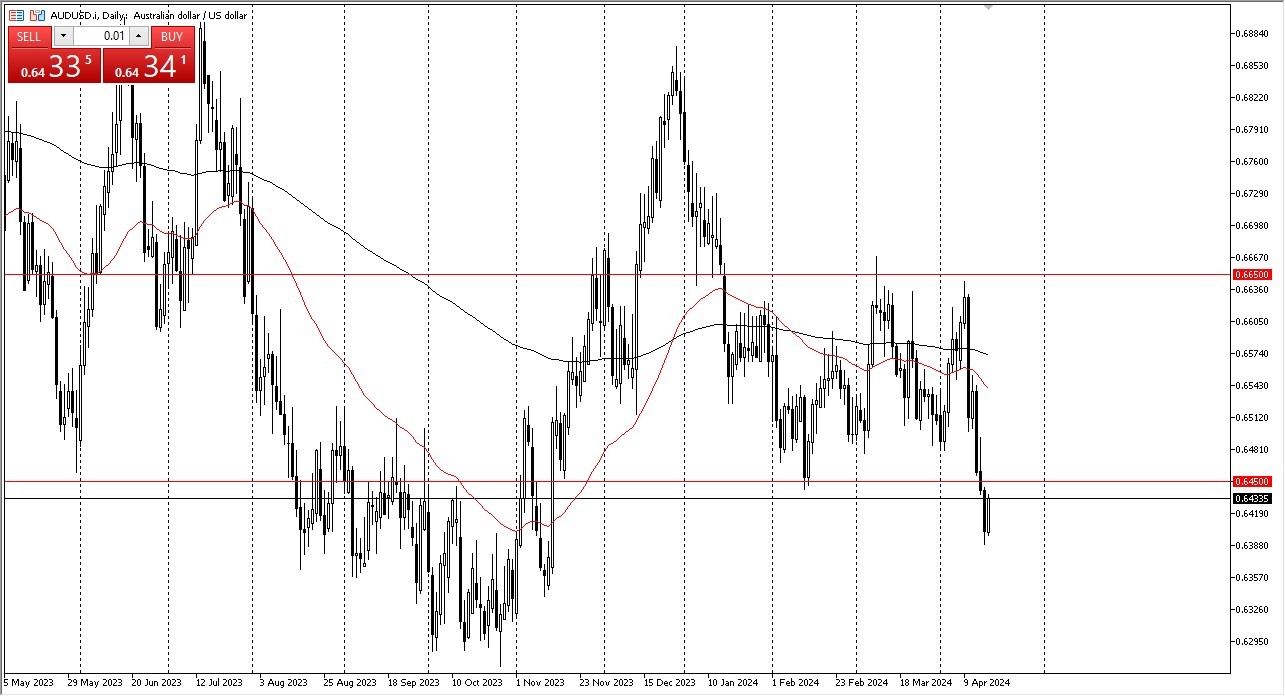

- The Aussie dollar did rally a bit during the trading session here on Wednesday, but the 0.64 or 0.50 level above should offer a significant amount of resistance as it had previously been supported.

- This would be a feature of market memory, and therefore I think it all tied together for a retest of the breakdown that we have recently seen.

- This could open up a nice trade, if you are patient enough to wait for signs of a turnaround.

Ultimately, I think this is a market that will perhaps show signs of exhaustion that people can start selling. Opening up the possibility of a move down to the 0.63 level. On the other hand, we could break above there, and if we do break above there, then the 50 day EMA above could potentially be a target. But you need a lot of risk on behavior to get there.

Not Looking to Buy the Aussie Dollar at the Moment

Ultimately, I don't like buying the AUD/USD because I think there are so much in the way of issues when it comes to a lot of risk on behavior that I'm simply looking for signs of exhaustion. Initially at the 0.6450 level, and then again and 0.65 and the 50 day EMA to start selling. If we do break above the 50 day EMA, then it would be a sign that perhaps a bottom has been put in.

Top Forex Brokers

Keep in mind that this is probably all about the US dollar more than anything else, so pay attention to what's going on in other major currency pairs, because that could give you an idea as to how the dollar may act here, as the markets seem to be focused almost solely on the bond market in the United States, and what the Federal Reserve may or may not do this year.

At this point, I suggest keeping an eye on the 10 year note, and of course all of the other major currency pairs such as the EUR/USD, GBP/USD, and USD/CHF pairs. The USD/JPY pair is in its own world at the moment, so it might not be the best signal to extrapolate into this market.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.