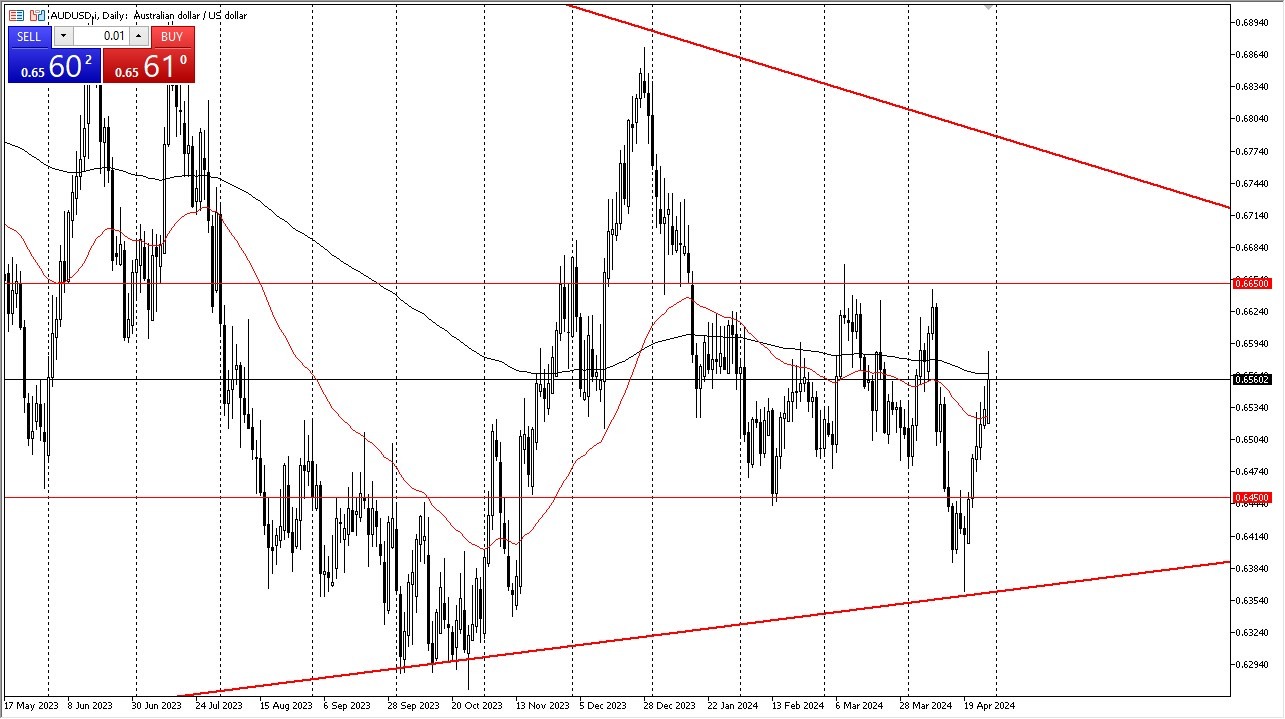

- The Australian dollar has been a very noisy over the last week or so, and it looks like we are going to continue to see this type of noise.

- The market has recently shown quite a bit of significant upward pressure and breaking through the 200 day EMA during the day on

- Monday.This is a positive sign, but there is a lot of trouble ahead possibly.

That being said, we are seeing a little bit of resistance above, and I think that comes into the picture as well with this. I've been somewhat wrong on the AUD/USD. I haven't necessarily sold it yet, but I've for the most part just been hanging around and trying to find some type of entry point to get short, some type of significant exhaustion.

Biding My Time…

We don't really have that yet, so at this point, I'm just more or less waiting. The 0.6650 level above has been significant resistance. And I do think that it's going to be difficult to break above there. After all, this is the Australian dollar and it's tied to risk appetite. Risk appetite is not necessarily strong at the moment everywhere.

Top Forex Brokers

Of course, there are a lot of geopolitical concerns that you have to take into account as well. So with all this, I do think that sooner or later we're going to run out of momentum, but you're going to have to be patient. The Aussie continues to make long wicks to the upside and then grind even higher. That's generally a very good sign.

But at this point in time, I think part of this might be a mechanism, reacting to the fact that the US dollar had been overbought against almost everything for a while. So, we'll have to wait and see. We're in the middle of the consolidation area from previous trading. So really at this point not much has changed other than just rapid volatility. This market is one that has made a nice move, but I am not as convinced on this momentum as I am in other markets at the moment.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.