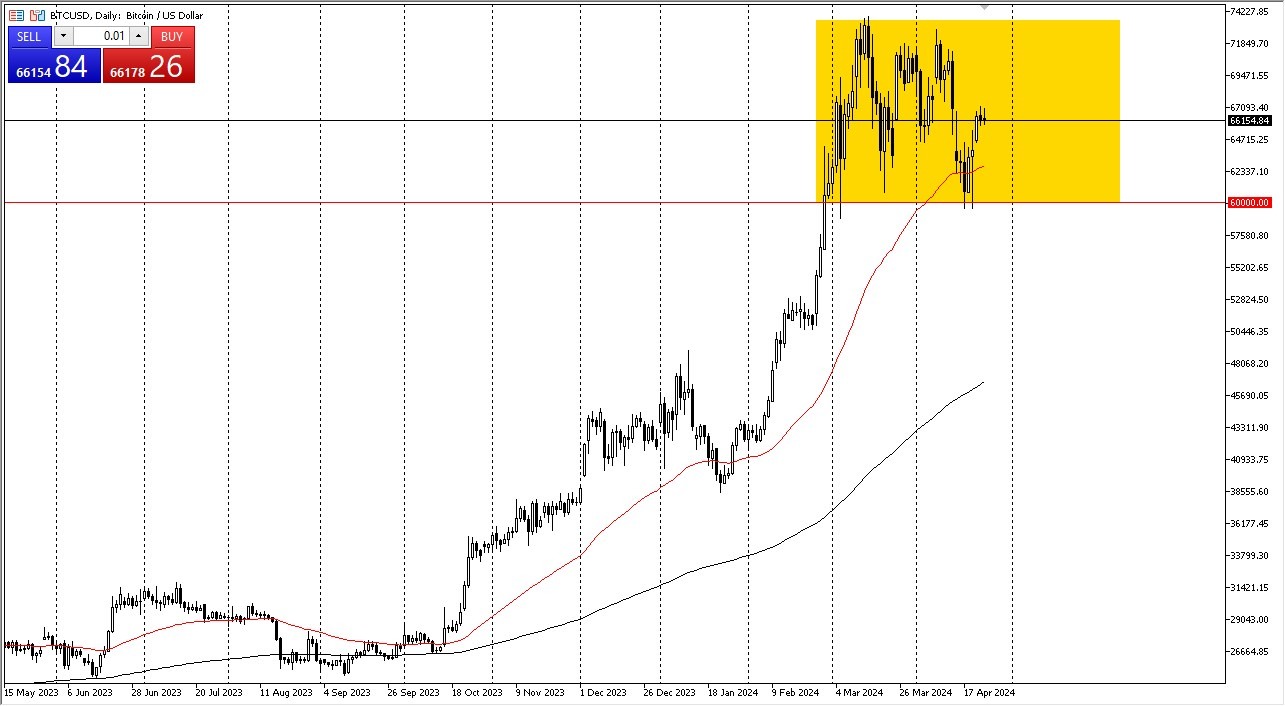

- Bitcoin initially did rally a little bit during the trading session on Wednesday, but it's probably worth noting we are essentially in the middle of a larger consolidation area, so it's not a huge surprise, to see that, you know, we just don't have the momentum to continue going higher.

That being said, I do like Bitcoin, and I do think that short term pullbacks will almost certainly offer buying opportunities that people are willing to take advantage of. The 50 day EMA underneath offers a significant end support level, while the $60,000 level underneath is a massive support level as well. With that being said, I think this is a situation where you are simply looking for buyers on dips and you are taking the opportunity to take advantage of any hint of value.

Top Forex Brokers

The Area Above

The $74,000 level of bond continues to be a significant barrier, and I think if we can break that, that obviously would be a monumental breakout, probably opening up the possibility of a move to closer to 80,000. That being said, I don't necessarily think that this is the easiest trade to take right now, but if we do pull back, I think you will start to scale back in.

It has been sideways for a couple of months, but that's mainly because we had a 92% run in six weeks. That's a lot to digest. And of course, now institutions are involved, so they prefer stability. This is a market that is going to be a lot different than in the past, now that the banks are investing in Bitcoin as well. That being said, it is unlikely that we will continue to see those massive shots higher, barring some kind of currency crisis, which is something that they have been warning me about since I was a teenager. In other words, don’t hold your breath on that. Bitcoin has now grown up and will be traded as such. The excitement might be gone according to many, but it is a step in the right direction as far as stability and use is concerned.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.