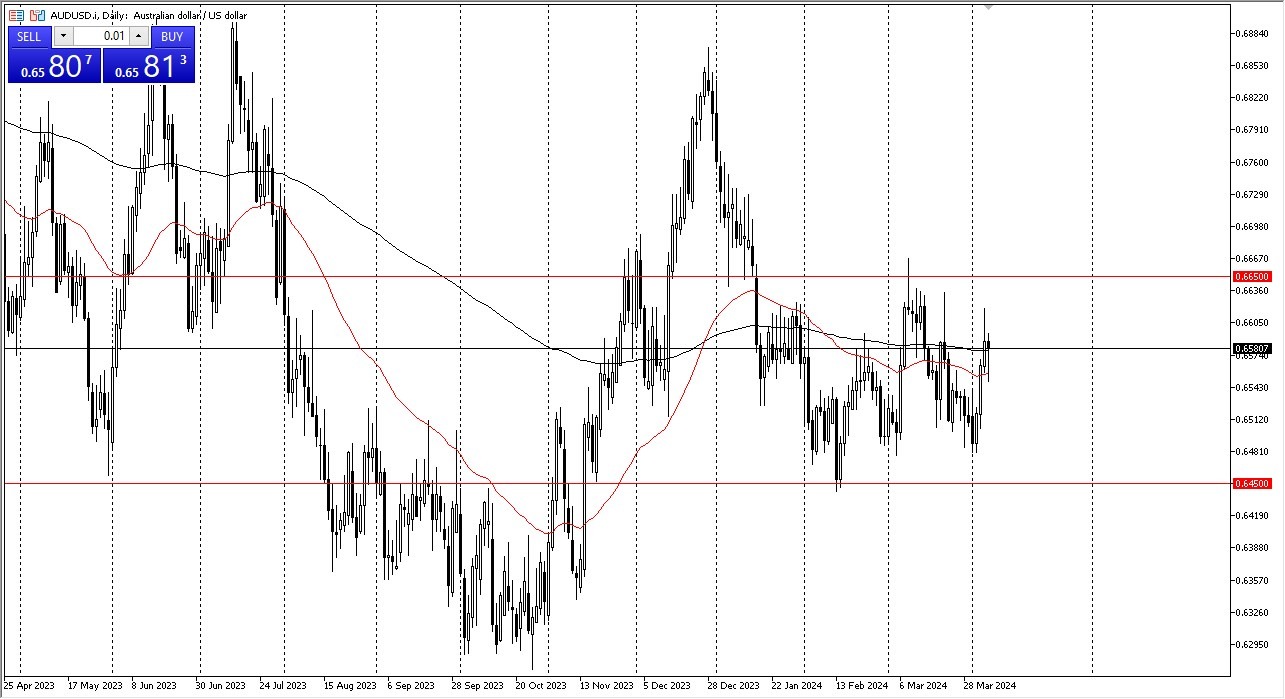

- The AUD/USD initially plunged during the trading session on Friday, breaking through not only the 200 day EMA, but also the 50 day EMA indicator.

- At this point, it looks like traders are willing to step in and pick this market up, but we are still very much in the middle of a larger consolidation area.

The Consolidation Area We Are In

That consolidation area, which is currently defined between 0.6650 on the top and 0.6450 on the bottom, is an area that I think we will stick to for quite some time. There's no fundamental reason whatsoever for one of these AUD/USD currencies to outperform the other, but that doesn't mean that things won't change. Remember that the US dollar, of course, is considered to be a safety currency, but at the same time, the Australian dollar is considered to be a risk on currency. It comes down to what animal spirits dictate worldwide. At this point, I think you've got a situation where everybody is expecting central banks around the world to start cutting sooner or later.

Top Forex Brokers

So, I think the currency markets may be somewhat range bound this year and the Australian dollar won't be any different. As things stand right now, I like the idea of fading signs of exhaustion on a move towards the resistance or fading on signs of exhaustion on a move towards support. I don't see the impetus for the market to break out of this range, but obviously that can change. As things stand right now, we are fairly close to the middle of the overall consolidation area, meaning that we are essentially near what most traders would think of as fair value.

This is a market that a lot of people will continue to get chopped up in, and as a result I think you have to be very cautious about the amount of money you throw into any particular position, at least until you see this market make a big enough move to finally free itself out of this range.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.