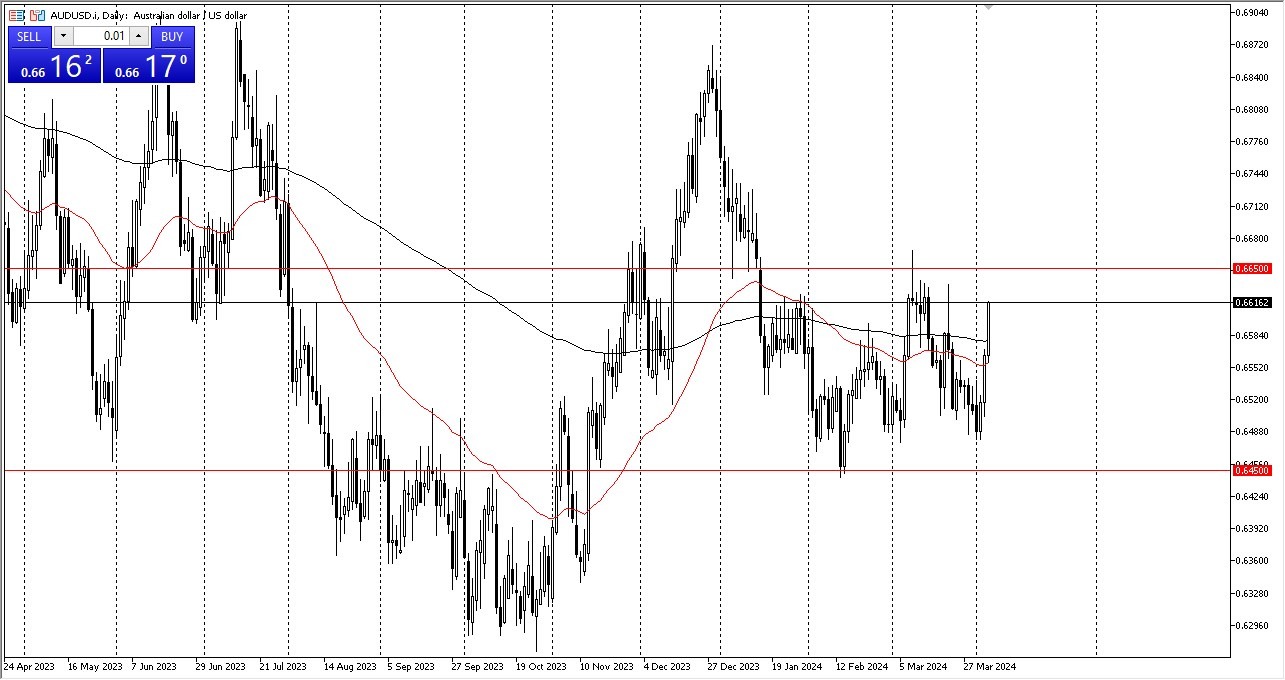

- The Aussie dollar has rallied rather significantly early during the trading session on Thursday.

- As we have broken above the 0.66 level, the 0.6650 level above is a significant resistance barrier.

- I think a lot of people are going to be paying close attention to this area. This is an area that's been important multiple times, so it does make a certain amount of sense that market reaction would show itself at this point.

A potential short?

If we do approach this level and it shows signs of exhaustion, it's very likely that traders will come in and start shorting. After all, we've been in a 200 point range for a while now, and unless something drastically changed because I don't see the AUD/USD market breaking out of here, the jobs number coming on Friday of course, will have a certain influence as well, and it could have people taking profit.

Top Forex Brokers

On the whole, I believe this is a market that if we can break above the 0.6675 level, then it can go much higher. But at that point, we would need to see a lot of reasons to believe that the Federal Reserve is in fact going to start cutting. And that would be if we get a poor jobs number, if we get a strong jobs number, we could very well turn back around.

The one thing that is driving the Aussie higher, from what I can see, though, is the fact that it is highly correlated to the gold market, which of course has been going straight up in the air. This is a market that is overdone and therefore a lot of people will be looking to potentially fade this move. However, if we do break above that crucial resistance barrier, it could truly send this market much higher, and perhaps have the Australian dollar take off quite drastically.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.