- The Australian dollar initially rally during the trading session on Monday, but it’s worth noting that most countries in Europe were shut down so the middle the day was essentially a waste of time.

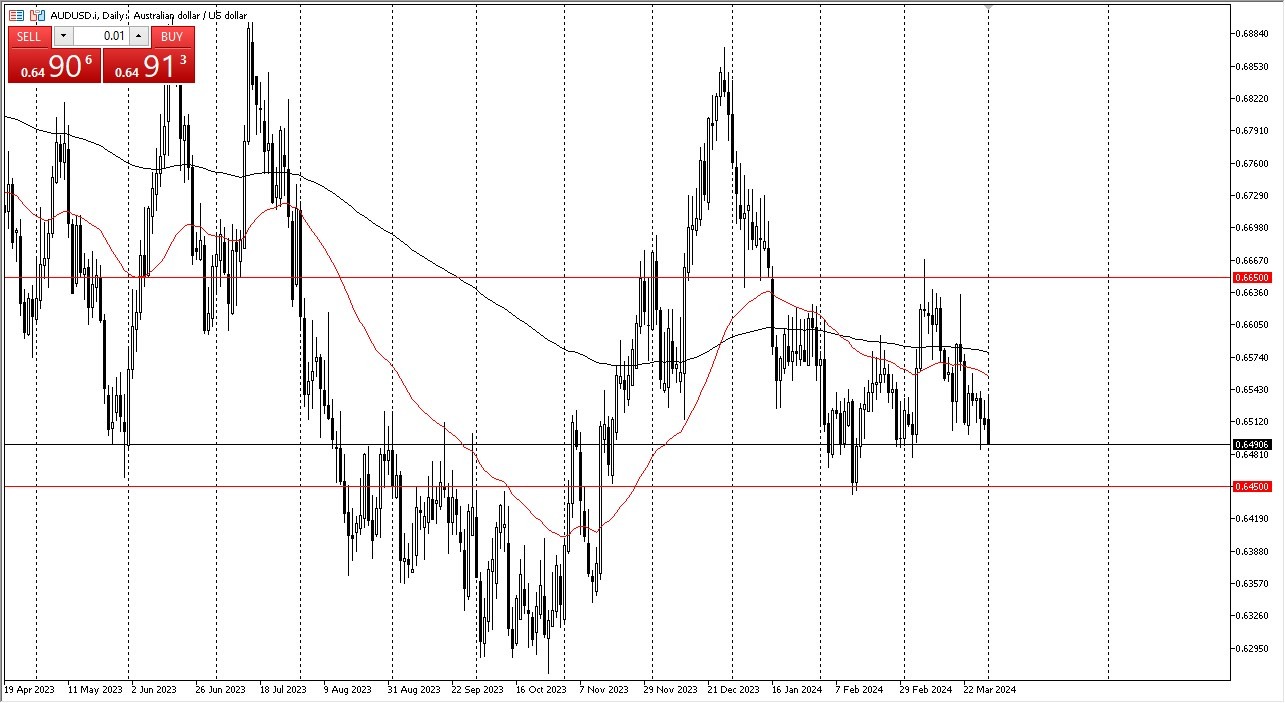

- Ultimately, this is a market that I think is trying to sort out whether or not it can get to the bottom of the overall range, which is closer to the 0.6450 level underneath, which is an area where we’ve seen the markets react to multiple times.

- With that being said, I think a lot of attention will be paid to this market if it gets down to that area.

Can the bottom hold?

At this point in time, paying close attention to the bottom, near the 0.6450. I think that will determine where we go next, and therefore I will be paying close attention to whether or not we can bounce from that level, or if we can break down below it. There are a couple of scenarios that I see playing out, with perhaps a move below the 0.6450 level opening up the possibility of a move down to the 0.63 level. That of course is a large, round, significant figure that a lot of people will pay close attention to, because if that gives way to the downside, this market will really start to unravel.

Top Forex Brokers

On the upside, if we were to somehow break above the 50-Day EMA, then the market opens up the possibility of a move to the 0.6650 level above. That’s an area where we have seen a lot of resistance previously, and if we can break above there, then I think you’ve got a real shot at this trend change in longer-term, and perhaps the Australian dollar really taken off against the US dollar. In general, this is a market that has been very noisy, and therefore I think it’s a situation where you will more likely than not see the Australian dollar stay in this overall range, as central banks around the world are likely to cut rates. However, one thing that I would board against is if we do in fact break down, that means we probably have a major “risk off” event going on as traders run directly into the US dollar again.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.